Bitcoin is entering a critical phase as it continues to consolidate just below its all-time high of $112,000, a level it has been unable to reclaim since late May. Despite several attempts to break higher, BTC has consistently found strong demand above key support zones, suggesting that buyers remain firmly in control. Now, with volatility compressing and momentum building, many traders believe a breakout is near.

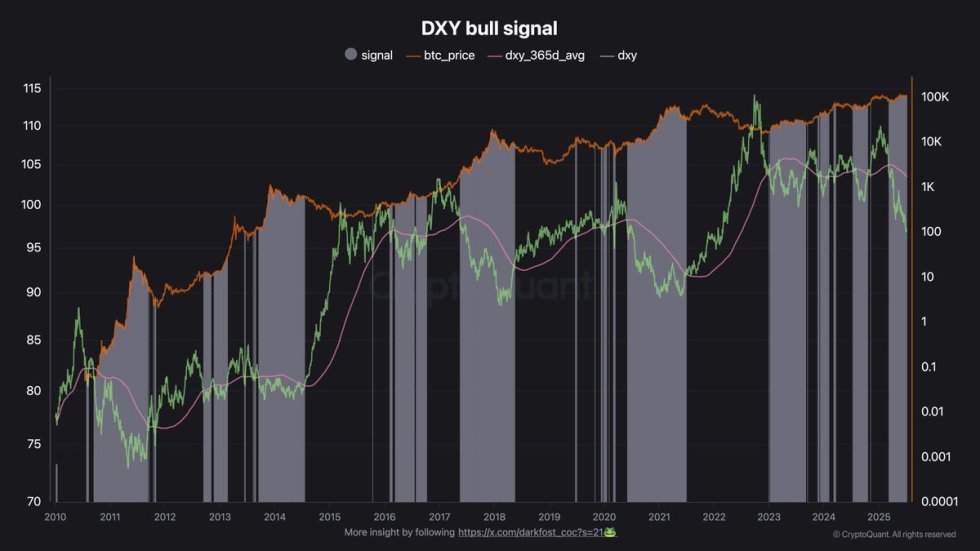

Top analyst Darkfost highlighted a key macro development that could fuel Bitcoin’s next move: the US Dollar Index (DXY) has just recorded its largest deviation below the 200-day moving average in the past 21 years. This weakness comes as US debt reaches a new all-time high, stoking concerns about long-term economic stability. While this setup may seem troubling on the surface, it historically favors risk assets like Bitcoin.

Periods of dollar weakness often coincide with rising demand for alternative stores of value. With BTC holding key support and macro forces aligning, the stage appears set for a push into price discovery. Investors now turn their eyes to the $112K barrier—if broken, it could open the gates for a strong rally ahead.

Bitcoin Awaits Breakout As Dollar Weakness Builds A Bullish Backdrop

Bitcoin and the broader crypto market remain in a state of eerie calm. Price action has stalled, with no clear breakout or breakdown across major assets. Bulls are increasingly optimistic, eyeing a breakout that could send BTC into uncharted territory. Meanwhile, bears maintain a cautious stance, expecting either prolonged consolidation or a sharp correction if key support levels fail.

According to Darkfost, macroeconomic conditions could soon tilt the balance. While the US national debt just reached a new all-time high, the US Dollar Index (DXY) is trading at historically weak levels, currently 6.5 points below its 200-day moving average. That marks the largest downside deviation in over two decades. Although such a development might seem troubling for traditional markets, it often signals strength ahead for risk assets like Bitcoin.

This inverse correlation between the dollar and Bitcoin is well-documented in traditional finance. When the DXY weakens and loses its safe-haven status, capital tends to rotate into alternative assets, including crypto. Historical data shows that BTC has consistently outperformed during periods when the DXY trades below its 365-day moving average.

The current environment mirrors those bullish setups. Despite the favorable macro backdrop, Bitcoin’s price has not yet reacted, continuing to trade below its all-time high. This disconnect may reflect market hesitation or a buildup of momentum before a large move. If history repeats, the dollar’s weakness could soon serve as a catalyst for Bitcoin’s next major rally.

BTC Price Holds Steady Below Resistance

Bitcoin continues to trade in a tight range just below its all-time high of $112,000, currently hovering around $109,000. As seen in the daily chart, BTC remains confined between two key levels: $103,600 acting as solid support and $109,300 as resistance. Since late May, the price has consolidated within this zone, building pressure for the next significant move.

The price action shows a consistent pattern of higher lows, indicating that bulls are stepping in to defend key support levels. The 50-day moving average (blue line) sits below the price at $106,742, reinforcing bullish momentum. Meanwhile, both the 100-day and 200-day moving averages are aligned upward, showing a healthy long-term trend.

Despite several attempts, Bitcoin has failed to close convincingly above the $109,300 resistance. A daily breakout above this level with strong volume would likely trigger a rally toward price discovery. On the other hand, if the price drops below $103,600, it could open the door for a deeper correction.

Featured image from Dall-E, chart from TradingView