Perpetual futures are a unique derivative product in the crypto market. Unlike traditional futures contracts, which have a set expiration date, perpetual futures have no expiration and aim to mimic spot market prices. They achieve this through a mechanism known as the funding rate, which ensures that the futures price stays in line with the spot price. Given their close tie to the spot markets and their ability to offer traders leverage, understanding the dynamics of perpetual futures becomes paramount when analyzing Bitcoin’s price performance.

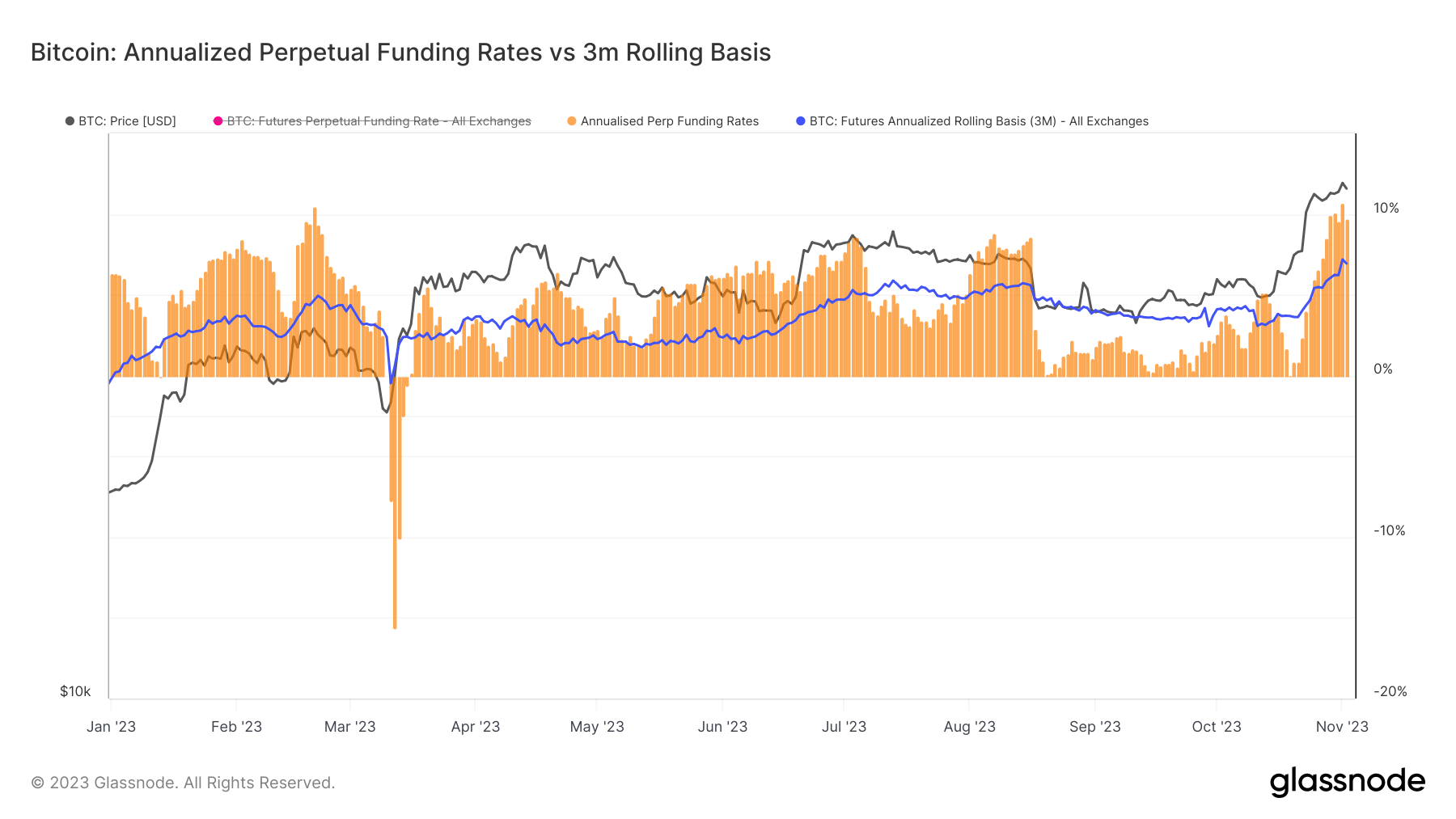

Between Oct.14 and Nov. 3, Bitcoin’s price experienced a considerable surge, moving from $26,800 to $34,900. It even briefly touched $35,400 on Nov. 2. Accompanying this bullish move, the Bitcoin futures annualized three-month rolling basis rose from 3.322% on Oct. 14 to a year-to-date all-time high of 7.194% on Nov. 2. Simultaneously, the annualized perps funding rate escalated from 4.541% to 10.74% by Nov. 1, settling at 9.774% on Nov. 2—also its highest since the start of the year.

A rising three-month basis signifies bullish sentiment for Bitcoin’s medium-term prospects. Traders seem willing to pay a premium on the futures, anticipating the price of Bitcoin to continue its upward trajectory over the upcoming quarter. On the other hand, a sharp increase in the perpetual funding rate indicates extreme short-term bullishness. This could be attributed to a high demand for leverage by bullish traders in the perpetual markets. The current significant differential between the perps rate and the three-month basis suggests an over-leveraged market. Historically, periods where the perpetual basis soars above the 3-month basis often hint at extreme optimism among market participants.

While the current data underscores a prevailing bullish sentiment, it also hints at potential vulnerabilities. A heightened demand in both perpetual and three-month futures might suggest that traders anticipate Bitcoin’s price to surge further. The robust basis increase underpins this sentiment, showing strong confidence in Bitcoin’s future performance. However, the disparities observed, especially in the perps rate, might also set the stage for potential price corrections if market sentiment shifts.

The post Perpetual futures market paints a rosy medium-term picture for Bitcoin appeared first on CryptoSlate.