The big news Tuesday was crypto not just posting gains, but also rising even as U.S. stocks sold off. That outperformance has been rare for what seems like months, with bitcoin and other cryptocurrencies watching from the sidelines as major stock market averages made new record highs on a regular basis.

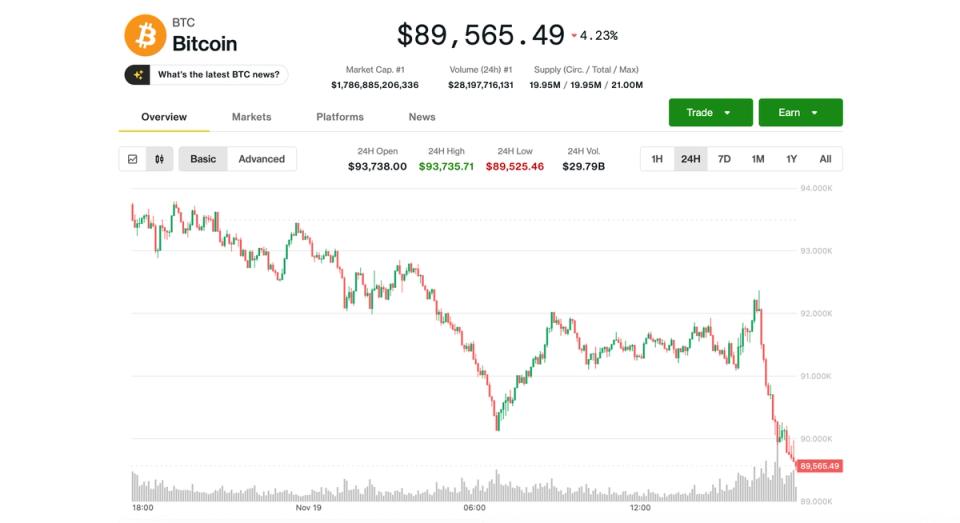

Sadly for the bulls, though, normality has returned just 24 hours later, with bitcoin tumbling 4% back below $90,000 even as U.S. stocks manage gains. Ethereum’s ether slid 6.5% to below $3,000.

Crypto-related equities broadly mirrored the price action. Bitcoin treasury firm Strategy (MSTR) fell over 8% to more than a one-year low, while stablecoin issuer Circle (CRCL), ether treasury firm BitMine (BMNR), miners Bitfarms (BITF) and Hive Digital (HIVE) saw similar declines.

Though well off session highs, the Nasdaq remains up 0.2% just after the noon hour on the east coast.

After relentless downward pressure on prices since BTC’s early October record, crypto investors remain deeply risk-averse. The Crypto Fear and Greed Index, a popular sentiment gauge, stayed pinned in “Extreme Fear” territory.

Vetle Lunde, head of research at K33, noted that the current drawdown — nearly 30% in 43 days — ranks among the worst compared to the seven corrections that lasted over 50 days since March 2017.

Steady outflows from ETFs have also added fuel to the selloff, Lunde said. Investors have yanked nearly $2.3 billion from U.S.-listed spot BTC ETFs through the past five consecutive sessions, Farside Investors data shows.

“BTC swept lows below the average cost basis of U.S. BTC ETFs, and if the current drawdown mirrors the two deepest drawdowns over the past two years, a bottom may form between $84,000 and $86,000,” he said. “If not, a revisit of the April low and MSTR’s average entry of $74,433 may be a natural leg lower.”