- DOGE’s liquidation reached $6 billion on the 19th of December.

- However, a few metrics showed signs of recovery.

Dogecoin [DOGE] was one of the most affected among the top 10 cryptos in terms of daily price drop. Meanwhile, the memecoin’s trading volume increased substantially, which could result in further price declines.

Does this mean investors should be prepared for a continued bear trend, or is a reversal possible?

What’s going on with Dogecoin’s trading volume?

Dogecoin’s price has dropped by more than 16% in the last 24 hours, which was one of the highest compared to any top crypto. At the time of writing, the coin was trading at $0.2982 with a market cap of over $43.9 billion, making it the 7th largest crypto.

A possible reason for this could be negative market sentiment around the memecoin.

AMBCrypto reported earlier that Dogecoin’s market sentiment has turned bearish. According to Ali Martinez, a popular crypto analyst, it seemed traders have become impatient with the current price consolidation.

However, the worse part was that the world’s largest memecoin’s trading volume increased by over 54% in the last 24 hours, causing the value to touch $10 billion. A hike in volume amidst a price drop indicates a continued price decline.

Apart from this, DOGE was also witnessing major liquidations as the number surpassed $60 million. To be precise, there were long positions worth $49.33 million and $11.66 million short positions on the 19th of December.

Source: Coinglass

Going forward with DOGE

AMBCrypto then assessed Dogecoin’s on-chain data to better understand whether this downtrend will continue or will investors earn profits again.

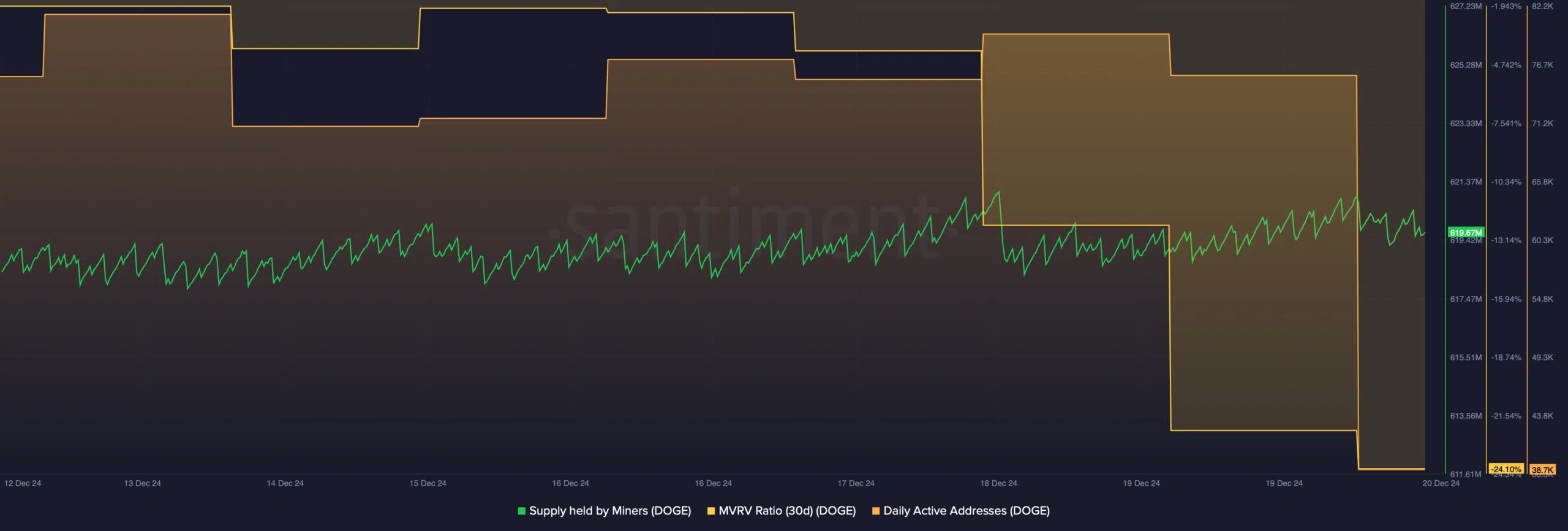

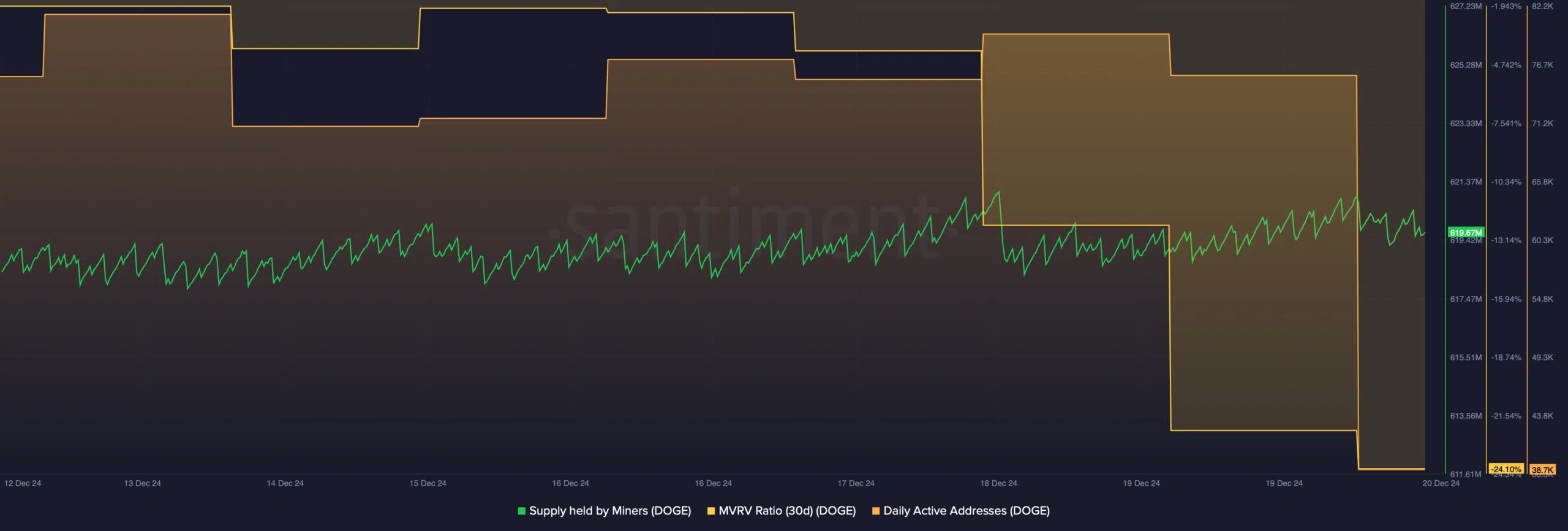

As per Santiment’s data, DOGE’s MVRV ratio dropped sharply last week. At press time, the metric had a value of -24%. Nonetheless, not everything was against the coin.

For example, the fear and greed index had a reading of 21%, meaning that the market was in an “extreme fear” phase. Whenever that happens, it hints at a possible bullish trend reversal.

Source: Santiment

The supply held by miners also increased slightly in the last week—a sign of rising confidence in the memecoin.

Moreover, Dogecoin’s network activity remained robust, which was evident from its high daily active addresses, which can spark a trend reversal too! The technical indicator Relative Strength Index (RSI) was about to enter the oversold zone.

Read Dogecoin [DOGE] Price Prediction 2024-2025

This suggested that buying pressure might increase, which can lift DOGE’s price up in the coming days. Nonetheless, the MACD continued to be in the bears’ favor, suggesting a further price drop.

Source: TradingView