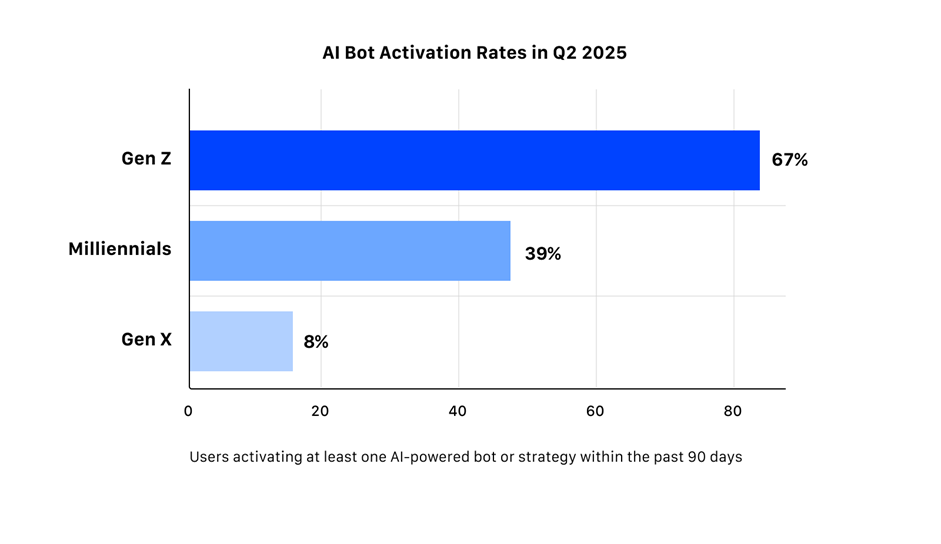

A recent behavioral study from MEXC Research reveals a dramatic generational shift in crypto trading. According to in-platform analytics of over 780,000 users, 67% of Gen Z traders (ages 18–27) already use or actively adopt AI-powered tools.

This cohort is embracing automation for purposes beyond convenience, to manage risk, reduce emotional bias, and delegate strategic decisions in volatile market conditions.

AI Adoption Soars Among Gen Z Traders on MEXC

MEXC’s Q2 2025 behavioral intelligence report shows that two-thirds of Gen Z users activated at least one AI bot or rule-based strategy in the last 90 days.

However, usage goes deeper than bot deployment. These users actively incorporate AI into their trading behaviors, with 22.1% engaging with AI tools at least four times a month.

Based on the report, Gen Z now accounts for 60% of all AI bot activations on the platform.

This cohort averages 11.4 days per month interacting with AI tools, which is more than twice the engagement of users over 30.

Their usage is also intentional, with the study showing 73% of Gen Z traders activate bots during volatility spikes but shut them off during low-volume or sideways markets. For them, AI is not a blanket solution. Rather, it is a selective, situational advantage.

Emotional Regulation and Delegation: The Gen Z Edge

MEXC Research’s findings suggest that, beyond trusting AI, Gen Z uses it as a psychological buffer. Traders using bots saw a 47% reduction in panic sell-offs during market stress, compared to those trading manually.

Rather than reacting to every market twitch, Gen Z configures automated strategies with clear rules, then steps back.

This method, described in the report as “structured delegation,” reduces decision fatigue and cognitive overload and mirrors broader digital behaviors in the workplace.

