Cryptocurrency-based treasury reserves have become a highly adopted initiative in the sector, with Ethereum and Bitcoin leading the charge. Even though the initiative kicked off with Bitcoin, Ethereum treasury reserves have witnessed exponential growth as accumulation grows among large companies in the past few months.

Institutional Ethereum Adoption Still Growing

Amid the new wave of crypto adoption in the financial landscape, Ethereum’s role as a premier institutional asset is gaining traction, with treasury reserves holding ETH expanding at a rapid pace. In recent months, corporate and cryptocurrency-native treasuries have both increased their holdings, indicating a growing conviction in Ethereum’s long-term value and utility.

However, Ted Pillows, a crypto enthusiast and investor, has reported a cooling down in ETH accumulation among treasury companies in September. Such a development hints at a potential pause in the accumulation trend.

Following months of aggressive ETH allocations, this cooling trend raises the question of whether treasuries are taking a break or waiting for the market to reevaluate. Data shared by Ted shows that companies have acquired over 816,000 ETH in the month alone. While it may seem like a large quantity, this is a 50% decline when compared to August’s accumulation.

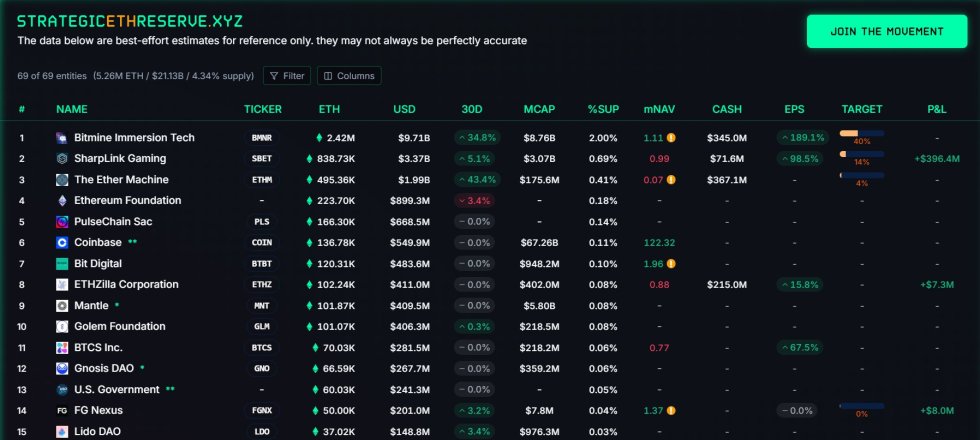

This drop in half marks one of the steepest month-to-month pullbacks of this year. Despite the pullback in institutional accumulation, Ethereum treasury reserves remain elevated, with over 5 million ETH held in total by companies.

According to the expert, there are now 5,255,246 ETH held by treasury reserve corporations, signaling growing confidence in Ethereum’s long-term value and utility. With these enormous holdings, ETH is positioned as a key component of treasury diversification strategies across the globe, highlighting not only its growing reputation as a store of value but also its pivotal role in decentralized finance and staking economies.

ETH Being Hailed As The Asset To Drive The Next Business Strategy

Forbes has proclaimed that the ETH treasuries could be the next big business strategy in the financial sector. What was once seen as a high-risk experiment is now being reconsidered as a forward-looking business strategy, with business and investors exploring ETH holdings as a hedge and a growth engine.

The firm’s bold statement is driven by its belief that ETH treasuries are yield-bearing assets, unlike Bitcoin, which typically sits idle on corporate balance sheets. Furthermore, Forbes stated that the statement is not from a speculative view because ETH is balance sheet engineering. By staking or lending ETH, treasury funds can lower circulating liquidity and generate new revenue streams.

At the time of writing, ETH’s price was trading back above $4,100, demonstrating a nearly 3% increase in the last 24 hours. Bullish sentiment is gradually returning to the market, as evidenced by an increase in its trading volume. Data from CoinMarketCap shows that the trading volume has spiked by more than 50% in the last day.