- MSTR is in a high-stakes gamble that could have profound consequences for both the company and Bitcoin’s future.

- Regular monitoring of MSTR’s balance sheet has never been more crucial.

“My goal is to buy more Bitcoin.”

MicroStrategy’s [MSTR] plan for the future couldn’t be clearer.

With 444,262 BTC worth $41.8 billion under its belt, the company has solidified its position as a key player in the crypto market, holding the power to tip the scales at will.

Now, all eyes are on its latest bold move. In a recent SEC filing, MicroStrategy proposed issuing a whopping 10 billion additional shares – an “urgent” action that has left market watchers divided.

Will this ‘strategic’ step spark even more Bitcoin purchases, or will it add to the volatility already building up for 2025? The clock is ticking.

MSTR’s balance sheet under scrutiny

In any major business move, acquiring significant capital is non-negotiable. Now, imagine MSTR deciding to buy an additional $10 billion worth of shares while already having 330 million shares outstanding.

This move would undoubtedly thrust its balance sheet into the spotlight.

Such a large acquisition would raise questions about the company’s financial health, its ability to manage the added debt, and how it impacts existing shareholders.

In this case, the stakes are even higher. Given MSTR’s heavy involvement in Bitcoin, investors are likely to speculate on how this acquisition might influence Bitcoin’s price.

To put things into perspective, MSTR’s recent financials tell an interesting story.

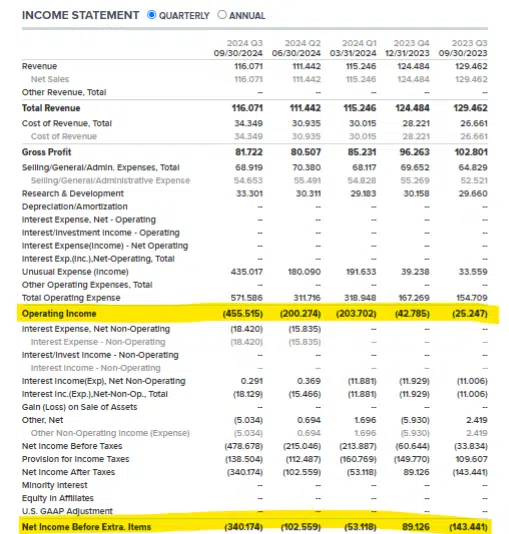

Source : MicroStrategy

For the third quarter, MSTR reported total revenues of $116.1 million – a 10.3% decrease from the previous year. Gross profit stood at $81.7 million, but with a gross margin of 70.4%, down from 79.4% in 2023.

These figures suggest that MSTR is facing some profitability pressure. However, the most telling number lies in the company’s operating expenses, which skyrocketed by 301.6% year-over-year, totaling $514.3 million.

This sharp increase in operating expenses signals a bold strategy, likely to secure additional capital for BTC-related ventures.

But here’s where things take a risky turn: if Bitcoin experiences a significant downturn, MSTR’s strategy could backfire.

Critics are quick to point out that the company may struggle to service its growing debt if Bitcoin’s value drops.

In essence, MSTR’s stock has become a proxy for Bitcoin, meaning that Bitcoin’s performance directly impacts the company’s fortunes. If BTC falls, MSTR’s stock could follow suit.

As a result, MSTR could be forced to sell off its Bitcoin holdings to raise capital, which could negatively impact Bitcoin’s price even further, creating a potential downward spiral for both.

The bottom line: MSTR’s heavy bet on Bitcoin puts it in a precarious position.

While the strategy could deliver huge gains if Bitcoin continues to rise, a sharp drop in BTC could trigger a chain reaction of financial instability.

Thus, here comes the ‘urgency’

MSTR is caught in a high-stakes gamble, attempting to solve a problem with an even bigger one. The push for $10 billion in capital funding isn’t just a strategic move – it’s becoming a matter of urgency.

With 330 million Class A shares already outstanding, MSTR is running out of options. Clearly, their ability to raise more funds through traditional means is nearing its limit.

This means that for MSTR to continue its Bitcoin buying spree, this $10 billion capital raise is absolutely essential.

The good news for the company? Michael Saylor controls 46.8% of the voting power, meaning only around 4% of the remaining shareholders need to approve for the proposal to pass, which makes it almost a done deal.

Once this funding is secured, MSTR is likely to ramp up its Bitcoin accumulation even further, keeping investors engaged and the stock afloat.

However, this strategy comes with risks. As we approach 2025, the volatile crypto market looms large, presenting significant challenges for both MSTR and Bitcoin.

Read Bitcoin’s [BTC] Price Prediction 2025-26

This volatility could trigger a cycle of risk, where each shift in Bitcoin’s price directly impacts MSTR’s ability to manage its debt.

The stakes have never been higher. This is a critical moment to watch closely in the coming months, as these developments could reshape the future of both MSTR and Bitcoin.