The AAVE price had a turbulent few sessions after rumors tied to World Liberty Financial (WLFI). On August 23, the token dropped from $385 to $339 — a fall of more than 8%. Yet, that same $339 level held as strong support.

While volatility spiked, data shows the move was more sentiment-driven than structural, and AAVE remains on course for higher targets.

Exchange Reserves and Whale Accumulation Back Strength

Over the past 30 days, AAVE exchange reserves fell 4.33%, sliding to 5.4 million tokens. That means about 244,400 AAVE left trading platforms. At the current price of $341, this equals roughly $83.3 million worth of tokens moving out of exchanges, a strong sign of accumulation rather than selling.

At the same time, whale wallets grew their holdings by 13.49%. Their stash rose from 17,222 AAVE to 19,542 AAVE, an addition of 2,320 tokens. At current prices, the extra holdings are worth nearly $790,000.

Large wallets adding while exchange reserves shrink typically signal confidence from deep-pocketed players, which might explain why the WLFI-driven AAVE price dip was limited.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Spent Coins and Cost-Basis Heatmap Confirm Stability

Another metric to consider is the spent coins age band. This indicator tracks whether older coins are being spent, which often shows selling pressure. On August 23, the total spent coins stood at 46,600 AAVE. By press time, it had dropped to 15,230 AAVE — a decline of about 67%.

Fewer older coins being moved means long-term holders did not rush to exit, even during the rumor-driven fall.

The cost-basis heatmap, which shows where traders accumulated tokens, adds further context.

At $339, about 143,470 AAVE are held. Another 135,820 AAVE sit near $337. These clusters reflect strong demand zones, confirming why $339 acted as the turning point. Even if another pullback appears, this zone might be able to offer support.

The biggest accumulation band sits deeper at $272.90, where heavy holdings provide a final line of support. Unless that level is broken, AAVE’s structure stays intact.

AAVE Price Action: Targets and Invalidation

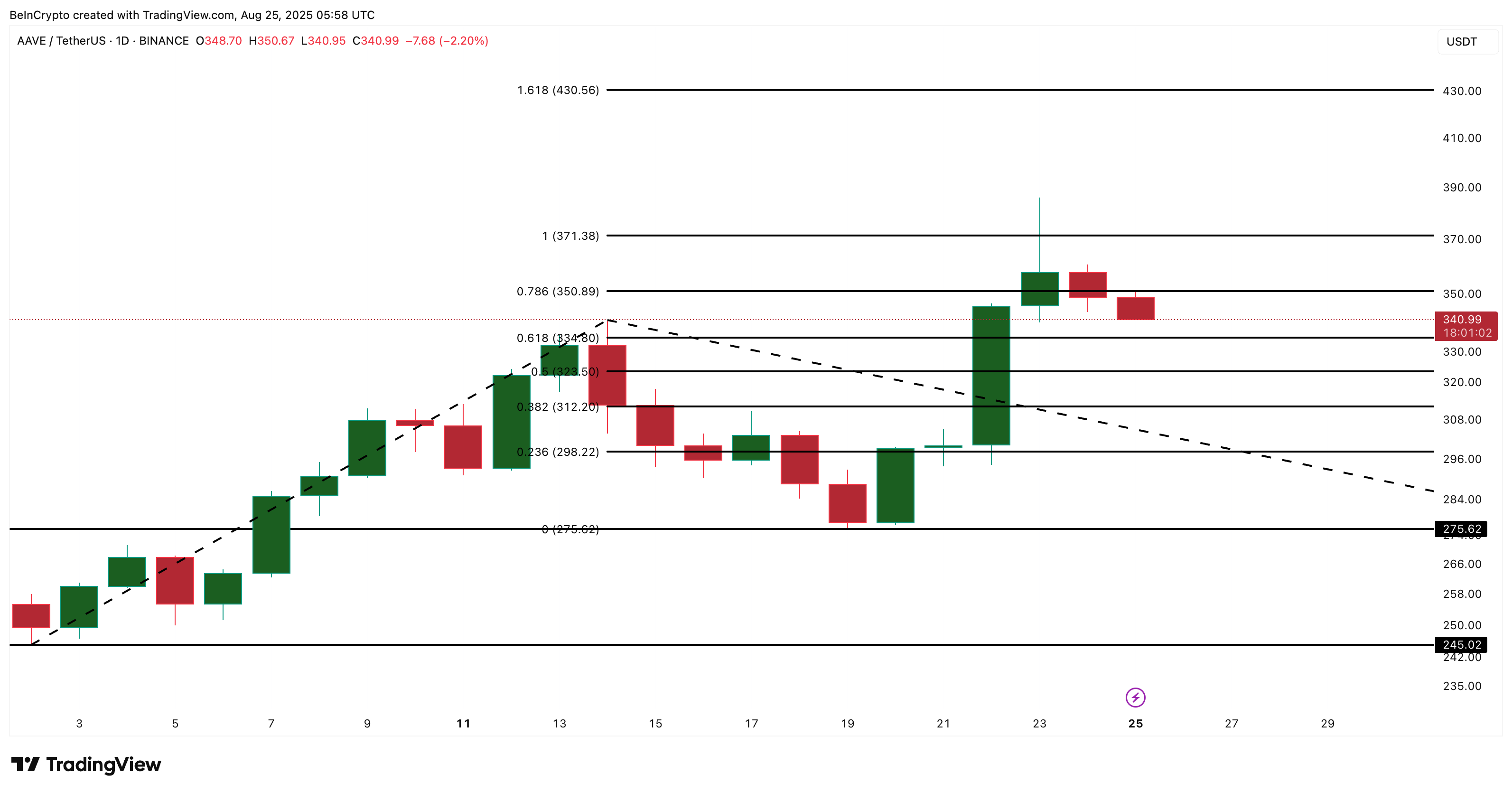

August has already been a strong month for the AAVE price. From $244 at the start of the month to a high of $385 on August 23, the token logged a gain of nearly 58%. Despite the WLFI setback, it still trades around $340, holding the uptrend.

The Fibonacci extension tool places $430 as the next bullish target, about 26% higher than the current levels. A confirmed daily close above $371 would open this path. However, post the current dip, $350 also emerges as a strong resistance level for the AAVE price. Even the cost basis heatmap from earlier identifies $352 as a strong accumulation level and, hence, a key resistance zone.

However, traders should also watch invalidation levels. A drop under $275 might break into the largest cost-basis cluster at $272.90 and flip the structure bearish in the short term. As for the immediate support, $334 looks strong.

The post AAVE Price Shrugs Off WLFI Jitters as Key Indicators Still Point to $430 appeared first on BeInCrypto.