The CEO of Cantor Fitzgerald LP, Howard Lutnick, says that stablecoin issuer Tether does hold some of the reserves it claims to have. The company, which acts as a custodian for the USDT stablecoin issuer, has reviewed some of the company’s financials.

Lutnick said at the World Economic Forum Summit in Davos that Tether held assets of $86 billion to support the $83 billion of its USDT stablecoin.

Tether CEO Promises Live USDT Reserve Breakdown

The company has faced scrutiny because its quarterly attestations do not undergo the same rigor as a full audit. They are a snapshot of its holdings. This accounting limitation has led some to question its usefulness.

Its attestations reveal that Tether buys US treasuries and uses cash and cash equivalents to back its stablecoins. It keeps most of its reserves in short-term treasuries and promises to redeem each USDT for $1.

Read more: What Is a Stablecoin? A Beginner’s Guide

Tether CEO Paolo Ardoino pledged to provide a real-time window into Tether’s reserves. He was grateful to Lutnick for clearing the air.

“It’s heartening to hear Cantor Fitzgerald CEO Howard Lutnick affirming the robustness of our reserves.”

The controversies surrounding Tether have been numerous. In 2020, the bank allegedly used fake executive names and shell companies to secure banking access after a run-in with the US Department of Justice. It later paid $41 million to settle allegations it lied about its reserves.

A recent UN report alleged that USDT was used in clandestine financial networks and money laundering in Asia. Tether criticized the UN report’s focus on the alleged misuse of USDT without recognizing the coin’s usefulness in emerging economies.

Read more: How to Buy USDT in Three Easy Steps – A Beginner’s Guide

Tether Rival Circle Praises Crypto’s Obscurity

Also speaking at Davos was the COO of stablecoin issuer Circle, Dante Disparte. Disparate said that crypto fading into the background at the World Economic Forum was a good thing. It meant that crypto was moving from hype into the background, similar to the dotcom era.

“It’s not dissimilar to the way the internet had to go through its dotcom bubble phase to hand over the development of the Internet to more durable, trusting and safe hands.”

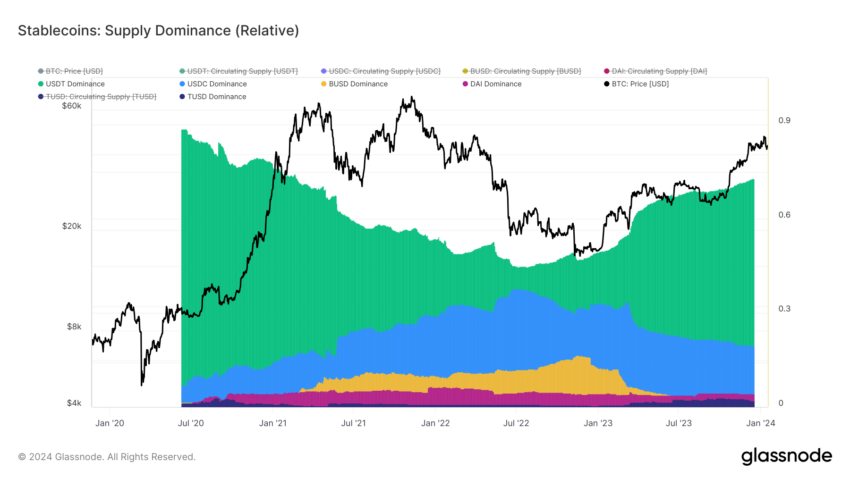

Circle’s USDC stablecoin lost market share to Tether after its assets were frozen due to a banking crisis in March 2023. Since then, the company has been pushing for wider adoption by launching a euro-based stablecoin on Solana. It also rolled out a new protocol to bring its stablecoin to more chains.

Circle’s focus has been trying to win favor by being compliant with regulations. Its EURC stablecoin, for example, complies with upcoming laws in Europe. Circle CEO Jeremy Allaire expects the US to roll out stablecoin regulations in 2024.

Do you have something to say about Tether’s reserves or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

![]()

Coinbase

Coinbase” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

Metamask Portfolio

Metamask Portfolio” target=”_blank”>Explore →

![]()

Wirex App

Wirex App” target=”_blank”>Explore →

![]()

YouHodler

YouHodler” target=”_blank”>Explore →

![]()

Margex

Margex” target=”_blank”>Explore →

Explore more

The post Backing USDT: Firm Asserts Tether Truly Holds Stablecoin Reserves appeared first on BeInCrypto.