Join Our Telegram channel to stay up to date on breaking news coverage

SUI coin price has surged 2% in the last 24 hours to trade at $1.85 as the Sui network continues to face a temporary outage, with the mainnet having been stalled for over two hours, with no new blocks produced, while core developers work on resolving a validator consensus issue.

The Sui team warned that decentralized applications like Slush and SuiScan may be unavailable, and transactions could be delayed or temporarily fail. Stakeholder Reset confirmed that there are no critical risks to funds and that delays are expected until normal operations resume. This is the second major outage for the network, following a similar incident in November 2025, with other top layer-1 networks, such as Solana, having faced comparable disruptions in the past.

Despite the outage, SUI price action has remained relatively flat, rising slightly from earlier intraday highs of $1.92. This contrasts with the broader crypto market, where Bitcoin is leading a strong rally, trading above $97,000. Year-to-date, SUI has gained over 30%, making it one of the best-performing cryptocurrencies in 2026. Analysts note that the stable price reflects strong market support and active market makers, which help mitigate the impact of network issues on token value.

Sui Mainnet is currently experiencing a network stall, and the Sui Core team is actively working on a solution. Be aware that dApps such as Slush or SuiScan may not be available, and transactions may be slow or temporarily unable to process at this time. Updates will be shared as…

— Sui (@SuiNetwork) January 14, 2026

The ongoing Sui network outage highlights the challenges layer-1 blockchains face in maintaining consistent operations. Developers are closely monitoring the network and coordinating to restore normal function. Investors and users are advised to follow official updates from the Sui team regarding resolution timelines and the resumption of services. The incident also emphasizes the importance of validator coordination and robust network monitoring in ensuring reliability for decentralized applications and token transactions.

SUI Price Eyes Further Gains as Bullish Pennant Forms

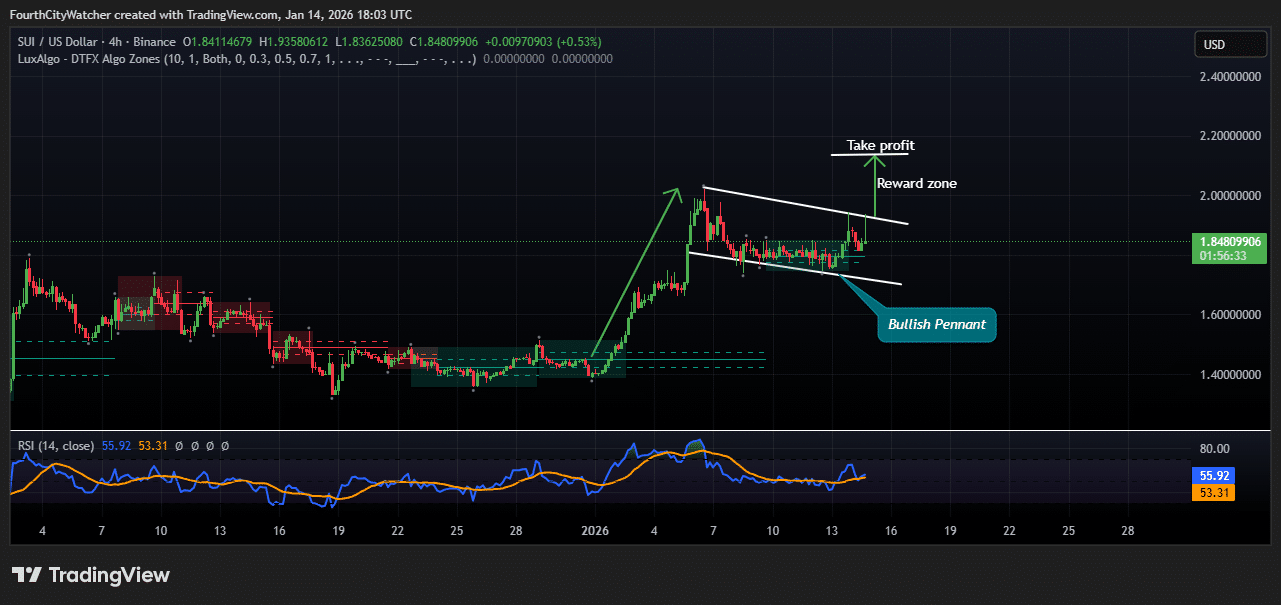

The SUI/USD 4-hour chart shows the formation of a bullish pennant, indicating a continuation of the prior strong uptrend. After consolidating between $1.40 and $1.50 in a sideways accumulation phase, SUI surged to nearly $1.95, marking a strong bullish impulse. The subsequent consolidation has taken the form of a narrowing pennant pattern, which typically signals that the market is pausing before continuing in the direction of the preceding trend.

The chart highlights a reward zone above the pennant, with a take-profit level slightly above $2.00. The potential reward is significant relative to the consolidation range, offering a favorable risk-to-reward setup. The lower boundary of the pennant acts as a support level, limiting downside risk, while the upper trendline serves as a breakout trigger for long positions.

SUIUSD Chart Analysis. Source: Tradingview

SUI Price Bulls Now Target $2.20 Ahead

A breakout above the pennant, confirmed by rising volume, would strengthen the bullish case and likely target the $2.10–$2.20 area in subsequent sessions. The Relative Strength Index (RSI) on the 4-hour timeframe is around 55, indicating moderate bullish momentum without being overbought. This indicates that SUI still has room to move higher before hitting potential resistance or overextended conditions.

Short-term pullbacks could occur near support levels, offering additional entry points for traders aiming to capture the next leg of the uptrend. The combination of a strong prior uptrend, pennant consolidation, and favorable RSI positioning points to a high-probability continuation trade.

In summary, SUI is showing a classic bullish continuation setup on the 4-hour chart. The bullish pennant formation provides a clear framework for identifying breakout levels, potential reward zones, and risk management. Traders targeting the $2.00–$2.20 range would be aligning with the market’s momentum, while stops near the lower pennant boundary offer protection against false breakouts.

With the prior uptrend as context and the RSI in a healthy zone, SUI appears well-positioned for another upward move, making this setup attractive for short-term swing or intraday traders looking to capitalize on momentum continuation.

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage