The XAG price remains on the radar for most investors as Silver leads gains among precious metals for weeks now. As it holds levels above $80, analysts now speculate whether $100 is next, and if so, what are the possible triggers?

Amid recent gains in precious metals, the CME is bracing for potential stress and has introduced new margin rules.

What Is Driving the Silver Price Surge?

Silver continues to make sharp gains after stabilizing above the $80.00 psychological level. This is so much so that the CME has had to adjust margin requirements, making it more costly to short precious metals.

Sponsored

Sponsored

As of this writing, the precious metal was trading at 83.59% per ounce, just shy of its $85.94 all-time high.

Silver’s tremendous 160% growth in the last year has been attributed to a confluence of tailwinds:

Against this backdrop, silver is seeing strong industrial demand from sectors such as electric vehicles and renewable energy.

Interestingly enough, we’ve been seeing momentum across a variety of asset classes in the past few days, despite the geopolitical shock of the US military intervention in Venezuela and the capture of Venezuelan President Nicolás Maduro.

While one would expect such an event to trigger a flight towards safe haven assets such as precious metals, even equities and Bitcoin saw a boost after the news broke. This means we’re currently seeing a so-called “everything rally”, at least in the short term.

Sponsored

Sponsored

In his usual provocative style, precious metals investor Peter Schiff recently dismissed Bitcoin’s performance (BTC is up about 6.5% in the last 7 days) by saying that investors should focus their attention on precious metals instead.

As reported by Coinpaper, Schiff claims we’re currently in the early stages of “what will likely be the biggest precious metals bull market in history”.

Is silver really set up for further gains or is the red-hot precious metal due for a cooldown? Let’s take a look at where the silver market currently stands.

Is silver going to hit $100 per ounce?

In the short term, the US intervention in Venezuela is seen as the primary catalyst in the silver market, which has allowed the precious metal to approach its all-time high levels once again.

Sponsored

Sponsored

US President Donald Trump has suggested that there is a possibility of further military action if Venezuela’s interim authorities don’t meet US demands, which adds a further layer of uncertainty to an already volatile situation.

Therefore, there is currently a clear narrative driving demand for safe haven assets such as precious metals.

From a more long-term perspective, investors are also betting on silver (and other precious metals) because there is a strong expectation of further interest rate cuts from the US Federal Reserve, amid Trump’s continued push.

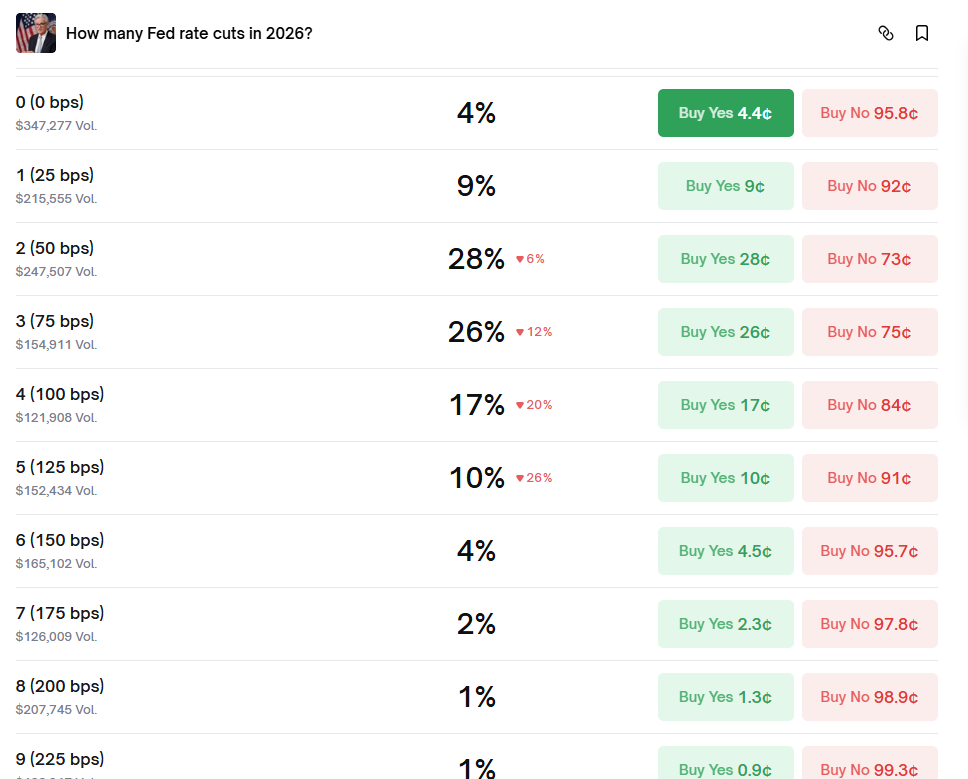

Currently, the markets are forecasting at least two interest rate cuts in 2026, but upcoming job numbers and inflation numbers will be under close scrutiny.

A weakening job market would would increase the probability of rate cuts, while heightened inflation would make lower interest rates less likely.

Sponsored

Sponsored

Low interest rate environments are favorable for non-yielding assets such as silver, since they reduce the opportunity cost of holding them.

For a highly bullish silver price prediction of $100 or more per ounce to materialize, multiple bullish forces would need to align at the same time.

Industrial demand would have to remain strong, driven by continued growth in solar installations, electrification, and electronics, while mining supply stays tight and is unable to respond quickly.

At the same time, silver would need to see sustained demand stemming from its role as a safe haven during economic or financial stress and as an inflation hedge.

Together, sustained physical demand, constrained supply, and renewed investment interest could push silver into the $100 range.

Prices well above $100 would likely require a more extreme trigger such as runaway inflation, a major financial crisis, a currency shock, or a genuine physical shortage that exposes a mismatch between paper silver and real metal.