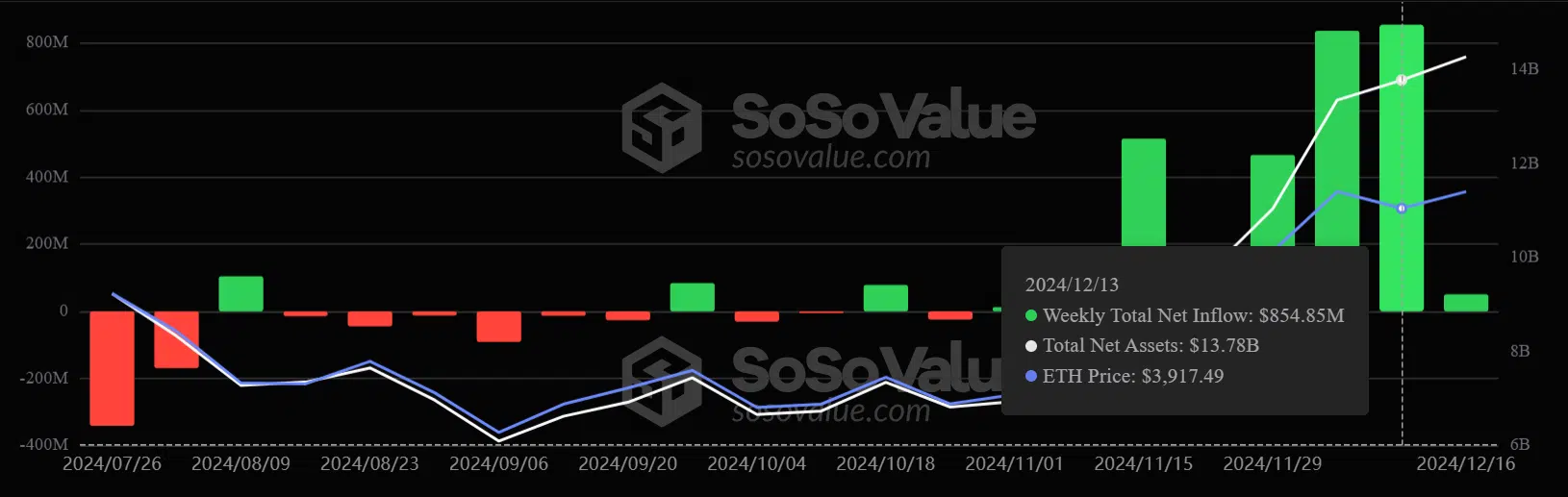

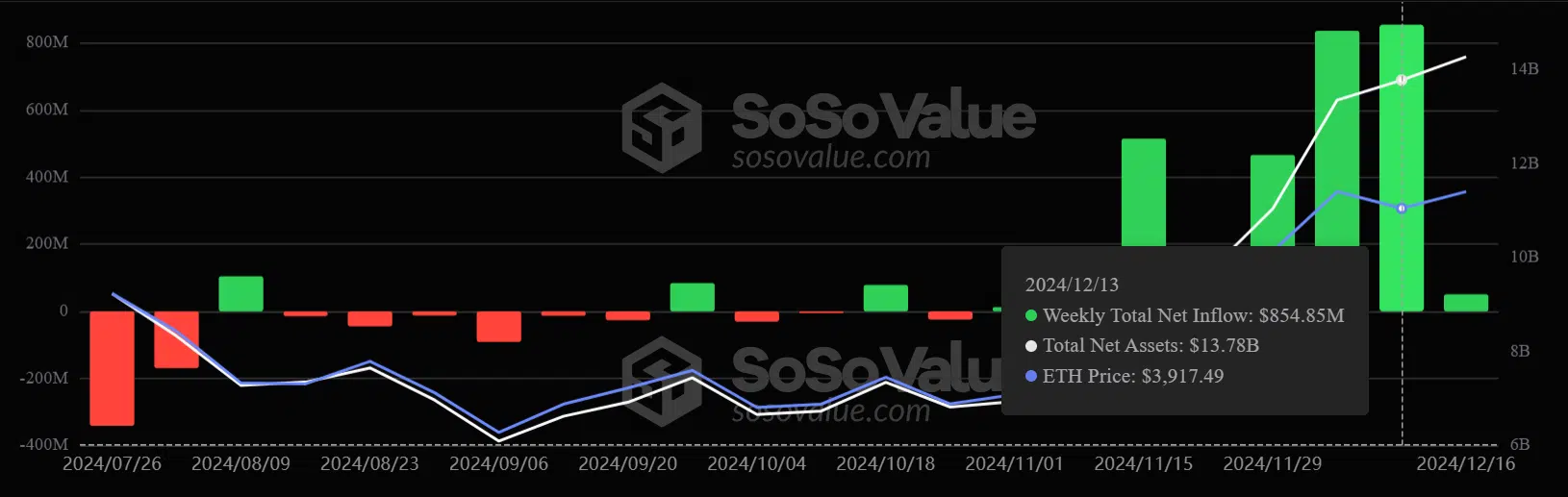

- ETH ETFs saw the highest weekly inflow of $854 million.

