XRP price is up a little over 4% in the past 24 hours, but this bounce is not enough to call a trend change. XRP has posted several sharp moves of 15% to 20% in recent weeks, yet each one faded before turning into a real rally.

The charts show why these bounces keep failing, and the one level that decides whether this attempt can finally break through.

Repeated Bounce Pattern Forms, but Selling Still Limits Momentum

For weeks, XRP has reacted each time the market’s buying and selling pressure — measured through the On-Balance Volume (OBV) indicator — has pushed against the same downward trendline. OBV tracks whether volume is flowing in or out of the asset, and its trend often leads price.

Since 14 October, OBV has formed a line of lower highs. Every time OBV moves close to that line, XRP gets a bounce.

One move lifted XRP 14.73% between 22 and 26 October. Another pushed the price more than 20% on 6 November. A similar approach toward this trendline is happening now. That surge in volume could be due to the ETF buzz.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

But this pattern also explains why each rally faded. Without OBV closing above the trendline, momentum stays weak. XRP needs that breakout first before any bounce can turn into a sustained move.

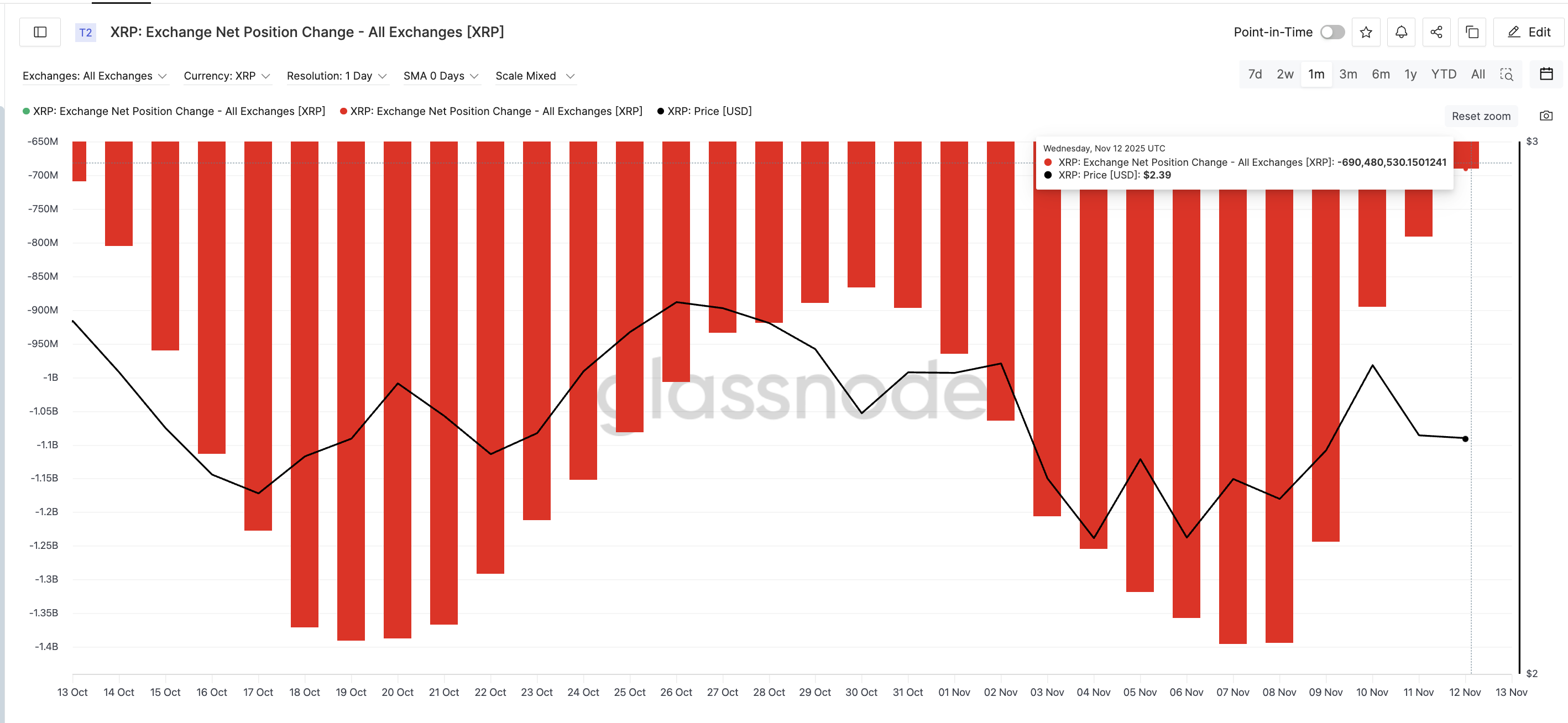

At the same time, fresh selling pressure limits the upside. Exchange data shows outflows — which help price — were strong until 7 November at roughly -1.39 billion XRP. As of 12 November, outflows have shrunk to about -690 million XRP, nearly a 50% drop.

