Several US economic data points are scheduled for release this week, with each bearing considerable implications for investor sentiment and thereby capable of influencing Bitcoin prices.

Investors can position their portfolios strategically by trading around the following headlines in the week between January 12 and 17.

4 US Economic Events to Watch This Week

The four macroeconomic events are concentrated between Tuesday and Thursday, increasing the chances of Bitcoin price volatility around these days.

Sponsored

Sponsored

US CPI Covering December 2025 Data

The US Consumer Price Index (CPI) release on Tuesday is the week’s most anticipated macro event, with markets pricing in a continuation of cooling inflation trends.

Expectations center on a headline CPI of around 2.7% year-over-year (matching November’s print) and a core CPI of 2.6-2.7%, reflecting the disinflation momentum from late 2025.

This follows a November report that came in below forecasts, which fueled optimism for Federal Reserve policy easing in 2026.

A cooler-than-expected print (lower inflation) would boost rate-cut odds ahead of the late-January FOMC meeting, weakening the dollar and supporting risk assets such as BTC.

Bitcoin could rally in the aftermath of soft CPI surprises, as lower readings tend to encourage investment in “digital gold” amid looser liquidity. Conversely, a hotter print could spark short-term volatility and downward pressure, reinforcing hawkish Fed views and pressuring BTC near $90,000 support levels.

Bitcoin was trading at $91,977 as of this writing, exhibiting muted volatility that positions it for a potential relief rally if the CPI undershoots. Overall, expectations lean toward a positive outcome for Bitcoin, with volatility expected but upside favored in a dovish scenario.

Sponsored

Sponsored

US PPI Covering November Data

Another key US economic data point to watch this week is the Producer Price Index (PPI) on Wednesday, which covers November 2025 data. The US PPI serves as a leading gauge of wholesale inflation, often foreshadowing consumer-level trends in CPI.

Expectations point to a stable print around 2.7% year-over-year (matching recent prior data), with core PPI similar, signaling contained pipeline pressures despite ongoing trade uncertainties.

Notably, the US PPI is a critical economic data in shaping Fed expectations. A softer reading would reinforce disinflation narratives, supporting further rate cuts and boosting risk assets, such as Bitcoin, by improving liquidity conditions.

This aligns with patterns where lower producer inflation eases dollar strength and encourages investment in high-beta assets such as BTC.

A hotter print, however, could raise concerns about inflation persistence (especially amid tariff debates), potentially pressuring yields higher and weighing on crypto.

Bitcoin sentiment on X remains cautiously optimistic, with PPI viewed as a secondary but confirmatory signal after Tuesday’s CPI. If aligned with cooling trends, it could extend any post-CPI upside, helping BTC hold or reclaim levels above $92,000.

In contrast, a surprise upward move might trigger short-term pullbacks toward $88,000-$90,000. Nevertheless, it is impossible to ignore Bitcoin’s resilience in recent macro setups, suggesting PPI is less likely to be a standalone driver but could amplify broader risk-on momentum if benign.

Sponsored

Sponsored

The next Supreme Court scheduled Opinion Day

The Supreme Court could release opinions in argued cases, including the ruling on Trump tariffs. The Supreme Court’s January 14 opinion day carries significant weight, as it may finally address the legality of President Trump’s sweeping “Liberation Day” tariffs imposed under the International Emergency Economic Powers Act.

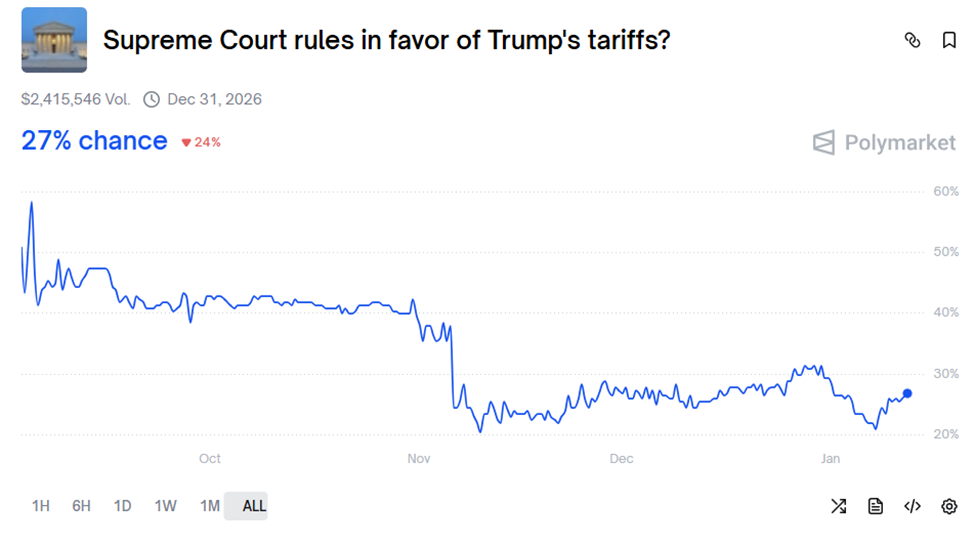

After no ruling on January 9, expectations (via Polymarket at 27% chance) lean toward the Court striking them down, potentially requiring refunds of $133-150+ billion in duties collected.

A Wednesday decision could be a major macro catalyst for Bitcoin, with an invalidation:

- Reducing inflation expectations (tariffs are seen as inflationary)

- Loosening financial conditions

- Weakening the dollar, and

- Boosting risk appetite

All these would create tailwinds for BTC as a hedge, potentially sparking a relief rally, with possible upside volatility and liquidity inflows.

Sponsored

Sponsored

Conversely, if the Supreme Court chooses to uphold Trump tariffs, which is less likely, it might sustain trade tensions, reinforcing inflation risks and pressuring risk assets in the short term.

Initial Jobless Claims

Thursday’s Initial Jobless Claims release provides the timeliest snapshot of US labor market health, with recent prints showing resilience. For instance, the previous week recorded around 208,000 versus expectations of over 210,000.

Forecasts hover near 220,000, reflecting steady but not overheating conditions. This data, which shows the number of US citizens who filed for unemployment insurance last week, is seen as a key indicator for the Fed.

Softer claims (lower layoffs) would support soft-landing narratives, reducing urgency for aggressive rate cuts and potentially capping BTC upside in the short term.

Hotter prints (higher claims) could signal cooling employment, boosting rate cut odds and acting as a bullish catalyst for Bitcoin by enhancing liquidity expectations.

A surprise lower could pressure yields higher and weigh on BTC toward $88,000, while elevated figures might extend post-CPI/PPI momentum if bullish.

Traders view this as confirmatory rather than dominant, but it could amplify volatility in a week already heavy with inflation data.