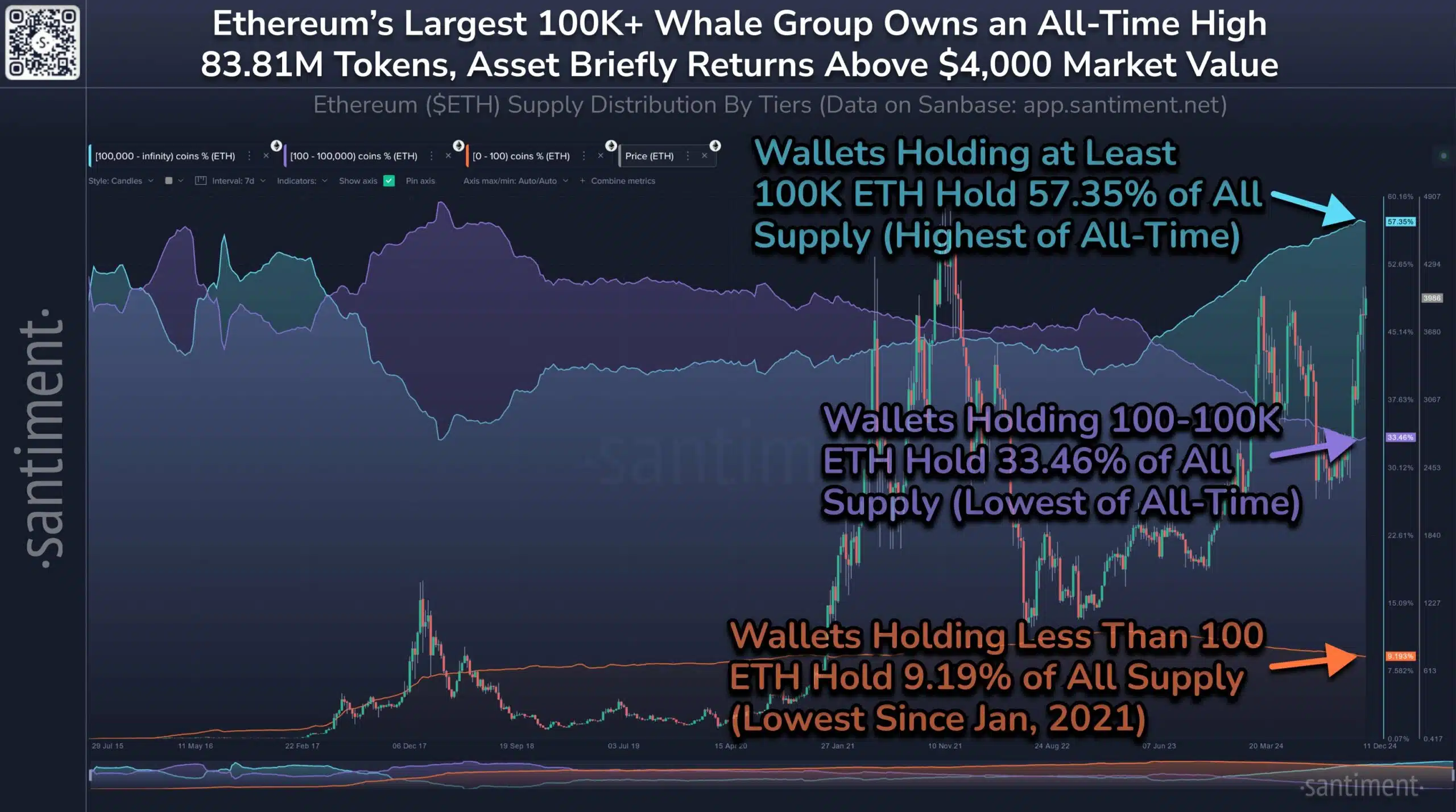

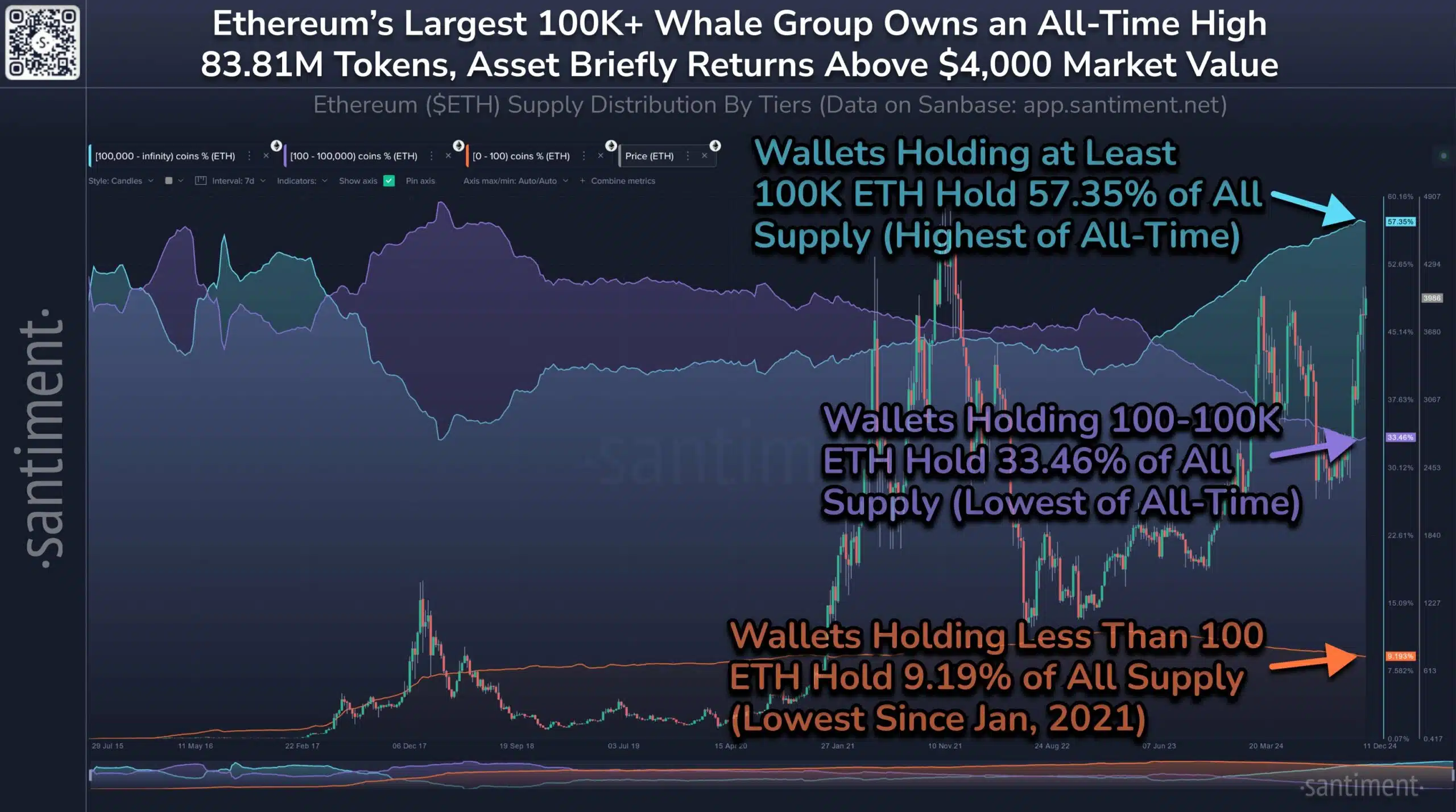

- Whales now hold 57% of ETH supply — Is there an extra rally on the cards?

Since November, the U.S. spot Ethereum ETFs have recorded strong demand, pushing ETH to $4K. Last week, the products netted a weekly inflow of $854.85M, the highest since launch.

This marked the third week of consecutive inflows that have lifted the king altcoin from $3K to $4K.

Source: Soso Value

Now, the ETF products have a cumulative inflow of over $2.3B and $14B in total net assets under management.

Unlike the muted demand seen after the launch in Q3 2024, the renewed institutional interest has been a positive sign, boosting the overall ETH market sentiment.

ETH vs. BTC

However, BlackRock’s ETH ETF, ETHA, maintained a disproportionate lead on the products. As of this writing, BlackRock had $3.2B inflows.

Fidelity’s FETH, and Grayscale’s ETH followed with $1.3B, and $614M. Bitwise’s ETHW came in fourth with a total of $415M inflows since launch.

That said, the renewed institutional interest allowed ETH to catch up to BTC after lagging for the past few months.

As illustrated by the ETH/BTC ratio, which gauges relative ETH performance against BTC, the altcoin briefly strengthened in November and December.

Source: ETH/BTC, TradingView

However, the ETH/BTC ratio was rejected at 0.040 and briefly slipped below the 20-day SMA (Moving Average), suggesting ETH was far from fully strengthening against BTC.

But most analysts expect the altcoin to hit a new all-time high by January 2025, citing historical patterns. Interestingly, whales were also well-positioned for a likely Ethereum surge in 2025.

According to Santiment data, 104 whales with over 100K ETH, now control 57% of all ETH supply, worth $330B. This reinforced a strong bullish conviction of likely extra upside for the altcoin.

Source: Santiment