Crypto Adopters 2024 — Which Countries Are Next?

So which country is set to be the next crypto hub in 2024? The answer may surprise you.

The other day I was wondering, which will be the next country in 2024 where Crypto will really take off. In order to come to my decision, I had to look at historical, present and future data. My research led me to realise that in order for a nation to be a potential crypto hub, certain factors must be at work.

Factors to evaluate whether a country/region is a good candidate for becoming a crypto hub:

1) Stable Regulatory Environment

- Clear and supportive legislation: countries with well-defined and favorable crypto regulations, will attract more blockchain-related businesses.

- Favorable tax policies for crypto transactions will be a significant incentive for investors.

- Robust AML and KYC procedures will help maintain a secure and trustworthy environment.

Note: AML and KYC stand for Anti Money Laundering and Know Your Customer. A typical example of Know Your Customer would be when you sign up to centralized exchanges such as Binance and Coinbase, and they ask for photo identification. It is so they KNOW YOU are actually who you say you are, and you are a legitimate individual.

2) Technological Infrastructure

· Internet penetration and quality: high level of internet access and speed is crucial for the widespread adoption of cryptocurrencies

· Availability of Blockchain Talent: Presence of skilled blockchain developers, entrepreneurs, and other professionals is vital for innovation and growth

· Tech-Savvy Population: A population that is more comfortable with technology and digital transactions is more likely to adopt cryptocurrencies

3) Economic Conditions

- Stable economic environment -> attracts investments.

- Financial inclusion — countries with an underbanked population can benefit from crypto adoption. Why? — large proportion of their population currently does not have access to a global banking system, (they are unbanked), however, those individuals are likely to have a mobile phone and access to the internet -> access crypto assets.

- Currency stability — countries with volatile fiat currencies will be more likely to see rapid adoption of cryptocurrency as it may be seen as a more stable form of value.

4) Market Demand and Societal Readiness

- Positive public perception of digital currencies-> public is more likely to warm to and adopt/experiment within the digital asset space.

- Widespread education and awareness of crypto -> increase the likelihood of adopting crypto.

- Use cases and practical applications: countries where crypto will have a real-world benefit such as remittance payments (sending money back home) or payment solutions can increase the likelihood of adoption of crypto. For example: if your family is from a third-world country, and you have migrated to a first-world country for economic reasons, the excess money you have made, is usually sent back to your family in the third-world country (this is what people are normally referring to when talking about remittance payments). But if your family resides in a country with large amounts of inflation, sending money back to them in their nation’s home currency may prove less valuable in the long term due to inflation. Furthermore, if that said home nation, is currently unbanked, then cross-border payments may mean that the money won’t arrive in your family’s bank accounts for weeks, even months. Therefore, that’s why cryptocurrency may become more attractive, as it helps eliminate all the aforementioned negativities.

5) Government and Institutional Support

- Backing from banks and financial institutions can legitimize and facilitate crypto transactions.

- Governments investing in blockchain technology.

- Taxation — if the government is imposing high amounts of capital gains tax, then this may prove to be a deterrent for potential investors who are looking to maximize their profits.

6) Legal and Security Considerations

- Property Rights and Legal Frameworks — strong property rights and legal frameworks that protect digital assets ownership and transactions.

- Robust cybersecurity measures to protect against fraud, theft, and other risks associated with cryptocurrencies.

7) Cultural Factors

- Societies that encourage innovation and are risk-takers are more likely to embrace cryptocurrencies.

What does the Data Say?

ChainAlysis 2023 Crypto Adoption Index 2023

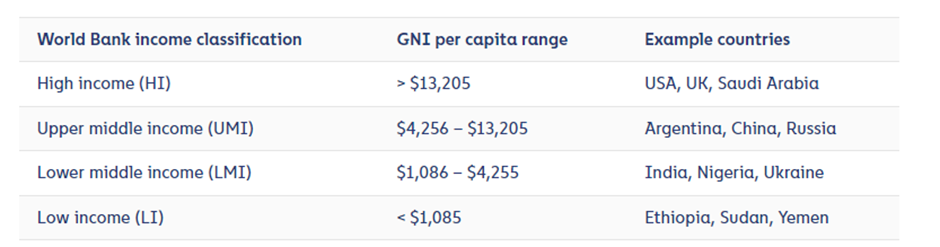

According to the report published in December of 2023, global crypto adoption is down, but it has been recovering since late 2022. However, Lower Middle Income (LMI) countries have seen much stronger recovery than anywhere else. Examples of these nations are: India, Nigeria, and Ukraine. Growth in crypto adoption in these countries is said to stem from: significant economic development in the last decade + 40% of the world’s population live in LMI countries meaning there is a large consumer audience.

When analyzing the report based on regional differences, it is clear that the Central and Southern Asia (CSAO) region is leading the growth resurgence:

- CSAO is the 3rd largest cryptocurrency market, accounting for 20% of global activity.

- 6 of the top 10 countries according to the Global Crypto Adoption Index are located in the region (India, Vietnam, Philippines, Indonesia, Pakistan, Thailand).

- DeFi payments seem to have increased the most out of all Web 3 activities, with DeFi accounting for 55.8% of regional transaction volume between July 2022 — June 2023, compared to 35.2% in the previous year.

