Strategy has just revealed its latest Bitcoin buy, its largest in a while and an indication that the price crash hasn’t scared away the BTC hoarder.

Strategy Has Acquired Another 8,178 Bitcoin

In a new post on X, Strategy Chairman Michael Saylor has announced the latest BTC acquisition made by the company. As is usually the case, the Monday announcement was preceded by a Sunday post with the company’s Bitcoin portfolio tracker, this time with the caption “₿ig Week.”

Saylor had also been doing other teasing for this purchase, like writing on Friday, “We bought bitcoin every day this week.” And indeed, the buy has turned out to be a big one.

In total, Strategy has added 8,178 tokens to its holdings with this purchase, spending $835.6 million. According to the filing with the US Securities and Exchange Commission (SEC), the acquisition was funded alongside $136.1 million in sales of the company’s STRF, STRC, and STRK at-the-market (ATM) stock offerings.

Strategy has been a consistent buyer of BTC in recent months, but lately, the firm was only making small purchases, making it look like its accumulation was slowing down. The latest buy, however, has broken the pattern.

It’s the largest Bitcoin acquisition that the company has completed since July 29th, when it made a monster purchase of 21,021 BTC for $2.46 billion. Back then, market conditions were completely different, with BTC having hit fresh highs just earlier that month.

The latest purchase, on the other hand, has come while the market has been facing significant bearish momentum, making it an especially bold one. So far, though, the bet hasn’t worked out, as BTC has only continued to slide lower.

The new $835 million round of accumulation occurred in the period between November 10th and 16th, and involved an average coin price of $102,171. BTC’s current value is down more than 8.5% compared to this mark.

Following the acquisition, Strategy owns a total of 649,870 BTC, with a cost basis of $48.37 billion. At the moment, the company’s treasury is worth $60.6 billion, putting it in a profit of 25%. Thus, while Bitcoin may have been going down, the firm still has room to absorb further downside.

Strategy isn’t the only large market participant that has ramped up buying recently. As analyst James Van Straten has pointed out in an X post, the large holders have been showing a slowdown in distribution.

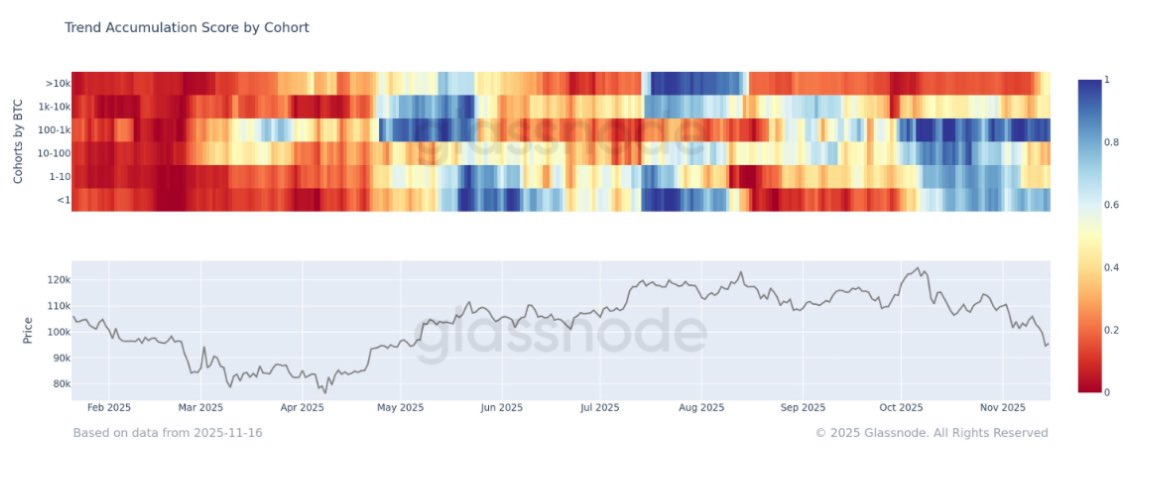

The data for the BTC Accumulation Trend Score over the past year | Source: @btcjvs on X

The indicator cited by the analyst is Glassnode’s Accumulation Trend Score, which tells us whether buying or selling is dominant among Bitcoin investors. From the above chart, it’s apparent that this metric has been close to 1 for the 100 to 1,000 BTC investors recently, a sign that the so-called “sharks” have been participating in strong accumulation.

The “whales,” holders lying in the 1,000 to 10,000 BTC range, have shown more mixed behavior, but the latest trend has been that of neutrality. The 10,000+ BTC holders, often called “mega whales,” are also showing a neutral behavior right now, but in their case, the neutrality marks a shift: these investors had been in a phase of distribution since August.

BTC Price

At the time of writing, Bitcoin is floating around $92,700, down more than 12% over the last seven days.

Looks like the price of the coin has been extending its decline | Source: BTCUSDT on TradingView

Featured image from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.