Given Bitcoin’s renewed upside momentum, robust optimism and confidence in the flagship digital asset have risen significantly within the crypto community. As a result, small-scale or retail investors are demonstrating a strong interest in BTC, indicated by their continuous accumulation of the coin at a rapid rate.

Small Bitcoin Wallets Under 1 BTC On The Rise

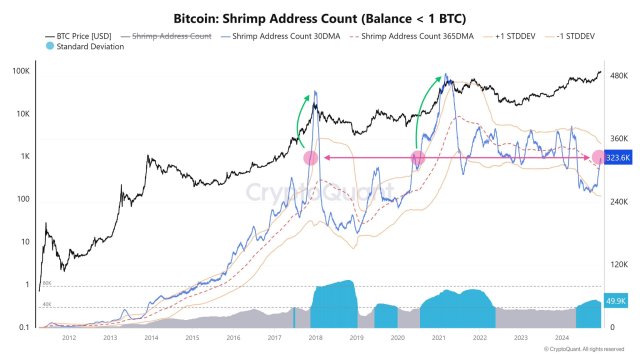

In a significant development, the number of Bitcoin wallet addresses holding less than 1 BTC has witnessed a notable uptick. Axel Adler Jr, a market expert and verified author at CryptoQuant, shared the positive advancements in small wallet addresses on the X (formerly Twitter) platform.

Specifically, this rise in addresses below 1 BTC highlights growing activity among smaller retail investors, reflecting Bitcoin’s stance as a leading asset. It also indicates rising confidence in the long-term prospects of BTC as individuals keep accumulating the crypto asset in spite of recent market turbulence.

Data from the CryptoQuant author reveals that the average number of wallet addresses holding 1 BTC or below has risen to about 323,000, with Bitcoin now trading at $101,000. This growth represents an over 21% surge from its previous level. Adler highlighted that these addresses began increasing at the $61,000 price mark, which was about 265,000.

Even though these holders are being referred to as “shrimps,” Adler noted that they are demonstrating great confidence in Bitcoin’s growth by keeping their holdings at the current levels. Thus, considering the current trend, the on-chain expert believes that the addresses below 1 BTC will increase constantly and reach 351,000 in the near term.

As prices continue to rise, this trend may be an indication of grassroots demand and decentralized adoption propelling Bitcoin’s distribution. Furthermore, the growth at the retail level could be crucial to the crypto asset’s future price dynamics.

Large Investors’ Confidence In BTC’s Prospects Holds Strong

A similar robust optimistic sentiment has also been cited among large investors or whales holding more than 1,000 BTC. Recent reports show that the total number of BTC held by these investors saw a notable upswing over the past week.

Adler reported that these holders have accumulated more than 3,867 million BTC, which is still growing. With this strong accumulation from both small and large-scale investors, the price of Bitcoin might finally attract the necessary strength for significant upward growth.

This increase in BTC whales comes in the midst of heightened market interest, and a continuous rise could act as a bullish signal for the digital asset’s price action. At the time of writing, Bitcoin was displaying a healthy movement, trading at the $105,115 price range. The asset has risen by nearly 4% in the last 24 hours.