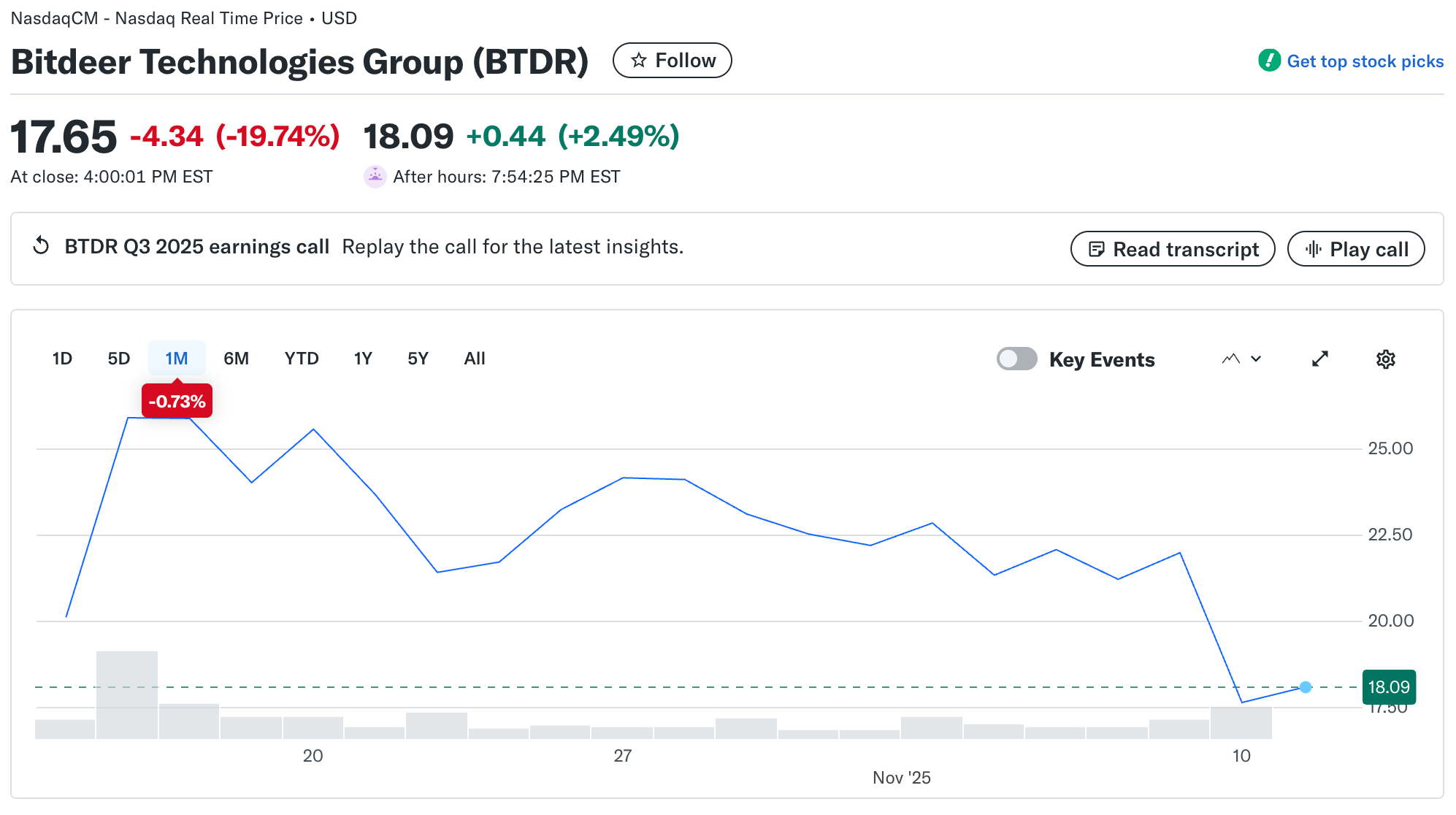

Bitdeer Technologies’ shares fell nearly 32%, closing at $17.65, after reporting a $266 million quarterly loss. The drop followed a 30% rally on October 15, when the stock hit $25.90, fueled by investor optimism over AI and data center expansion plans.

The reversal highlights tension between growing revenue and Bitcoin production, and the impact of non-cash losses, capital expenditures, and large-scale infrastructure investment on profitability.

October Rally Fueled by AI and Infrastructure Expansion

On October 15, Bitdeer (NASDAQ: BTDR) shares surged by more than 30% to $25.90 after announcing plans to expand into AI and high-performance computing (HPC) workloads. BTDR stock had fallen to $17.65 on Monday, marking a nearly 32% decline from its October peak.

The company said it will allocate 200 MW of energy to AI services. It targets annual revenues exceeding $2 billion by 2026. Bitdeer also added 241,000 mining machines across Norway, the US, and Asia. The firm mined 1,109 BTC during the quarter.

The expansion positioned Bitdeer alongside other miners such as MARA, IREN, and Core Scientific, which are increasingly integrating AI and HPC capabilities. Investors initially responded positively, seeing diversification into AI as a way to offset volatility in Bitcoin mining margins.

Quarterly Loss and Market Reaction

Bitdeer released unaudited Q3 2025 results, with revenue rising 174% year over year to $169.7 million. Adjusted EBITDA reached $43 million. The growth reflects higher Bitcoin production and efficiency gains from self-mining expansion.

“Q3 marked a quarter of strong execution and financial performance. Revenue, gross profit, and adjusted EBITDA improved significantly. Efficiency gains were driven by our self-mining expansion. Allocating 200 MW to AI cloud services could generate annualized revenue exceeding $2 billion by the end of 2026.” Matt Kong, Chief Business Officer at Bitdeer said.

However, the optimism reversed as the company posted a net loss of $266.7 million. This compares to a $50.1 million loss in the same quarter last year. It stemmed mainly from non-cash revaluation losses on convertible debt and elevated operational expenses.

Despite mining gains and expanded infrastructure, including the AI transition, which generated $1.8 million in revenue, investors focused on the impact of these paper losses. Following the report, Bitdeer shares dropped nearly 30% on the NASDAQ.

Continued AI Transition and Operational Highlights

In October, Bitdeer continued its progress on its AI-focused infrastructure buildout. Operational data confirm increased production capacity and a growing hash rate, signaling the company’s intent to scale AI workloads while maintaining mining operations. However, Q3 results show financial pressures from capital-intensive expansion and market volatility. This weighed on short-term investor sentiment.

The post From Hero to Zero: How Bitdeer Lost 32% Despite Mining 1,109 Bitcoin appeared first on BeInCrypto.