According to a press release, MARA Holdings, Inc. now reports holdings valued at close to $6 billion, totaling 52,477 BTC. That level puts the miner among the largest public corporate Bitcoin holders, trailing only Michael Saylor’s Strategy in the public treasury rankings.

Mining Output And Treasury Growth

MARA produced a little over 700 BTC in August, and it kept an average pace of 22.7 BTC mined per day for the month.

Bitcoin’s price fell about 5% during the period; prices peaked near $124,400 mid-month before slipping toward $107,000. Based on reports, the company chose to add to its treasury rather than sell, buying the dip and increasing its Bitcoin reserve to the current level.

“Given the decline in Bitcoin price during the month, we took the opportunity to add to our treasury and currently hold over 52,000 BTC,” CEO Fred Thiel said.

Hashrate Gains And Site Progress

The firm said its energized hashrate edged up to 59.4 EH/s. All miners at MARA’s Texas wind farm are installed and connected, and the company says that site is on track to be fully operational by the fourth quarter of 2025.

Production momentum carried into the summer: block wins rose by 27% in July after recovery at the Ellendale site, lifting monthly output from 591 BTC in June to 692 BTC in July, before the 705 BTC recorded in August.

Position Among Public Holders

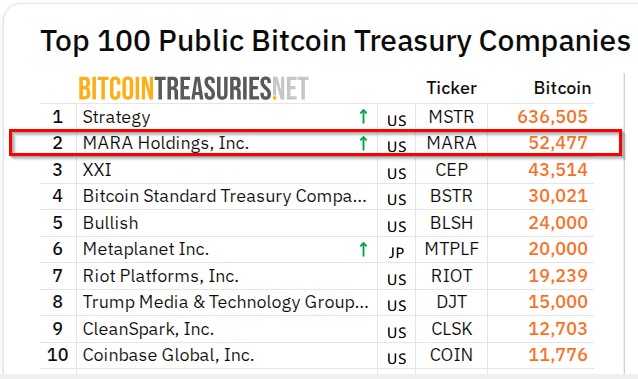

Reports have disclosed that MARA ranks second among public companies by Bitcoin holdings, with Michael Saylor’s Strategy still in the lead, holding about 636,505 BTC following a disclosed additional purchase worth $449 million.

Other firms listed near the top include Twenty One with 43,514 BTC, Bitcoin Standard Treasury Company with 30,020 BTC, and Bullish with 24,000 BTC.

Meanwhile, shareholders have seen a total return of 700% over the past five years. That long-term gain contrasts with more muted recent returns, as Bitcoin’s swings and high operating costs have weighed on performance.

Expansion Moves And Europe Push

MARA is also moving beyond mining. The company announced plans to buy a 64% stake in Exaion, a unit of French energy company EDF, with an option to boost ownership to one-third by 2027.

The stated goal is to pair MARA’s infrastructure with AI-driven edge solutions to lower costs and serve Europe’s growing AI needs.

MARA is building its place as one of the biggest Bitcoin holders. With 52,477 BTC worth almost $6 billion, the company has secured a leading spot among public firms.

Featured image from Getty Images, chart from TradingView