- Context-dependent cycles

- Is it all about ETFs?

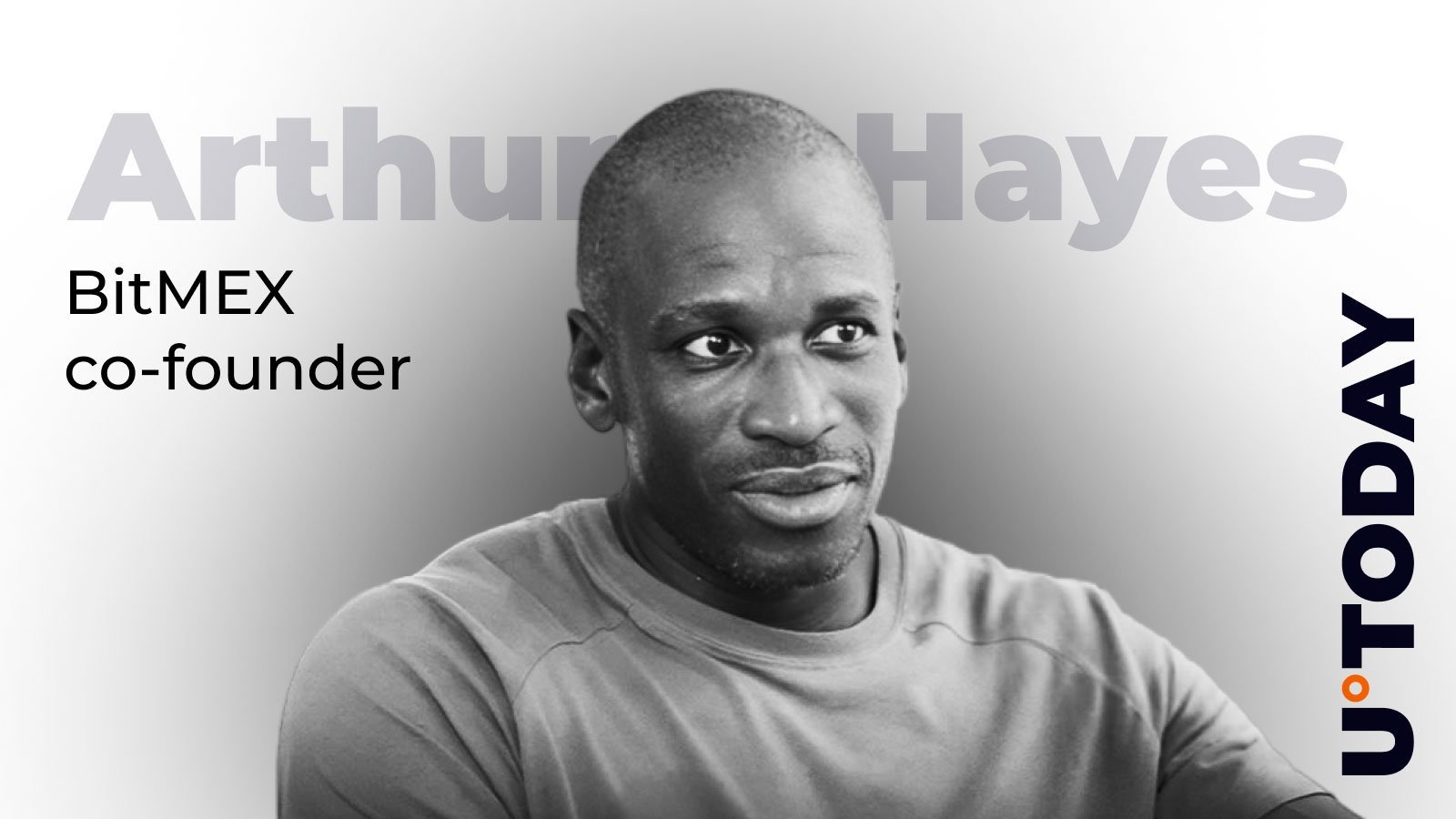

In a recent blog post, former BitMEX CEO Arthur Hayes argues that Bitcoin’s four-year cycle is essentially dead. His explanation is based on different macroeconomic drivers that were behind Bitcoin’s price action in the past.

As reported by U.Today, Hayes previously predicted that the leading cryptocurrency could hit $1 million by 2028.

Context-dependent cycles

There have been a total of three Bitcoin cycles, during which the cryptocurrency hit new record highs.

However, he argued that the cycle theory will fail this time, and those who continue to apply it do not understand why the cryptocurrency surged in the first place.

During the “genesis cycle,” which took place from 2009 to 2013, Bitcoin’s massive bull runs were fueled by aggressive quantitative easing in the U.S., which was implemented in response to the global financial crisis (GFC).

The “ICO cycle” was then fueled by yuan credit expansion. According to Hayes, the market peaked around 2017 when Chinese credit growth slowed down.

The 2021 bull run happened due to the massive trillions of dollars worth of stimulus. The massive run ended as soon as the U.S. moved to tighten monetary conditions in 2022.

Meanwhile, the current US administration is aiming for abundant liquidity, while China’s rather restrained credit growth is not likely to be a headwind. Hence, Bitcoin will essentially keep following the money supply instead of the calendar.

Is it all about ETFs?

As reported by U.Today, CEO Ki Young Ju also previously opined that the four-year cycle theory is essentially dead due to holders outnumbering traders.

There is a popular belief that the cycles have been upended by the introduction of extremely successful Bitcoin exchange-traded funds (ETFs).