Crypto markets sold off sharply after Japan’s 10-year government bond yield surged to its highest level since 2008. The move triggered a wave of global de-risking and one of the largest liquidation events in weeks.

The move erased billions of dollars in digital-asset value, highlighting just how exposed crypto remains to macroeconomic liquidity shifts far outside its own ecosystem.

Sponsored

Sponsored

Japan’s Yield Spike: The Yen Carry Trade Unwinds and Crypto Feels It First

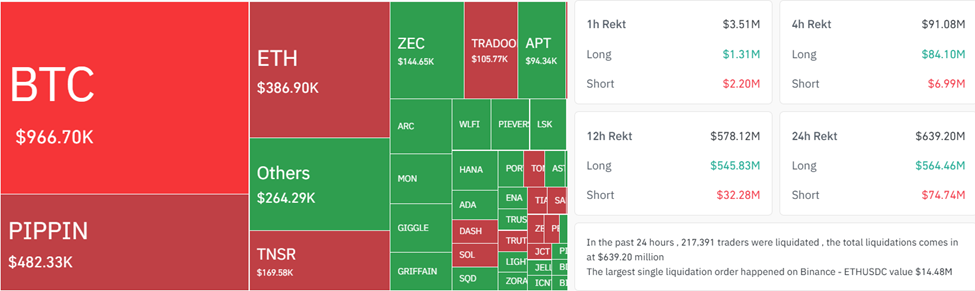

The total crypto market cap declined by approximately 5% over the last 24 hours, with Bitcoin and Ethereum prices falling by more than 5%.

According to Coinglass, more than 217,000 traders were liquidated during the downturn, resulting in a loss of almost $640 million in positions.

This illustrates how quickly leverage can evaporate when global rates move violently.

The catalyst came from Tokyo, where the 10-year Japanese government bond yield spiked to 1.84%, a level not seen since April 2008.

The prevailing sentiment is that the yield breakout is more than just a technical move. It signals that the decades-long yen carry trade may finally be unwinding.

Sponsored

Sponsored

For nearly 30 years, Japan’s near-zero interest rates allowed investors to borrow cheaply in yen and deploy capital into higher-yielding assets abroad. Such avenues include:

- US Treasuries

- European bonds

- Risk assets like equities and crypto.

Rising yields in Japan threaten to reverse this flow, pulling capital back home and tightening liquidity globally.

“For 30 years, the Yen Carry Trade subsidized global arrogance — zero rates… free leverage… fake growth… entire economies built on borrowed time and borrowed money. Now Japan has reversed the switch. Rates climbed. Yen strengthened. And the world’s favourite ATM just turned into a debt-collector,” wrote data scientist ViPiN on X (Twitter).

When Japanese yields rise, global liquidity contracts, leading to a repricing across the market. This likely explains why Silver (XAG) has not yet experienced its Supercycle, and Bitcoin is dealing with late-cycle volatility.

“Japan is draining liquidity, Bitcoin is absorbing the shock, and Silver is preparing for the repricing of a lifetime,” stated one analyst in a post.

Sponsored

Sponsored

Crypto’s Sell-Off Isn’t Local, It’s a Macro Liquidity Crunch

Shanaka Anslem, an ideologist and popular user on X (Twitter), described the JGB breakout as “the chart that should terrify every portfolio manager.

The strategist, who has reportedly witnessed infrastructural breakdowns, currency shocks, and state-level crises, cited:

- Inflation above 3%,

- Higher wage growth, and

- A Bank of Japan that is increasingly losing its ability to suppress yields.

These forces are pushing Japan into a structural shift away from the ultra-loose monetary regime that defined global markets for decades.

Sponsored

Sponsored

“When Japan raises rates, it sucks liquidity out of the global system. The “fuel” that powered the stock market rally is being drained. We can expect volatility in high-growth stocks as this “cheap money” era ends,” added another investor in a post.

The timing of the move is especially significant. The Federal Reserve has just ended its quantitative tightening program, the US faces record Treasury issuance, and interest payments on US debt have crossed the $1 trillion annual mark.

Meanwhile, China, historically one of the largest foreign buyers of US Treasuries, has slowed its accumulation. With Japan now under pressure to repatriate capital, two of America’s most important external funding sources are simultaneously stepping back.

“When the world’s creditor nations stop funding the world’s debtor nations at artificially suppressed rates, the entire post-2008 financial architecture must reprice. Every duration bet. Every leveraged position. Every assumption about perpetually falling rates. This is not a Japanese story. This is the global story. The 30-year bond bull market ended. Most just have not realized it yet,” Shanaka articulated.

Crypto, as one of the highest-beta corners of global markets, tends to react first when liquidity tightens. The scale of the liquidations suggests that leveraged traders were caught offside by the bond volatility, forcing rapid position unwinds across major assets.

Rather than a crypto-specific meltdown, the sell-off reflects a broad revaluation of duration, leverage, and risk as global bond markets reset.

Therefore, traders should probably watch Japan’s bond market as closely as they watch Bitcoin charts. If JGB yields continue to rise, it could tighten global liquidity through the end of the year.