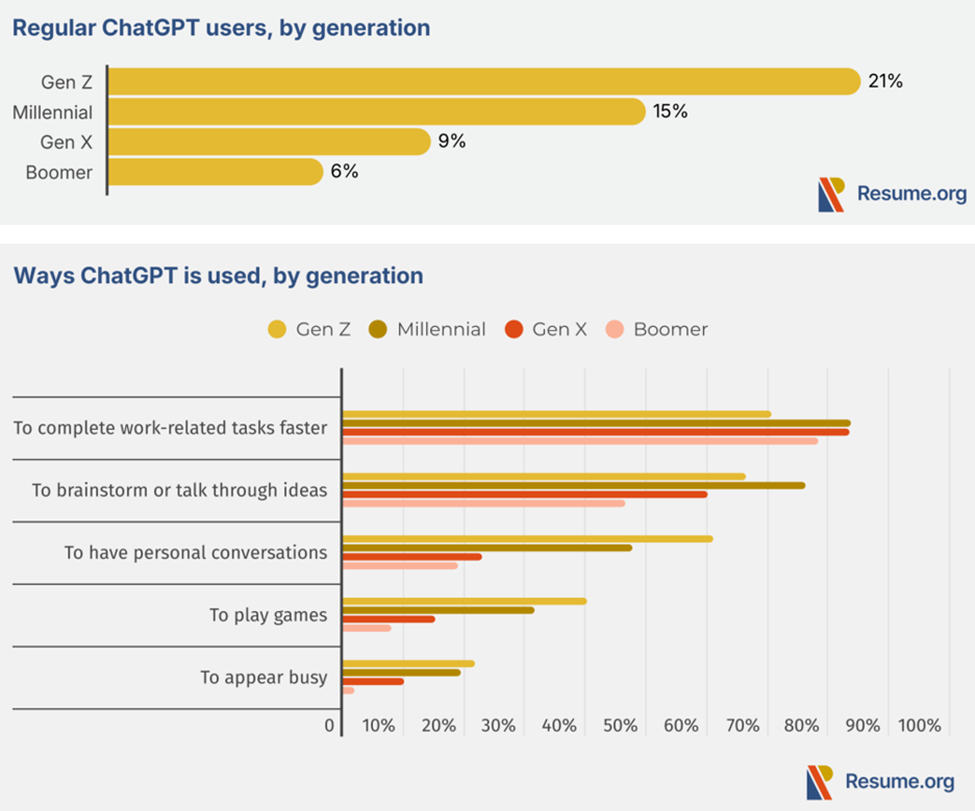

According to a May 2025 survey by Resume.org, over 50% of Gen Z workers view ChatGPT as a co-worker or “friend.” AI is going beyond replacing human judgment to enhance emotional discipline for these users.

Risk Management Reimagined

The shift toward AI is also transforming how risk is managed. Gen Z users who engage with AI trading tools are:

- 1.9x less likely to make impulsive trades within the first three minutes of major market events

- 2.4x more likely to implement stop-loss and take-profit strategies

- 58% of Gen Z bot usage occurred during spikes in MEXC’s internal volatility index

These patterns reflect a new style of semi-automated trading, where bots act as fail-safes in moments of high emotion or uncertainty. AI is going beyond accelerating trades, enforcing discipline when it matters most.

Gen Z vs Millennials: Two Trading Operating Systems

Further, MEXC’s cross-generational analysis reveals a fundamental divergence in trading psychology. On the one hand, millennials lean toward structured, thesis-driven approaches that heavily use charts, research, and manual oversight.

On the other hand, Gen Z approaches trading like they use Discord or TikTok — rapid, reactive, and interface-dependent.

Rather than long-form strategies, Gen Z favors modular, customizable tools that allow for flexible control. Their trading activity is shaped by emotional bandwidth and attention cycles.

They toggle automation on and off based on market mood and personal stress levels, a behavior foreign to the older cohort’s more static strategies. This reflects broader patterns in copy trading, influencer-led decision-making, and social-driven investment communities.

This report suggests that Gen Z is already building the future of crypto trading rather than waiting for it. However, in their pursuit of prioritizing speed, clarity, and emotional control, users must also be wary of blind trust.

Overreliance on AI tools can introduce new risks, including algorithmic bias, flawed datasets, and model opacity, posing systemic threats.

The post 67% of Gen Z Crypto Traders Use AI to Manage Volatility, MEXC Study Shows appeared first on BeInCrypto.