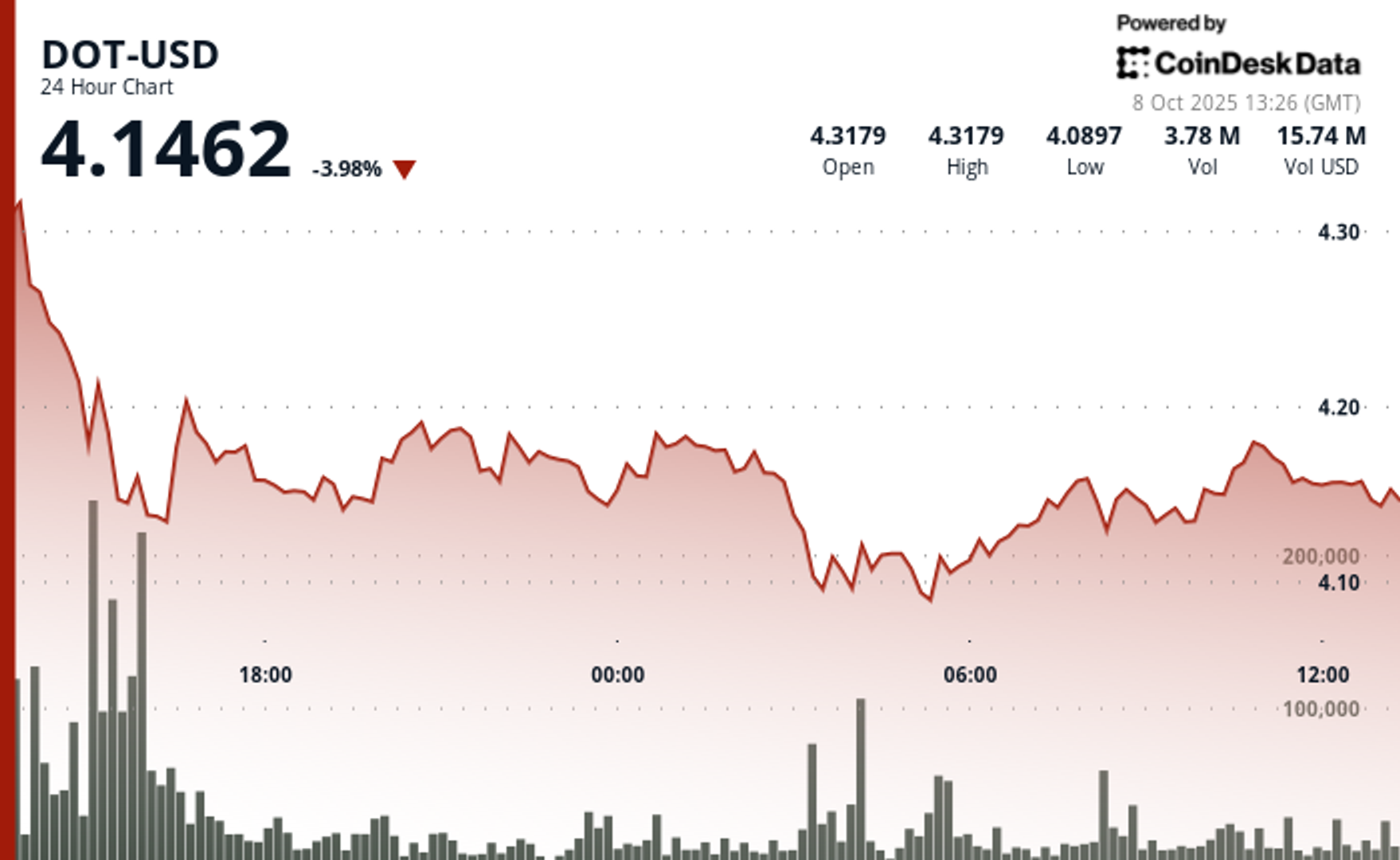

Polkadot (DOT) encountered substantial volatility throughout the last twenty-four-hour period, with the cryptocurrency retreating 4%, according to CoinDesk Research’s technical analysis model.

The model showed that the most noteworthy movement materialised when DOT plummeted to its lowest juncture of $4.07 on elevated volume of 3.16 million, considerably above the twenty-four-hour average of 2.31 million, establishing robust volume support at this level.

Following this capitulation event, DOT demonstrated resilience by recovering to the $4.15-$4.18 range, suggesting institutional buying interest emerged at lower levels and potential stabilisation around current support zones, according to the model.

On the news front, Polkadot is consolidating its core system services into Asset Hub on Nov. 4, turning it into the ecosystem’s superchain: Polkadot Hub, according to an earlier post on X.

In recent trading, DOT was 4.2% lower, around $4.13.

The wider crypto market also declined, with the broad market gauge, the CoinDesk 20, down 3.2%.

Technical Analysis:

- Volume analysis revealed 3.16 million units traded during the 3:00-4:00 session on Oct. 8, considerably above the twenty-four-hour average of 2.31 million, indicating robust institutional interest.

- Price action established formidable support at $4.07 level during the capitulation event

- Recovery pattern from $4.14 to $4.16 during the sixty-minute period demonstrated resilience of the $4.14-$4.15 support zone.

- Elevated volume activity during 12:21 and 12:33 recovery candles suggested institutional accumulation at depressed levels.

- Consolidation around $4.15-$4.16 levels through 12:15 indicated potential stabilisation around current support zones.

Disclaimer: Parts of this article were generated with the assistance from AI tools and reviewed by our editorial team to ensure accuracy and adherence to our standards. For more information, see CoinDesk’s full AI Policy.