- BTC’s fear and greed index revealed that the market was in a “fear” phase.

- Selling pressure was high, which can push BTC down further.

Bitcoin [BTC] has now dropped below $95k, sparking investor fears of a further price decline. As the year ends, the community expects a price hike. However, investors should remain cautious as BTC’s price may decline further in the coming days.

Bitcoin’s trouble continues!

As per CoinMarketCap, BTC was trading at $93,99k, at press time, which was a clear signal of the king coin struggling after it witnessed a pullback from the $100k mark. This recent price drop has pushed more investors at a loss.

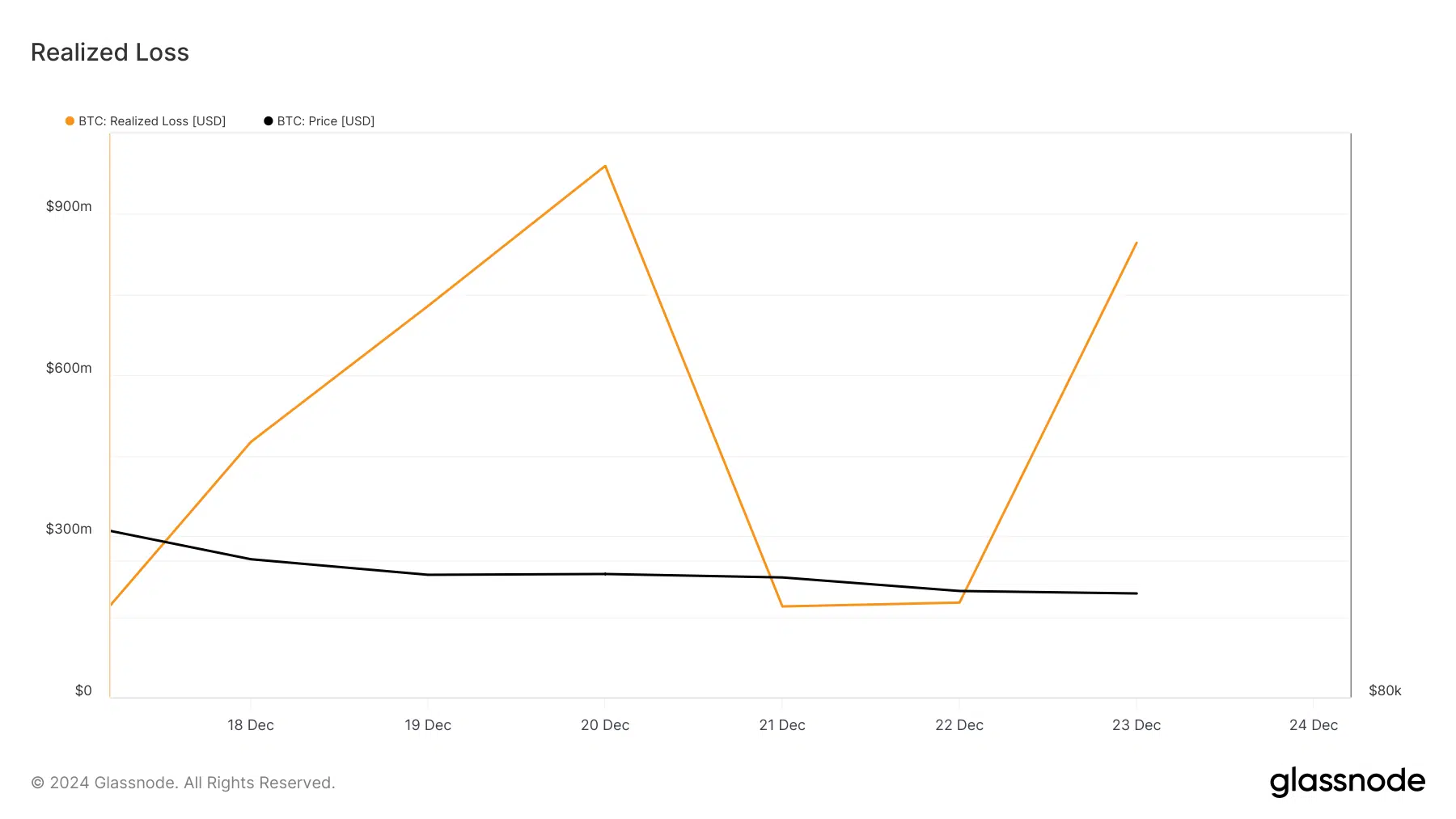

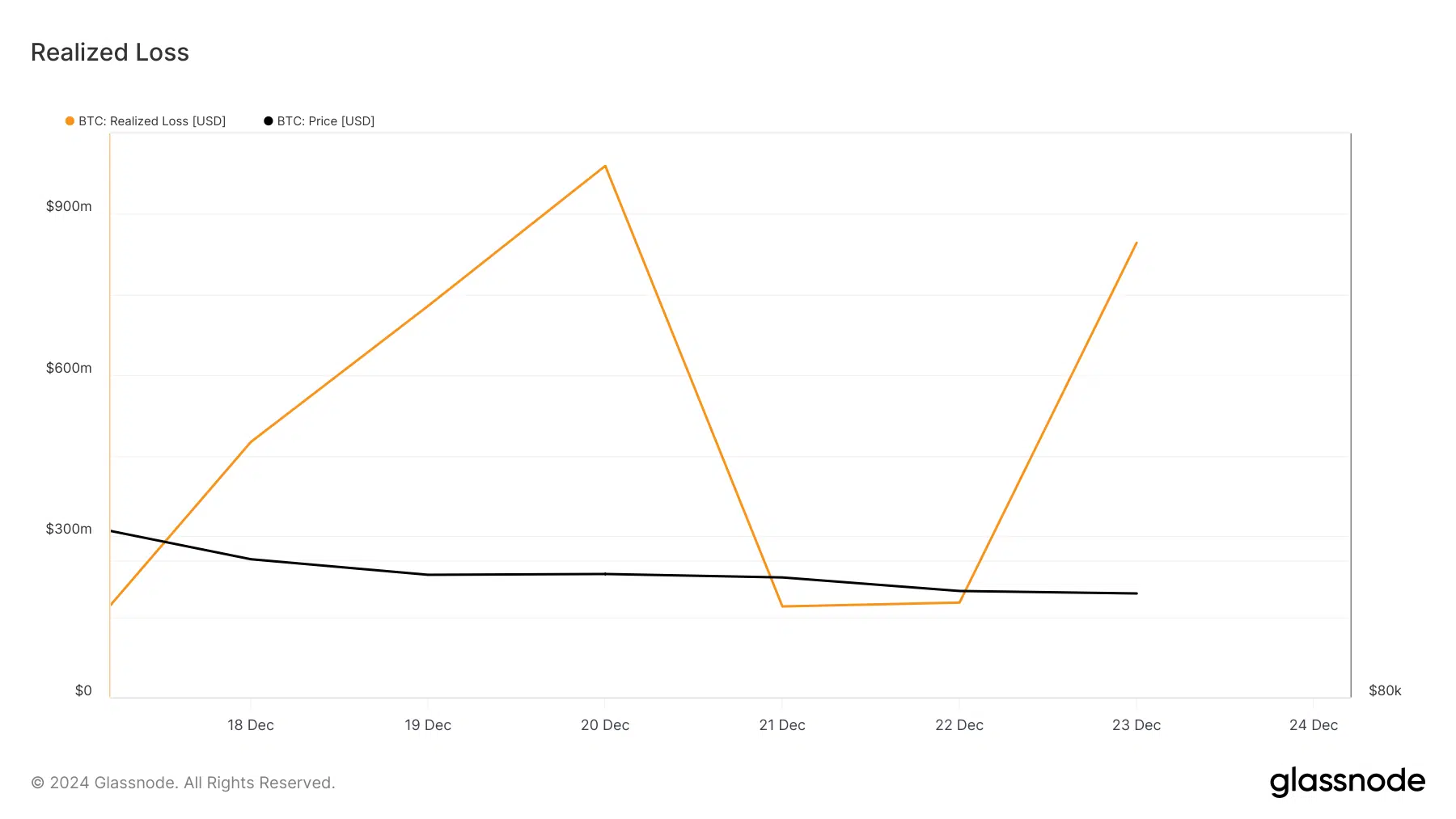

Glassnode’s data revealed that BTC’s realized loss shot up sharply in the last few days. For initiators, the metric indicates the total loss (USD value) of all moved coins whose price at their last movement was higher than the price at the current movement.

Source: Glassnode

Additionally, the fear and greed index, at the time of writing, had a value of 36%, meaning that the market was in a “fear” phase. This suggested that investors were panicking about the declining price action, which possibly could harm BTC more.

Will Bitcoin drop further?

The aforementioned metrics hinted at a further price decline, leading AMBCrypto to investigate further. Glassnode’s data revealed that Bitcoin’s accumulation trend score dropped from 0.9 to 0.7 in the last two weeks. A number closer to one indicates high buying pressure.

The decline suggests that investors were skeptical about buying Bitcoin, a sign of rising bearish sentiment in the market.

Other metrics also pointed to a bearish outlook. BTC’s aSORP turned red, indicating that more investors were selling at a profit. In a bull market, this can signal a market top.

The binary CDD showed that long-term holders’ movement in the last 7 days was higher than average. If these movements were for selling, it may have a negative impact.

Source: CryptoQuant

Notably, technical indicators also didn’t favor the bulls. For example, the Relative Strength Index (RSI) went southwards. Bitcoin’s Chaikin Money Flow (CMF) also followed a similar declining trend.

Both these indicators hinted at high selling pressure which can push BTC’s price down.

Read Bitcoin [BTC] Price Prediction 2024-25

If that’s to happen, then BTC might first test its support at $91k. A further price decline can result in a plummet to $87 in the coming days.

However, such negative sentiment doesn’t generally remain in the market for long. So, the possibility of a BTC trend reversal can’t be ruled out yet.

Source: TradingView