The Esya Centre, a think-tank based in India, has suggested that the Indian government’s choice to tax crypto has been a failed exercise. The move, designed to discourage speculative trading and improve traceability, has instead driven over five million traders offshore, causing exchanges to hope for some tax relief in the next fiscal year.

The Indian government introduced a 1% tax deducted at source (TDS) on crypto trading in 2022. While this was meant to improve transparency and increase tax revenues for the exchequer, affected Indians are now doing business at exchanges were the taxman cannot reach.

Users Elect to Avoid India Crypto Tax

Along with TDS, the government introduced a 30% capital gains tax on the profits earned from April 2022. Additionally, capital gains tax from one asset could not offset taxes levied on profits from other assets.

As the government applied more reporting obligations, some users weighed the risk of not reporting versus the risk the government would discover unreported local income. In the end, most chose not to report income earned from foreign exchanges.

Read more: How to Choose The Right Crypto Exchange

Vikash Gautam, the author of the report and an adjunct fellow at the Esya Centre, said:

“There is an urgent need to reduce the TDS in particular to fix this to the benefit of the Indian economy and Virtual Digital Assets (VDA) investors / consumers.”

The Prevention of Money Laundering Act (PMLA) also defines exchanges as reporting entities. Non-compliant businesses could face up to seven years in prison if they don’t report TDS.

However, as more Indian users moved offshore, compliant exchanges could collect fewer crypto taxes, hurting the government’s income prospects. In the 2023 fiscal tax year, the government collected $19.2 million in tax revenues.

Exchanges Hope for Tax Relief

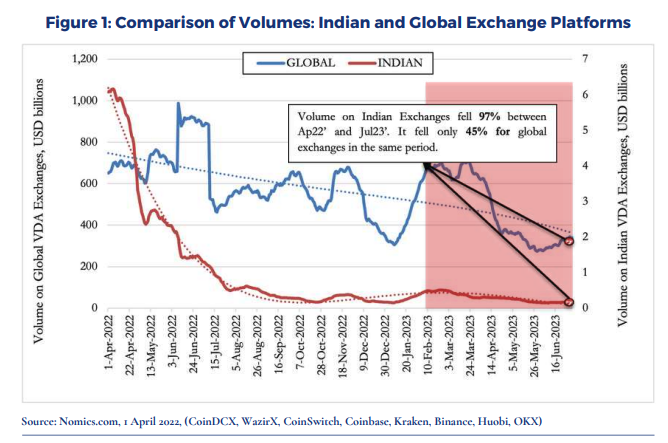

Indian exchanges like CoinDCX, WazirX, and CoinSwitch saw a significant dropoff in volumes since the TDS tax was introduced July 2022. Looking at differences in weekly unique visitors, Esya estimates that three to five million Indian users went offshore, with one overseas platform reporting 450,000 signups in the month after the TDS tax was introduced.

In August 2022, CoinDCX laid off 12% of its staff amid the unfavorable rules and the ongoing bear market. By October, trading volumes on Indian exchanges had fallen from $4.7 billion at the beginning of the year to $137 million.

Esya previously predicted that exchanges could lose up to $1.2 trillion by 2026. Accordingly, Indian crypto firms hope the government will offer some tax relief in its 2023-2024 Union Budget.

Read more: How to Reduce Your Crypto Tax Liability: A Comprehensive Guide

Do you have something to say about how India crypto taxes are affecting exchanges and users or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Top crypto platforms in the US | November 2023

Paybis

Paybis” target=”_blank”>No fees for 1st swap →

iTrustCapital

iTrustCapital” target=”_blank”>Crypto IRA →

Coinbase

Coinbase” target=”_blank”>$200 for sign up →

Uphold

Uphold” target=”_blank”>No withdrawal fee →

eToro

eToro” target=”_blank”>$10 for first deposit →

BYDFi

BYDFi” target=”_blank”>No KYC trading →

The post How India’s Controversial Crypto Tax Policy Has Failed appeared first on BeInCrypto.