XRP has gained 10% since the beginning of December. The rise aligns with the broader market recovery. Many XRP holders expect the price to rise further, but they should also be aware of several concerning factors.

These factors may limit XRP’s ability to recover this month. The following analysis breaks them down.

Sponsored

Sponsored

Factors That Could Create New Selling Pressure on XRP in December

CryptoQuant data shows a sharp spike in XRP Ledger Velocity. It has reached the highest level of the year.

This metric measures the frequency with which assets are transferred across the network. A strong increase suggests that XRP is not being locked in cold wallets or held for long-term purposes. Instead, it is being traded rapidly among market participants.

CryptoOnchain, an analyst at CryptoQuant, explains that this surge often signals high liquidity and strong participation from traders. It may even involve large transactions from market “whales.”

The indicator itself is neutral, but sudden spikes often lead to significant price fluctuations. As a result, any negative catalyst at this time could push XRP back down and erase the early-month recovery.

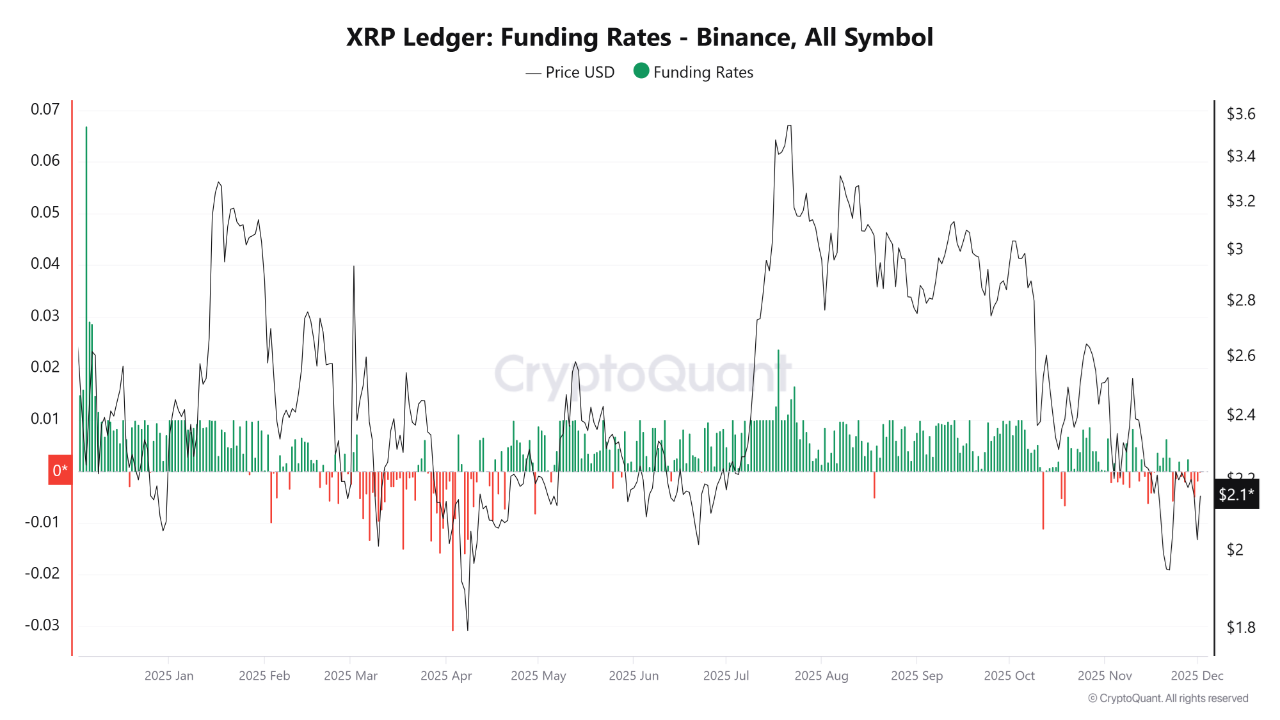

Negative signals are already emerging. The first is a surge in short positions. This rise has created heavy selling pressure in the derivatives segment.

Sponsored

Sponsored

Funding rates remain mostly negative, indicating that short positions are dominant. It reflects increasingly bearish sentiment among traders. Historical data also shows that a deep negative funding rate in April coincided with XRP dropping below $2.

“As more traders pile into shorts in the derivatives market, the continuation of the trend becomes more likely, since the persistent short pressure keeps the appetite for opening long positions low. Under these conditions, the probability of price retesting the $2.0–$1.9 zone increases,” analyst PelinayPA predicts.

Overall, the early-December rebound is not strong enough to reverse the broader downtrend that has persisted since July. PelinayPA’s view remains reasonable under current conditions.

