Zcash (ZEC) is now trading just below a key technical resistance range, with price action showing signs of slowing following an earlier surge. At the time of writing, ZEC is priced at $240, with a 24-hour trading volume of $730 million.

Meanwhile, the token is down slightly in the past 24 hours but remains up over 460% over the past month (CoinGecko data). The 24-hour price range shows a high of $308 and a low of $237, indicating high intraday volatility following a sharp rally.

Wedge Pattern Approaches Resistance

Current chart patterns show ZEC forming an ascending wedge. This structure often appears during strong rallies and typically signals a point where momentum begins to narrow. The price is now approaching a resistance zone between $280 and $313, marked by Murrey Math levels. These levels are often referenced by traders during periods of overextension.

Movement into this zone has slowed. If volume increases, the price may test this resistance again. If not, the market may start to turn back toward lower support levels. The closest zones of support on the chart appear at $250 and $220.

In addition, the Relative Strength Index (RSI) has reached 69, close to the typical overbought mark of 70. The 14-day RSI moving average is now at 70, which suggests momentum has stretched.

So far, the RSI has not broken above the overbought level. However, staying near these levels may lead to sideways trading as participants wait for a new direction. A short pullback is also a common reaction when RSI hovers at these highs.

Multi-Year Breakout Meets Initial Target

ZEC recently completed a major technical breakout. According to analyst Javon Marks, the token ended a downtrend that lasted over a year and a half. After the breakout, the price moved quickly toward $308, which matched a key target. Marks stated,

“Another >1,000% callout in the books.”

A second target has been placed near $596.65, though this remains above current levels.

The move followed a period of low resistance and accelerating buying volume. The price has not yet shown any extended correction, though activity near $308 may lead to consolidation.

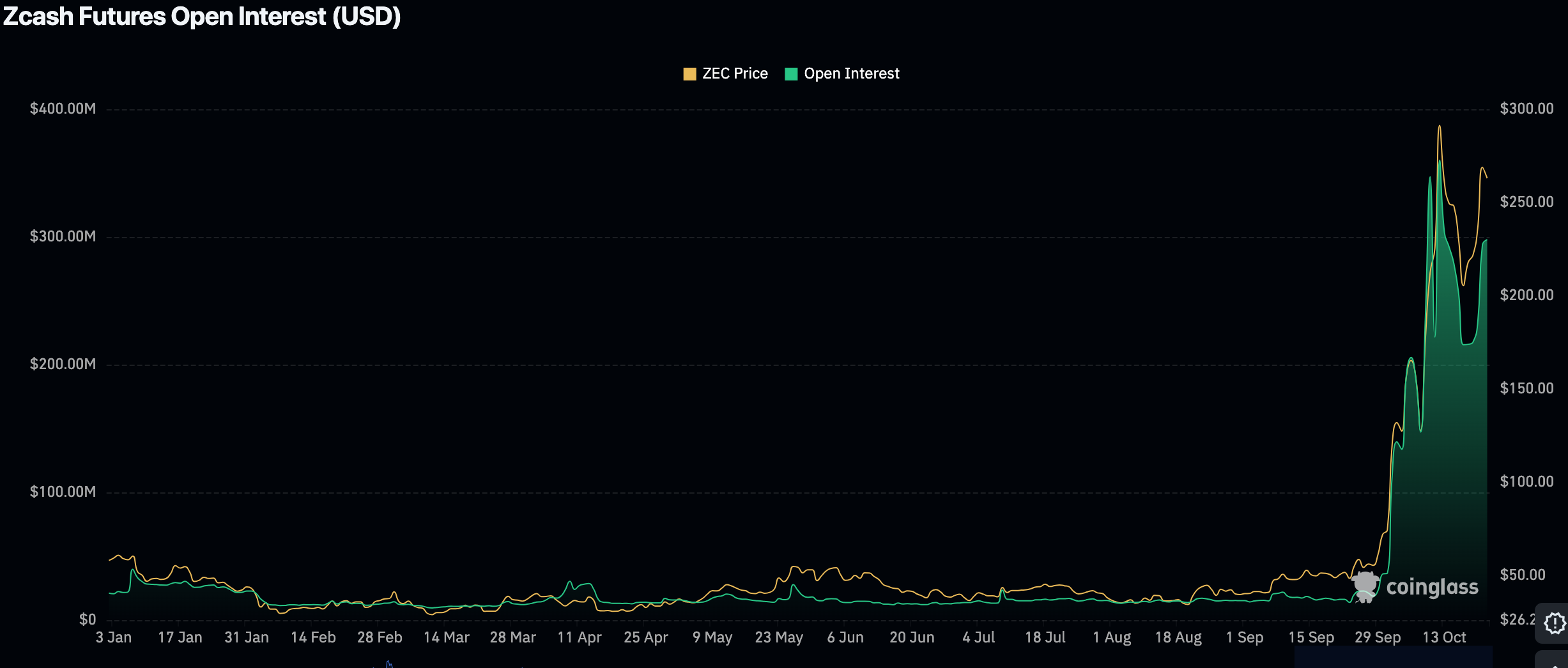

Futures Interest and Mixed Market Sentiment

According to Coinglass, open interest in ZEC futures reached $306.3 million, rising from under $50 million in September. This sharp increase reflects a surge in speculative participation. Such growth often coincides with higher volatility and larger position sizes.

Market sentiment remains split. Analyst Henry wrote,

“ZEC looks cooked. $311 wick was the exit liquidity.”

He also added that failure to hold above $300 could lead to moves toward the mid-$240 range. He referenced a possible head and shoulders pattern forming, while noting that bulls would need to act quickly to change momentum.

As CryptoPotato posted on X, Zcash founder Zooko responded to recent price speculation by saying,

“I don’t know why the Zcash price has been skyrocketing. And I don’t know if it is going to go back down.”

He also dismissed suggestions of coordinated market manipulation, calling them “just more cynical propaganda.”

The post ZEC Hits $308 Then Dumps Hard: What’s Next for This Breakout? appeared first on CryptoPotato.