This means more tokens are remaining on exchanges, where they can be sold, making it harder for XRP to extend gains.

Key Supply Wall Still Controls XRP Price Breakout Window

The next question is simple: when can XRP’s bounces finally turn into a proper rally?

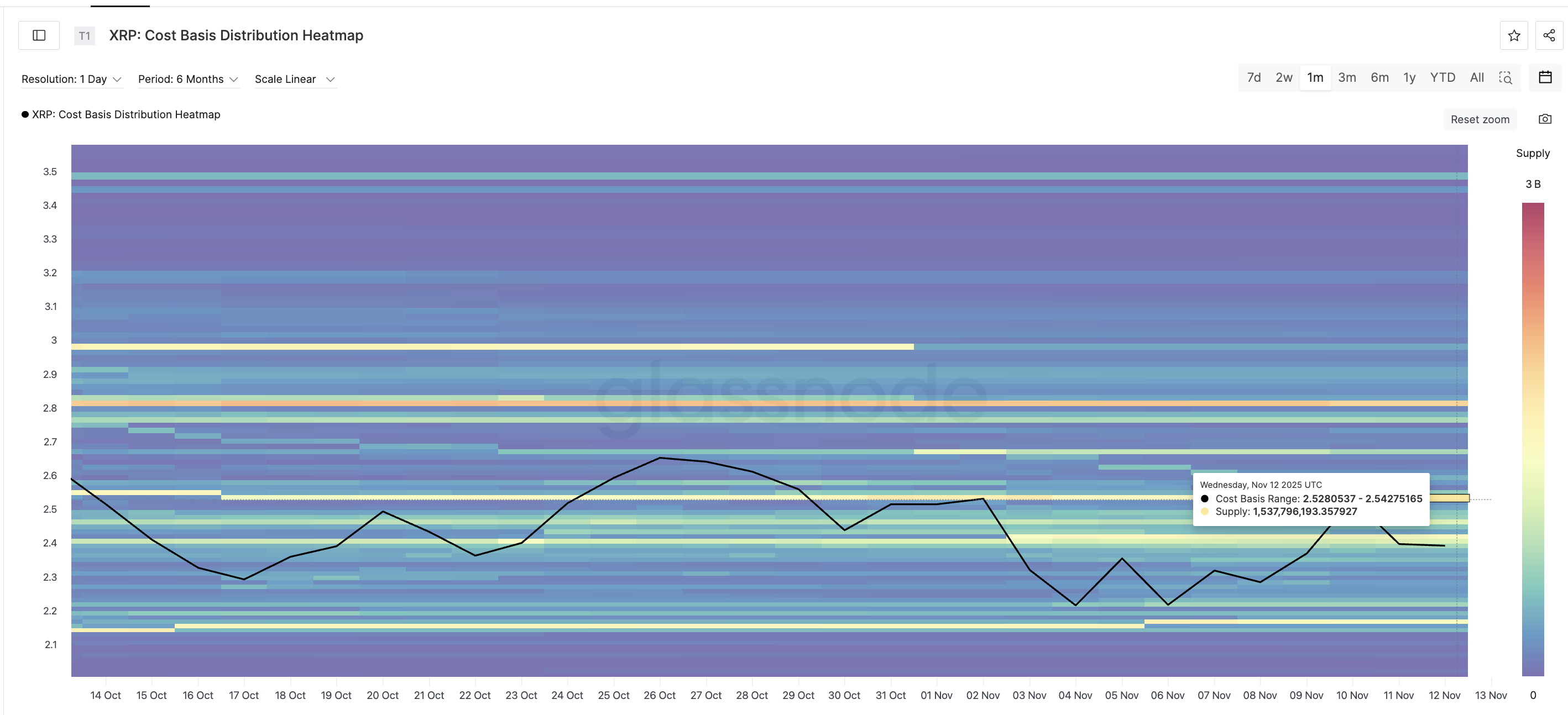

The answer sits on the cost-basis heatmap, which highlights where the biggest supply clusters sit. One of the strongest walls lies between $2.52 and $2.54, backed by about 1.53 billion XRP. This band has stopped every breakout attempt since early November.

To break the pattern, XRP needs a clean daily close above $2.56, not just a wick. That move would clear the supply block and confirm buyers have absorbed the pressure that has capped the chart for weeks.

If this happens while OBV also breaks its trendline, the move becomes much stronger. That would open the next target at $2.69, where the next major reaction zone sits.

The invalidation level remains at $2.21. A close below it would weaken the entire setup and expose $2.06, especially if exchange outflows drop further and selling returns. For now, XRP price is showing strength, but the story is the same: bounces stay bounces until XRP closes above $2.56. Only then can a true rally begin.

The post When Can XRP Price Bounces Turn Into Rallies? One Level Holds the Answer appeared first on BeInCrypto.