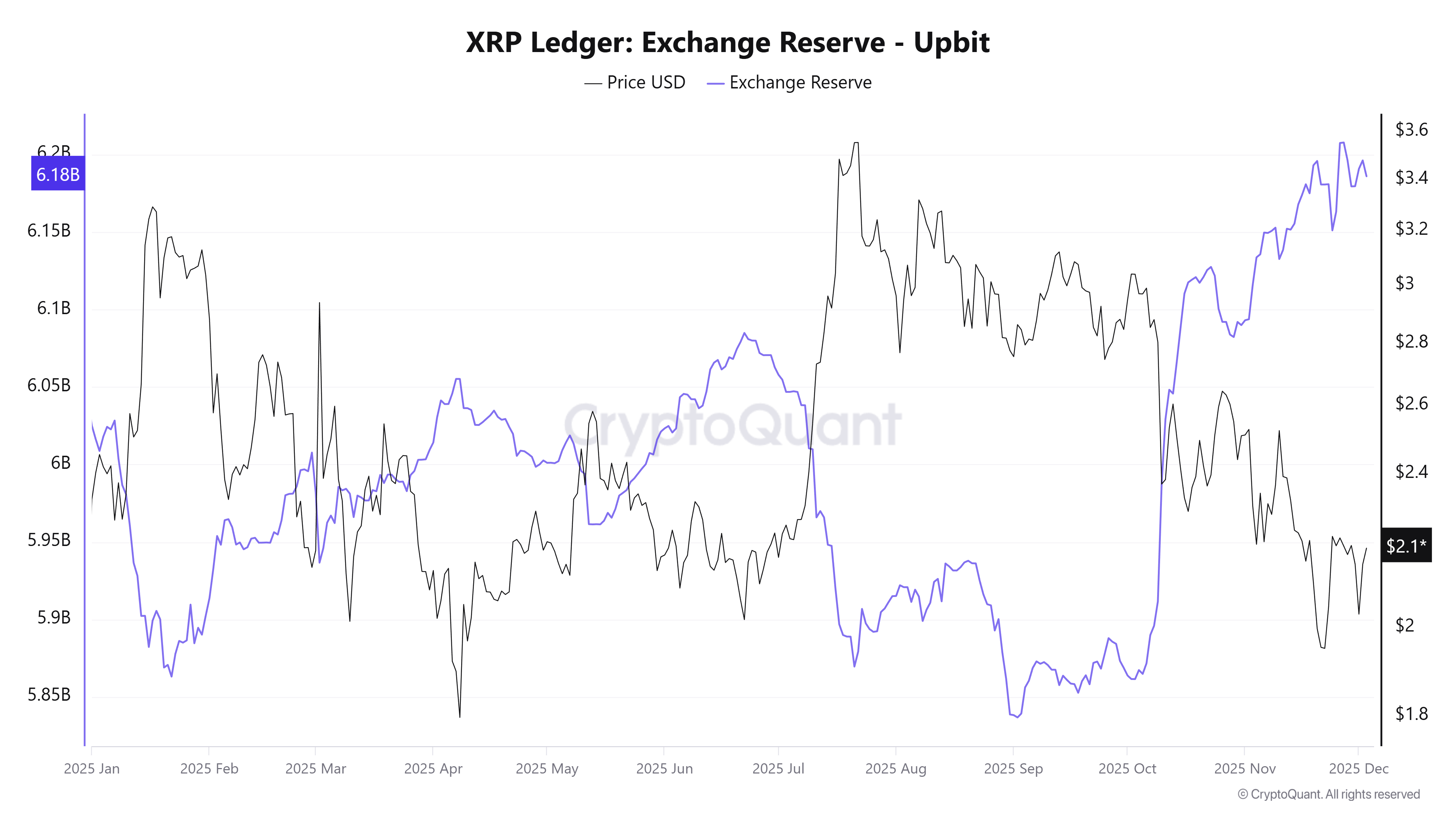

Selling pressure may also come from Korean investors. CryptoQuant reports that XRP balances on Upbit stand at 6.18 billion, compared to 2.6 billion on Binance. The influence of Korean traders cannot be ignored.

XRP reserves on Upbit have increased steadily for three consecutive months. They are now at the highest level of 2025. This trend could create potential selling pressure for XRP in December.

If Korean investors sell, combined with bearish signals from the derivatives market and rising Velocity, XRP’s price may face further downside.

However, XRP ETFs currently serve as the strongest counterweight to potential selling pressure. Data shows that these ETFs have maintained positive net inflows for three straight weeks. Vanguard has also ended its multi-year crypto ban and will allow XRP ETF trading in December.