On-chain data shows the Bitcoin Network Value to Transactions (NVT) ratio is above the bear zone, implying the recent price growth might have been healthy.

Bitcoin NVT Ratio Has Remained Outside Red Since October

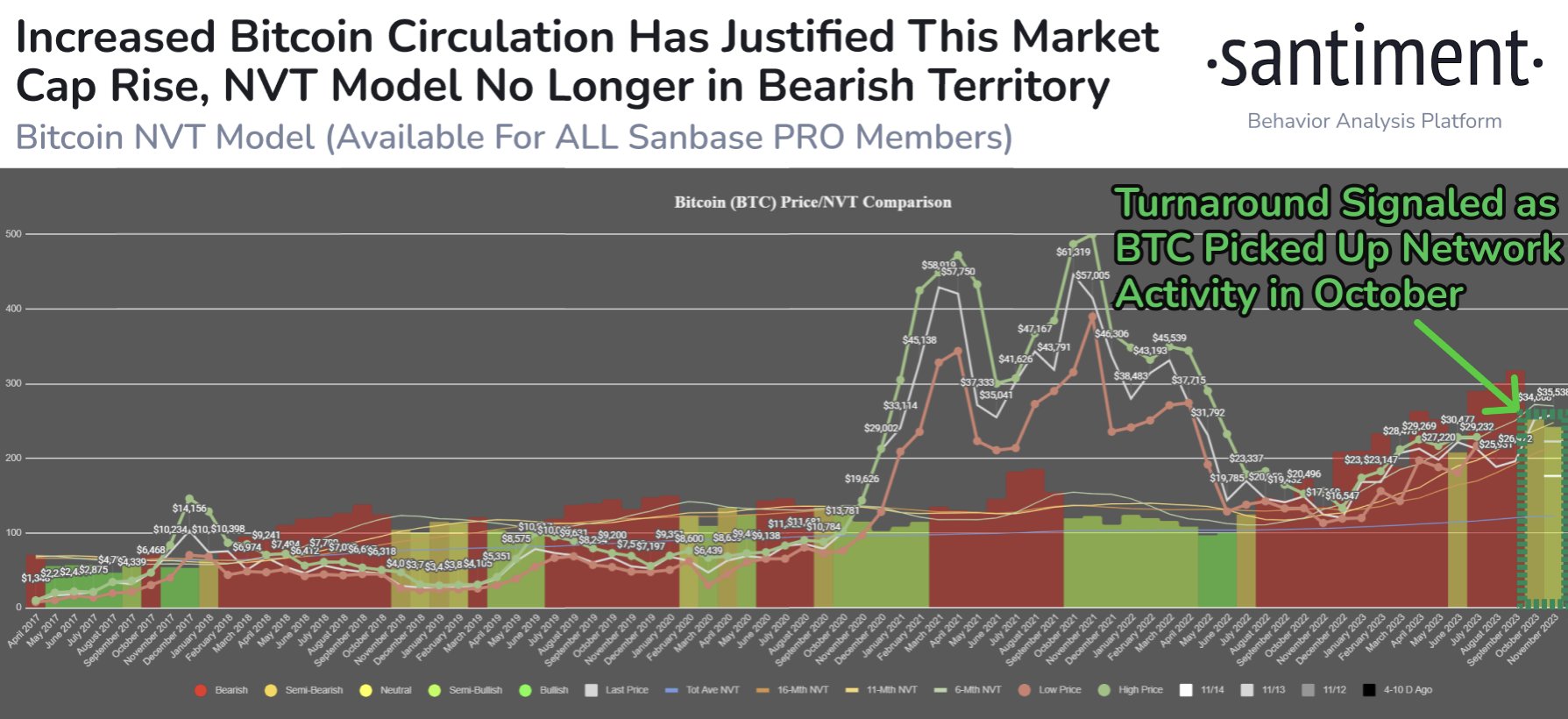

According to data from the on-chain analytics firm Santiment, the NVT ratio has seen a significant improvement recently. The relevant indicator here is the “NVT ratio,” which keeps track of the ratio between the Bitcoin market cap and daily circulation.

The market cap here is naturally the total value of the asset, while circulation refers to the number of unique tokens observing some movement on the network inside a 24-hour rolling period.

Some other analytics websites use transaction volume in place of circulation, but Santiment’s version uses the latter because the volume often contains noise that’s not relevant to the market (like relay transactions of the same coins, which are counted multiple times in the volume, but only once in circulation).

When the value of the NVT ratio is high, it means that the price of the asset is high compared to the blockchain’s ability to transact coins right now. Such a trend can suggest the coin may be overvalued at the moment.

On the other hand, the metric being low implies the cryptocurrency might be underpriced currently as its transaction volume is at healthy levels compared to the market cap.

Now, here is a chart that shows the trend in the Bitcoin NVT ratio over the last few years:

Looks like the value of the metric has been green in recent days | Source: Santiment on X

As displayed in the above graph, the Bitcoin NVT ratio exited the historical bearish territory back in October and has continued to be outside it in the weeks since then.

The metric hasn’t exactly returned to the bullish zone proper yet; it has been more leaning towards neutral. However, the fact that the indicator has improved inside this period despite the cryptocurrency’s market cap also seeing a significant boost at the same time is certainly a positive development, as it suggests that the network activity growth has been outweighing the rise in the price.

At the current values of the ratio, the transaction activity of Bitcoin is justifying its market cap, so at the very least the asset may not be in immediate danger of a correction.

This naturally means that the rally should be able to continue for a while until the ratio returns back into the bearish territory (which may not even happen if the circulation continues to improve, as it has been during the price surge so far).

BTC Price

After seeing a pullback to as low as $35,000 earlier, Bitcoin has successfully recovered back above $37,000 during the past day.

The value of the asset has registered a strong rise during the past day | Source: BTCUSD on TradingView

Featured image from Jievani Weerasinghe on Unsplash.com, charts from TradingView.com, Santiment.net