Sequans Communications, a France-based fabless semiconductor firm, today announced the purchase of 1,264 Bitcoin (BTC) for a total of $150 million, averaging $118,659 per BTC. This latest acquisition brings the company’s total BTC holdings to 2,317 BTC.

Sequans Expands Bitcoin Holdings With 1,264 BTC Purchase

In an announcement made earlier today, French firm Sequans revealed it had acquired 1,264 BTC in its latest purchase. The New York Stock Exchange-listed (NYSE) firm now holds a total of 2,317 BTC, acquired at an average price of $116,493 per BTC, including fees.

Sequans recently closed a $384 million private placement, aimed at funding its growing Bitcoin treasury strategy. CEO Georges Karam emphasized that the company’s decision to increase BTC exposure is driven by a goal to enhance financial resilience and long-term strategic optionality.

According to details, the deal consisted of a $195 million sale of American depository shares (ADS). In addition, the deal included warrants at $1.40, with $189 million of five-year secured convertible debentures valued at a 4% discount.

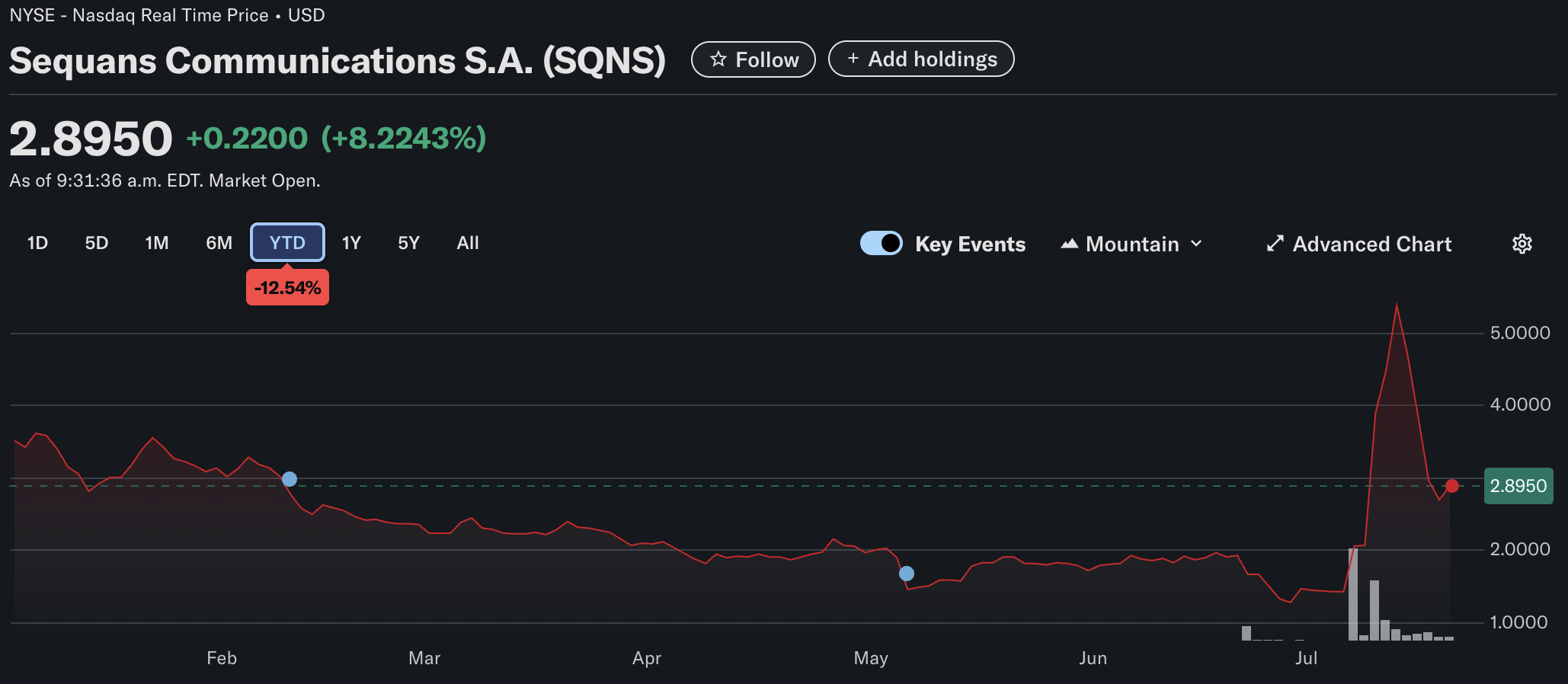

Following today’s announcement, Sequans’ share price surged 8.2%, trading at $2.89 at the time of writing. However, the stock remains down by 12.5% on a year-to-date (YTD) basis.

