Layer-1 (L1) coin IP has emerged as the market’s top gainer today, defying the broader crypto downturn to post a 4% increase in the last 24 hours.

However, despite the price surge, warning signs are flashing under the surface. On-chain activity remains muted, suggesting the rally may not be backed by strong fundamentals.

Traders Bet Against PI Despite Price Rise

While most cryptocurrencies traded lower on the day, PI has bucked the trend to record gains. However, the rally may not last long, with on-chain metrics signaling growing skepticism among traders.

For example, amid its 4% rally over the past day, IP’s daily trading volume has dipped 38%, indicating that fewer participants support the upward price move.

When an asset’s price rises while its trading volume falls, it suggests that fewer participants are driving the price movement. This indicates weak buying momentum or a lack of broad market support behind the IP price rally.

Such conditions make the coin’s rally unsustainable, increasing the risk of a reversal or pullback.

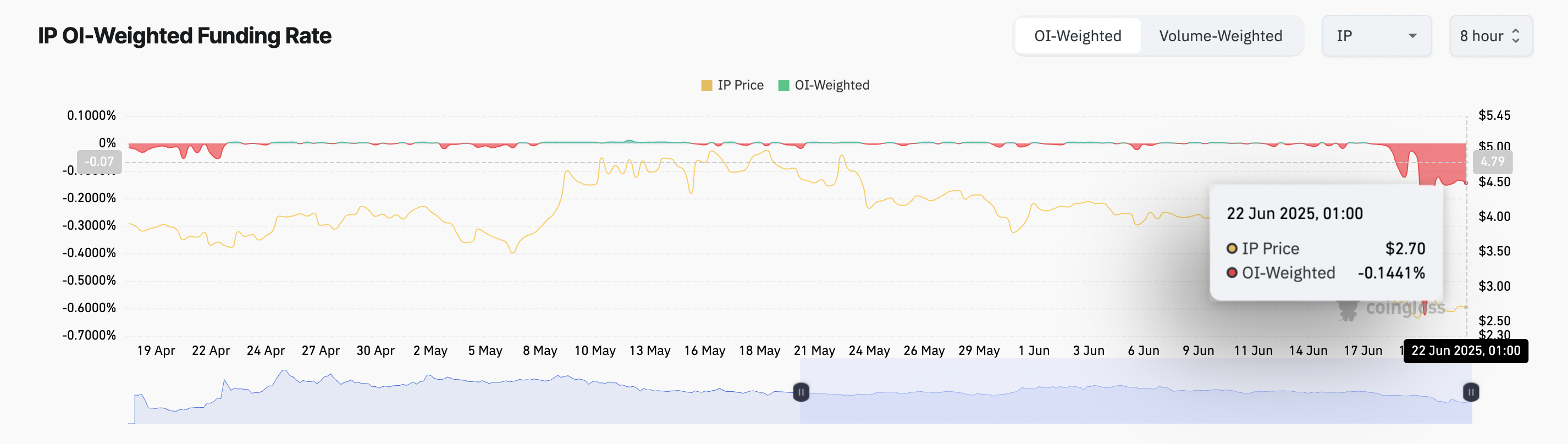

Furthermore, IP’s funding rate remains negative, reflecting that many traders in the futures market are taking short positions—betting that the price will fall. As of this writing, this stands at -0.14%.

The funding rate is a periodic fee paid between traders in perpetual futures markets to keep contract prices aligned with the spot price. When the funding rate is negative, short traders are paying long traders, indicating that the majority of the market is betting on a price decline.

In IP’s case, the negative funding rate indicates that many traders anticipate a reversal of its recent price rally. This reflects the persistent bearish pressure that has kept the coin’s performance subdued over the past several weeks.

Can IP Rebound? Token Eyes $3.17 If Demand Returns

As of this writing, IP trades at $2.75, hovering above a key support level at $1.59. If demand weakens, IP risks plunge below this floor and potentially fall under the $1 mark.

However, a resurgence in new demand for the altcoin could invalidate this bearish outlook. In that scenario, IP’s price may rebound toward $3.17. A successful break above that resistance could propel the IP token price toward the $4.41 level.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.