Michael Burry, the legendary hedge fund manager known for his prescient bets against the US housing market, has now turned his focus to the semiconductor sector.

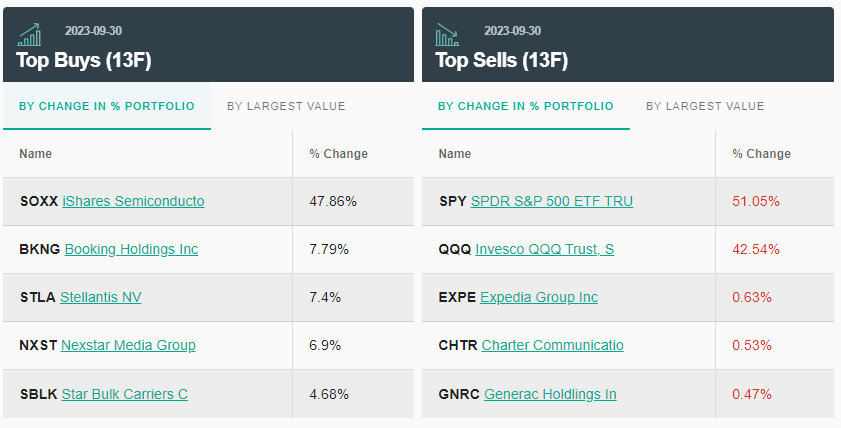

Burry’s Scion Asset Management has initiated a substantial bearish position in semiconductors, diverging from his previous controversial bearish bets against the S&P 500 and Nasdaq 100.

Burry Now Bearish on Semiconductors

According to recent filings, Burry’s latest move involves purchasing put options with a notional value of $47.4 million against the iShares Semiconductor ETF. This move comes as the ETF records a significant year-to-date increase of 45.37%.

Notional value, as opposed to the actual amount paid for these contracts, represents the total value of securities underlying the options. This figure is typically much lower than the notional value, though specific amounts were not disclosed in the regulatory filings.

This pivot follows Scion’s closure of its bearish options against broader market indices. Previously, Burry’s firm held put options with notional values amounting to over $1.6 billion against the Invesco QQQ Trust ETF and the SPDR S&P 500 ETF. The S&P 500 and Nasdaq 100 have witnessed a 3.6% and 3% decline in the third quarter, respectively.

Put options grant the right to sell shares at a predetermined future price. These are common instruments to express a defensive or bearish stance in the market. However, the exact performance of Burry’s positions remains unclear. This is because regulatory filings do not require disclosing specific details such as options strikes, purchase prices, or expiration dates.

Burry’s decision aligns with other notable investors and hedge funds adjusting their positions in the semiconductor sector. For instance, Soros Fund Management offloaded its stake in Nvidia. Meanwhile, Tiger Global Management and Eisler Capital increased their investments in the same company.

Read more: Crypto vs. Stocks: Where To Invest Your Money in 2023

Closing Out S&P500 and Nasdaq Shorts

These moves come against the backdrop of Burry’s earlier predictions of a potential US recession and a slowdown in the Federal Reserve’s rate hikes. In August 2023, Scion Asset Management made a significant bearish bet against the stock market. This signals a lack of confidence in the economic recovery.

This $1.6 billion notional value bet represented a substantial portion of the fund’s portfolio. However, the actual expenditure on these contracts is speculated to be much lower.

Burry’s new strategy in the semiconductor sector, closing out positions in the S&P 500 and Nasdaq 100, reflects an intriguing shift in his investment approach.

Read more: AI Stocks: Best Artificial Intelligence Companies To Know in 2023

Top crypto platforms in the US | November 2023

Paybis

Paybis” target=”_blank”>No fees for 1st swap →

iTrustCapital

iTrustCapital” target=”_blank”>Crypto IRA →

Coinbase

Coinbase” target=”_blank”>$200 for sign up →

Uphold

Uphold” target=”_blank”>No withdrawal fee →

eToro

eToro” target=”_blank”>$10 for first deposit →

BYDFi

BYDFi” target=”_blank”>No KYC trading →

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content.

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.

The post Bearish Burry Shorts Semiconductors After Closing Out Controversial S&P500 and Nasdaq Puts appeared first on BeInCrypto.