Data shows the Bitcoin correlation with the US dollar index and stock market indexes like S&P 500 and Nasdaq 100 have dropped low recently.

Bitcoin Is Showing Little Correlation To Any Index Right Now

In a new post on X, the market intelligence platform IntoTheBlock noted how the correlation of BTC with traditional assets has dropped to low values recently.

The relevant metric here is the “correlation coefficient,” which keeps track of the linear dependence between the prices or values of any two given commodities or assets.

When the value of this metric is above zero, it means that the assets in question are moving in the same direction right now. The closer the indicator’s value is to 1, the stronger this correlation is, and the more striking the resemblance between the two price trends.

On the other hand, the negative indicator implies that there may be a correlation between the commodities, but it’s a negative one. This means that if one asset goes up, the other will react by moving down. Once again, the closer to -1 is the coefficient, the more tied the assets are.

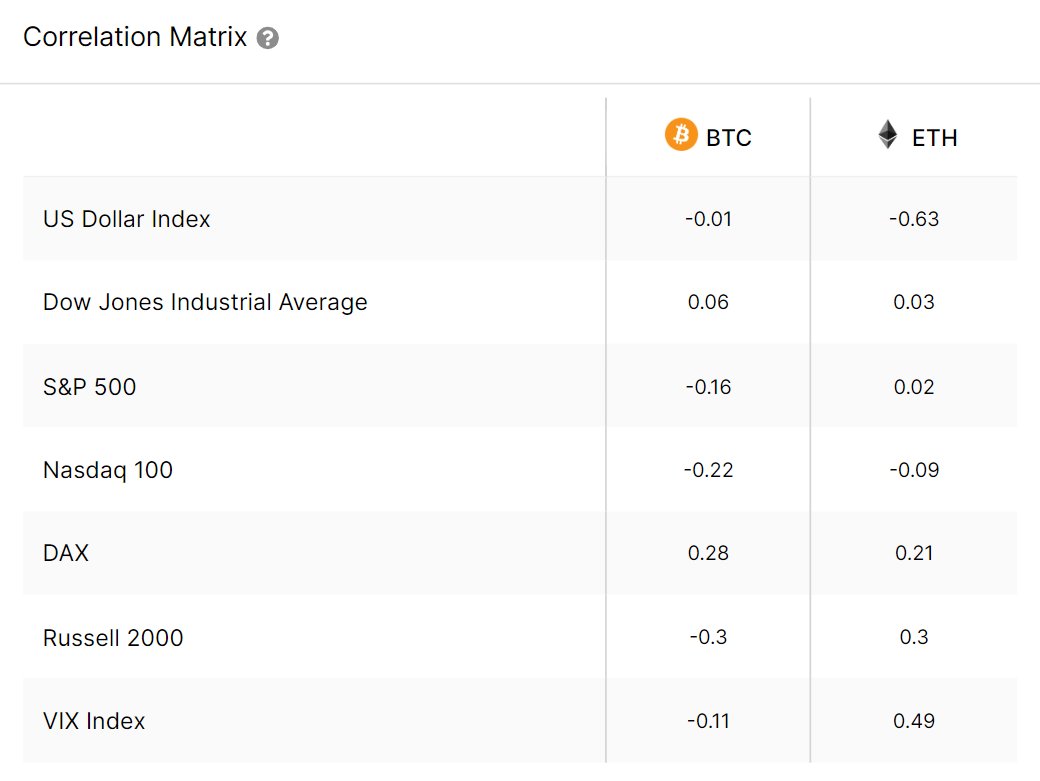

The correlation coefficient is zero or close to zero, suggesting that there is little correlation between the assets. Now, here is a table from IntoTheBlock that shows what the correlation coefficient of the top two cryptocurrencies, Bitcoin and Ethereum, looks like for various indexes right now:

As displayed above, the correlation coefficient between Bitcoin and the US Dollar Index is -0.01, meaning that the cryptocurrency isn’t tied to the index.

Ethereum, on the other hand, is showing some degree of correlation to the DXY, as the coefficient’s value is -0.63 currently. The negative value naturally implies ETH has been moving against the index.

For the rest of the indexes, both BTC and ETH have a correlation coefficient value between -0.3 and 0.3, implying that the digital assets don’t have any real relationship to them.

One exception in the case of Ethereum and is the VIX index. The second largest coin in the cryptocurrency sector currently has a correlation coefficient of 0.49 with this stock market volatility index, which is a notable value.

The two digital assets having little correlation to traditional assets like the S&P 500 and Nasdaq 100 may be good news for their investors, as the coins present a portfolio diversification avenue.

However, Bitcoin and Ethereum don’t offer much diversification, as some recent data revealed that ETH and many other top assets in the sector are highly correlated to BTC.

BTC Price

At the time of writing, Bitcoin is trading at around $26,500, down 1% during the past week.