President Donald Trump’s revived push to acquire Greenland is no longer confined to diplomatic cables and political headlines.

It is now being actively priced by crypto-native markets, where traders are turning geopolitical uncertainty into tradable probabilities, well before any deal materializes.

Trump’s Greenland Gambit Is Turning Into a Crypto Trade

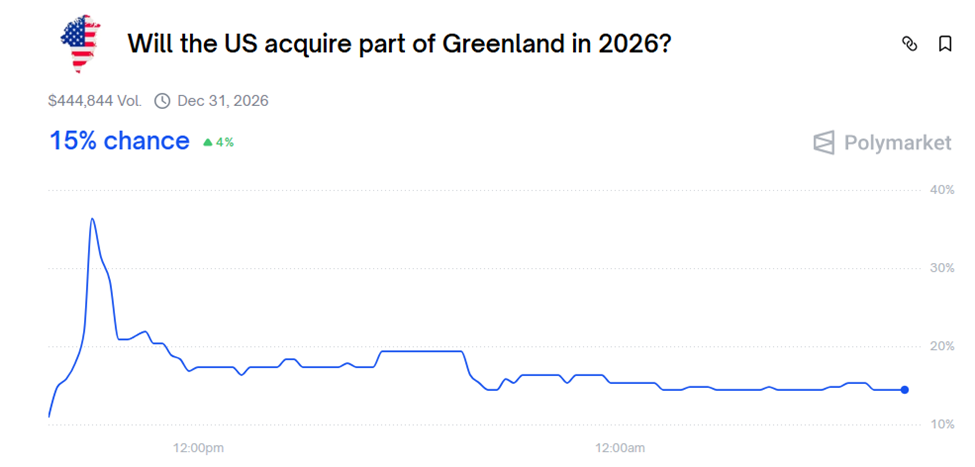

On-chain prediction platform Polymarket shows that the question “Will Trump acquire Greenland before 2027?” is currently priced at around 15%, with nearly $3 million in total volume committed to the outcome.

Sponsored

Sponsored

While the odds remain low, the activity itself is telling, showing that crypto markets are not debating whether the idea is realistic—they are already trading it.

The timing matters. Reuters reports that on January 7, US Secretary of State Marco Rubio confirmed he will meet Danish leaders next week to discuss Greenland. He emphasized that Washington has not retreated from Trump’s long-standing interest in the Arctic territory.

Echoing Trump’s previous remarks, Rubio cited US national security concerns amid increased Russian and Chinese activity in the region. He also stressed that diplomacy remains the preferred route, even as he stopped short of ruling out more forceful options.

Notably, Denmark and Greenland have firmly rejected any sale, reiterating that “Greenland is not for sale,” and European allies have warned that US aggression could fracture NATO.

Sponsored

While no invasion appears imminent, the escalation in rhetoric has been enough to trigger real-money positioning on-chain.

It mirrors what is already happening in Venezuela, where Polymarket bettors are already profiting.

Polymarket data shows traders breaking the Greenland situation into distinct escalation paths rather than treating it as a binary event. Beyond the headline market on a full acquisition, related contracts reveal a hierarchy of expectations.

A separate market asking whether the US will acquire part of Greenland in 2026 is priced at 15%, while a more extreme scenario, US military invasion, is trading at just 8–9%, making it the most heavily discounted outcome.

By contrast, a symbolic move such as Trump visiting Greenland by March 31 carries the highest probability at roughly 22–23%, though liquidity there is notably thin.

Order book data reinforces the message. Across markets, sellers dominate above current prices, capping upside near 16–18 cents on acquisition-related bets.

Sponsored

Sponsored

Buyers step in only below the market, signaling cautious conviction rather than speculative frenzy. In short, traders are willing to price geopolitical risk, but not to chase it.

Why Crypto Cares About Greenland As Markets Price Scenarios, Not Soundbites

The story’s traction in crypto circles extends beyond politics. Greenland’s vast renewable energy resources and cold climate have revived speculation about its long-term potential as a Bitcoin mining hub, particularly as the US seeks to reduce reliance on foreign hash power.

However, according to the Financial Times, Greenland may not be the mining hub some think it is. Experts cite 80% ice cover, sparse infrastructure, and complex ores. Yet climate change and limited exploration keep prospects alive.

At the same time, Greenland’s rare earth mineral reserves, critical for GPUs, AI infrastructure, and advanced hardware, are a strategic prize that could ripple through crypto-adjacent sectors such as AI tokens and real-world asset (RWA) projects.

Sponsored

Sponsored

At a macro level, traders are also framing the situation as part of a broader “hard assets versus fiat” narrative. Large-scale territorial or resource acquisition implies fiscal expansion, debt issuance, and heightened geopolitical tension.

These conditions have historically strengthened Bitcoin’s appeal as a hedge, even if they introduce short-term volatility.

It is essential to reiterate that Polymarket does not predict outcomes. Rather, it reveals how capital responds to uncertainty. Unlike traditional markets, which often wait for policy clarity, on-chain prediction markets translate headlines into probabilities in real time.

The result is a parallel pricing system for global power moves, visible down to individual wallets.

Whether Trump’s Greenland ambition advances or stalls, the signal is already clear. Crypto markets are increasingly functioning as early warning systems for geopolitical risk, absorbing, pricing, and stress-testing scenarios long before diplomats reach a resolution.