Today’s purchase places Sequans Communications among the leading publicly listed companies with significant Bitcoin treasuries. According to CoinGecko data, only 17 companies globally hold more than 2,000 BTC on their balance sheets.

Michael Saylor’s Strategy remains the undisputed leader, having announced an additional 6,220 BTC purchase today, worth nearly $740 million. As of now, Strategy holds 607,770 BTC at an average cost of approximately $71,756 per BTC.

Other names amongst the top 10 corporate Bitcoin holders include MARA Holdings, Riot Platforms, XXI, Metaplanet, Galaxy Digital Holdings, Tesla, and Coinbase. Major Bitcoin mining companies like CleanSpark Inc., and Hut 8 Mining Corp round out the list.

Wall Street Witnessing Bitcoin Frenzy

The past week has seen an unprecedented flurry of Bitcoin acquisition activity. Between July 14 and July 19 alone, there were at least 58 public announcements related to BTC purchases by institutional players.

A week ago, Japanese firm Metaplanet announced a 797 BTC purchase, propelling its total holdings to 16,352 BTC. Similarly, Nasdaq-listed Semler Scientific unveiled a 210 BTC acquisition last week.

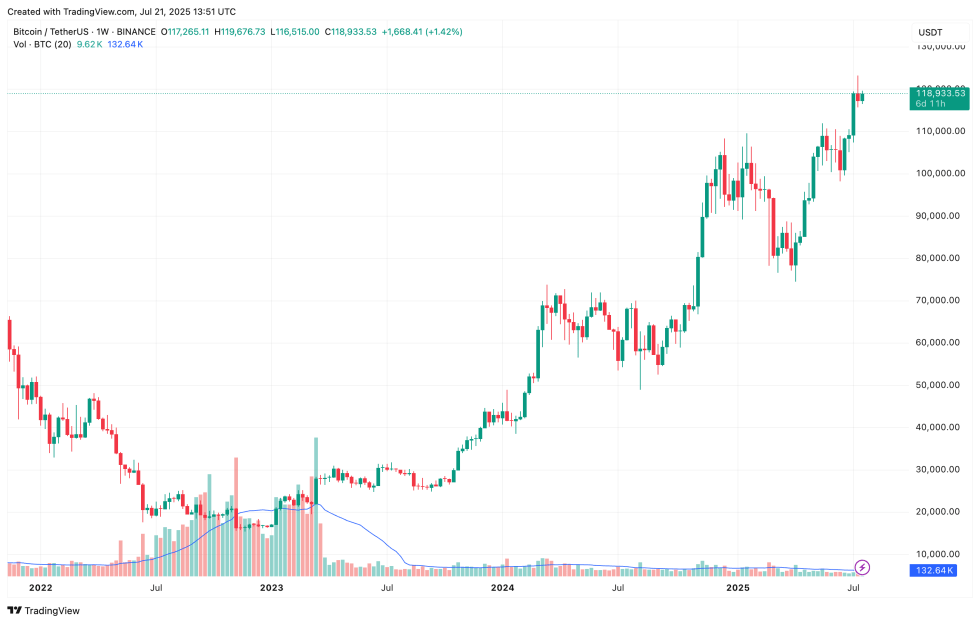

The corporate embrace of Bitcoin appears to be spreading beyond the usual suspects in the US and Asia. Canadian firms are also beginning to explore BTC as part of their treasury allocation strategies, a trend that could accelerate if current market momentum holds. At press time, BTC trades at $118,933, up 0.5% in the past 24 hours.

Featured image from Unsplash.com, charts from Yahoo! Finance and TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.