Crypto Adopters To Look Out For

Philippines

- Young tech-savvy population, that is used to connecting online as geographically they are naturally disconnected as they are a nation of small islands. World’s biggest exporter of Human Capital, creating a greater need for Filipinos to connect with people at home (the larger potential market for remittance payments).

- Axle Infinity is an NFT mobile-based game, that is super popular in the Philippines with 28.3% of its total web traffic stemming from the Philippines, illustrating the receptiveness of the population towards Web3 and Crypto.

- The government is pushing towards greater regulatory clarity as they have now designated a special economic zone in the Bataan region where cryptocurrency companies can gain tax benefits + operate in a ‘regulatory sandbox’ designed to nurture innovation.

India

- Leads the world in grassroots adoption and the second largest crypto market in the world by raw estimated transaction volume + 4th in centralized exchange use.

- 2nd largest population in the world is predicted to be 1st largest by 2025.

- Young tech-savvy population, as evidenced by the disproportionate amount of software engineers and CEOs within the tech space which stem from India.

- Top cryptocurrency market despite unfavorable regulatory and tax environment (30% tax on gains).

Singapore

· Crypto-friendly regulatory framework -> clear guidelines from the Monetary Authority of Singapore.

· Technological Infrastructure -> High internet penetration (88%) + strong fin tech sector = conducive for crypto adoption.

· Financial hub: established global financial center-> attracts numerous fintech and blockchain companies.

Switzerland

· Zug is home to “crypto valley” -> global center for crypto and blockchain technology.

· Regulatory framework: a progressive approach to cryptocurrency regulation -> encouraging innovation.

· Financial stability-> Switzerland is financially stable.

Japan

- Regulatory clarity — one of the first countries to regulate cryptocurrency exchanges, providing clarity and security for investors.

- Technological adoption — high technology adoption rates + strong gaming culture-> tech-savvy population.

- Economic factors — one of the largest economies with a significant amount of retail investor interest in cryptocurrencies.

South Korea

- High internet penetration rate — highest rates of internet penetration + robust IT infrastructure, South Korea, well positioned for crypto adoption.

- Government support — government invested in blockchain technology and warming to crypto regulation.

- Cultural factors — the popularity of gaming ($217 billion global video game industry)-> look at Philippines where the NFT game Axle Infinity, really took off + digital currencies = tech-savvy population -> crypto adoption.

United States

- Innovation and Investment — strong culture of innovation + largest economy in the world.

- Regulation is varying, but there may be a growing movement to a more cohesive regulatory environment.

- Market size — the largest economy in the world, a significant impact on the global cryptocurrency market.

Germany

- Regulatory recognition — Germany recognizes Bitcoin as a legal form of currency.

- Europe’s largest economy -> significant market for crypto adoption and innovation.

- Technological infrastructure — high levels of tech adoption + strong presence in innovation make Germany a potential leader in the crypto space.

Brazil

- High inflation rates + currency devaluation-> crypto attractive alternative for wealth preservation.

- Technological adoption- high rate of internet and smartphone penetration.

- Regulatory progress — growing interest from government and financial institutions in cryptocurrencies.

TURKEY (The Underdog)

Turkey to me, is an underdog to become the next crypto hub of 2024.

Okay so let’s look at an analytical, quantitative approach and see what the data says:

- 12% increase in crypto investors among the Turkish Population aged 18–60 from 40% in November 2021 to 52% in May 2023 (HALF OF THE POPULATION IS USING CRYPTO!!).

- Bitcoin dominates, attracting 71% of overall crypto investors, Ethereum with 45% of overall interest, and stable coins attract 33% of investors

- 21% show interest in NFTs, 19% in Metaverse, and 18% in meme tokens.

- 57% of participants became familiar with crypto through their family and friends

- 27% of participants attribute entry into the crypto world to social media influencers

Source: (Understanding Crypto Users in Turkey: More Than Half of Turkish Adults Invest in Crypto| KuCoin)

What has caused the surge in cryptocurrency ownership? (source)

- Economic instability — inflation and currency devaluation mean many Turks have turned to digital assets as a more stable store of value

- Young and tech-savvy populations that are digitally inclined to embrace new technologies

- Regulatory environment: there are no stringent restrictions on cryptocurrency use, this lax environment has encouraged people to explore and invest in digital currencies

How are people using cryptocurrency in Turkey?

- Trading and investment: trading cryptocurrencies on local and international exchanges. Why? Potential for high returns + their local currency is extremely volatile thus making crypto trading an attractive option

- Remittances: cryptocurrency is a cost-effective way to send and receive money across borders, which is helpful for Turks given their geographical location and diaspora

- Daily transactions: some businesses in Turkey have started accepting cryptocurrencies as a form of payment, integrating it into daily life

Future Potential of Cryptocurrency in Turkey

- Economic empowerment: cryptocurrencies can provide the population with greater control over their finances, reducing the dependence on traditional banking systems and foreign currencies

- Innovation and Startups: rise in cryptocurrency interest can act as a catalyst for innovation, leading to the establishment of crypto-related startups and businesses in Turkey

- Tourism and Trade: Turkey can leverage crypto to attract a new segment of tourists (crypto enthusiasts), and crypto can facilitate trade with countries where digital currencies are popular.

Crypto Adopters 2024 — Which Countries Are Next? was originally published in The Dark Side on Medium, where people are continuing the conversation by highlighting and responding to this story.