Data shows the crypto futures market has observed over $181 million in liquidations today after Bitcoin rallied beyond the $41,000 mark.

Crypto Futures As A Whole Has Seen $311 Million In Liquidations Today

According to data from CoinGlass, the crypto futures sector has gone through some chaos during the past 24 hours, as more than $311 million in contracts have found liquidation.

“Liquidation” here naturally refers to the process that a contract open on any derivative exchange goes through when it racks up losses equal to a specific portion of the initial position (the exact measure of which may differ between platforms) and the platform forcibly closes it up.

The reason behind the mass liquidations witnessed during the past day is the volatility that the crypto sector as a whole has gone through inside this window. The futures flush began as BTC made a sharp upward push and broke past the $41,000 level for the first time since April 2022.

From the above table, it’s apparent that the short contract holders have sustained the majority of the liquidation brunt, as $182 million in such contracts have gone down the drain.

This is obviously because a lot of the volatility in the past day has been towards the upside. However, longs haven’t come out scatheless, as they have also suffered almost $129 million in liquidations.

This is because the various assets have gone through pullbacks since the initial surge, as Bitcoin itself had managed to surpass the $42,000 level before it returned under the mark. As for how the liquidations look when broken down into individual symbols, the table below shows it.

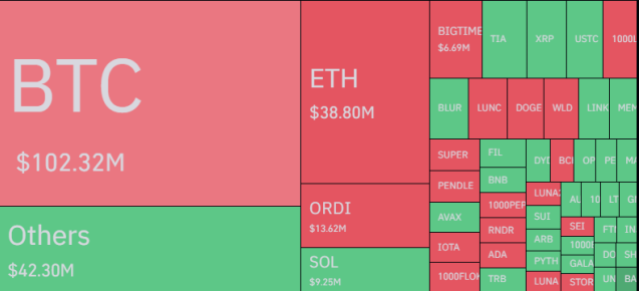

Unsurprisingly, Bitcoin, the most dominant asset in the sector, is behind the largest portion of the futures flush at over $100 million. Ethereum then follows in second with its liquidations of almost $38 million.

Interestingly, many altcoins are green in this table, meaning their long liquidations have outpaced the shorts. Solana (SOL) is a major example due to the coin registering a negative return of 3% during the past day, unlike many other top coins enjoying profits instead.

Mass liquidation events like the one seen today aren’t rare in this sector because most coins display a significant amount of volatility, and the futures side is often overleveraged due to extreme amounts of leverage being easily accessible on most platforms.

This elevated risk of liquidation in the market can certainly make crypto futures a risky place to navigate for the uninformed trader.

Bitcoin Price

Bitcoin is floating about the $41,500 level after its pullback from above $42,000.