CoreWeave’s $9 billion plan to acquire Core Scientific is facing growing resistance, and crypto markets are paying attention.

The unexpected shareholder pushback has coincided with a sharp rally in AI tokens, suggesting that investors see deeper implications beyond the boardroom.

CoreWeave Builds Out AI Infrastructure

CoreWeave is one of the largest AI infrastructure providers in the United States. In June, it proposed an all-stock acquisition of Core Scientific, a Bitcoin mining firm now repositioning itself as a data center player for AI workloads.

But that plan is seeing pushback. The deal seemed to be going smoothly, until Two Seas Capital, Core Scientific’s largest shareholder, objected.

Two Seas Capital has a 6.3% stake in Core Scientific. Today, the firm announced it would vote against the deal. The firm believes the offer dramatically undervalues Core Scientific and exposes shareholders to unnecessary risk.

“We invested in Core Scientific because we believe in [its] ability to create value in building…infrastructure at scale. We are therefore disappointed that the Board of Directors has chosen to sell the Company to CoreWeave. From our perspective as a shareholder of Core Scientific, the proposed sale materially undervalues the Company and unnecessarily exposes its shareholders to substantial economic risk,” Two Seas’ statement read.

On the surface, Core Scientific has plenty of good reasons to sign this AI development deal with CoreWeave. The firm’s revenues fell dramatically in early 2025, and CoreWeave is preparing to pay $9 billion for it.

However, this offering consists of CoreWeave stock, not fiat currency.

This deal is also uncollared. So, Core Scientific shareholders like Two Seas won’t receive a share adjustment if CoreWeave’s stock price drops. Simply put, the firm needs more assurances than that.

While CoreWeave is a major player in AI cloud services—reportedly one of OpenAI’s preferred GPU providers—it faces its own vulnerabilities.

The firm heavily depends on a handful of high-profile clients, and its valuation is tethered to volatile market sentiment around AI.

Any pullback in demand, shift in regulatory environment, or funding shortfall could impact Core Scientific’s stock price.

So, Two Seas’ position is clear. It’s not rejecting the merger outright, but it wants a deal with more guarantees or a higher asking price.

But why would the crypto market care about this?

AI Tokens React as Investors Sniff Out Scarcity Narrative

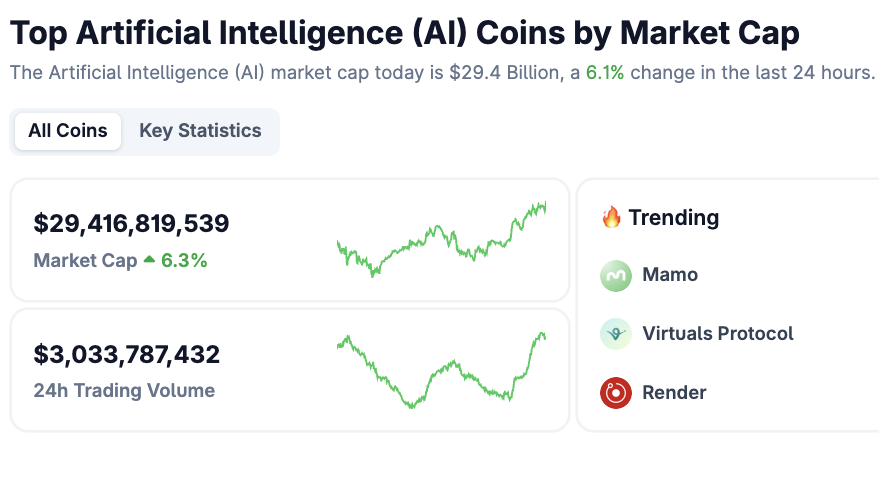

Shortly after Two Seas’ letter went public, the crypto market’s AI sector surged. The total market cap of AI coins jumped over 6% in a matter of hours, according to CoinGecko data.

The market’s reaction reflects a deeper narrative. CoreWeave’s aggressive $9 billion offer and Two Seas’ firm resistance both point to the rising strategic value of data centers and power capacity in the AI era.

With centralized AI infrastructure constrained and contested, investors may be rotating into decentralized AI platforms that promise scalability without single points of failure.

In crypto, narratives drive flows. The public friction between CoreWeave and Two Seas became a narrative trigger—reinvigorating interest in the AI token space.

While this shareholder dispute may resolve through a revised deal or protracted negotiation, the message is already out that AI infrastructure is valuable, limited, and contested.

Overall, the traders should expect more capital rotation into AI-native tokens as narratives shift toward long-term infrastructure plays.

The post AI Coins Surge After $9 Billion CoreWeave Deal Faces Pushback appeared first on BeInCrypto.