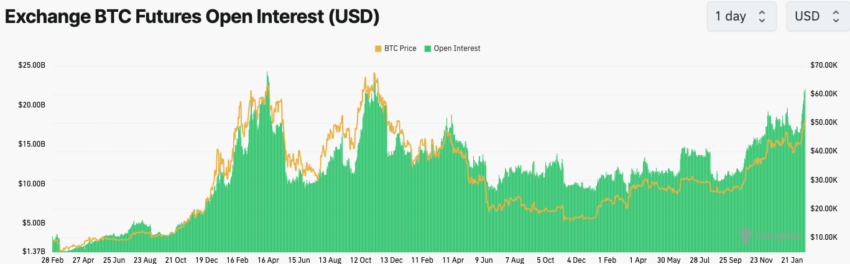

Open interest in Bitcoin futures has risen to over $23 billion. The leverage on these positions is low, which lowers the chance of major price crashes due to liquidations.

Open interest in Bitcoin futures has rallied over 20% to highs not seen since the 2021 bull run.

Why the Sudden Interest in Bitcoin Futures?

The CME Group and Binance dominate Bitcoin futures open interest at $6.39 billion and $5.75 billion, respectively. Bybit and OKX follow with $3.89 billion and $2.19 billion, respectively.

Read more: Where To Trade Bitcoin Futures: A Comprehensive Guide

Since the start of 2024, investor interest in Bitcoin futures has surged. CoinShares confirmed $1.9B inflows into Bitcoin products in 2023 in its January report. Exchange-trade futures products offer tradeable shares of Bitcoin futures.

Bitcoin futures ETFs were approved by the US Securities and Exchange Commission in 2021. For a time, they were the only way institutions got regulated exposure to the asset.

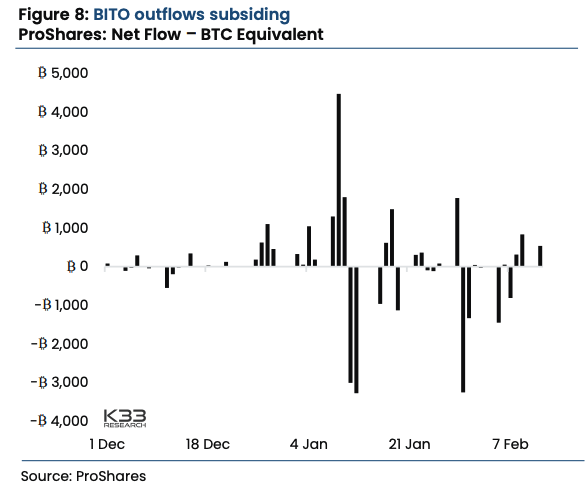

The largest Bitcoin futures ETF, the ProShares Bitcoin Strategy ETF (BITO), surpassed $2 billion in managed assets in the first week of January. However, the fund saw massive outflows towards the end of the month. The outgoing flows have since subsided.

Low Leverage Lowers Liquidations’ Risk

However, the surge in open interest for Bitcoin futures is unlikely to cause a price crash, according to data from CoinGlass. While leverage levels have ticked slightly higher from 0.18 to 0.2 in recent weeks, they are far from levels seen in August last year.

Sophisticated traders use leverage to amplify returns from long or short positions. Long positions predict a higher future price for the asset in a futures contract, while short positions expect lower prices.

Read more: How To Trade Bitcoin Futures and Options Like a Pro

Cryptocurrency futures trading platforms notify the trader when they must add more money to keep their positions open. This usually happens when the investor’s margin falls below an exchange’s threshold for a given asset price.

The exchange will liquidate the trader’s margin if he fails to add more funds to cover his position. Therefore, the exchange could tank an asset’s price through liquidations if their margin trading clients use higher leverage and fail to cover their positions.

With a leverage ratio of around 0.2, this is less likely to happen. It also highlights how BTC’s recent rally to $50,000 and the recent approval of regulated investment vehicles like ETFs that track the asset directly negate the need for undue risks. BlackRock, the second-largest provider of spot Bitcoin ETFs, recently accrued 100,000 BTC as demand for its ETF shares grows.

BeInCrypto contacted the largest crypto derivates platform, CME Group, for comment but had not heard back at press time.

![]()

PrimeXTB

PrimeXTB ” target=”_blank”>Explore →

![]()

Wirex App

Wirex App” target=”_blank”>Explore →

![]()

AlgosOne

AlgosOne” target=”_blank”>Explore →

![]()

YouHodler

YouHodler” target=”_blank”>Explore →

![]()

KuCoin

KuCoin” target=”_blank”>Explore →

![]()

Margex

Margex” target=”_blank”>Explore →

Explore more

The post Why $23 Billion in Leveraged Bitcoin (BTC) Positions Won’t Cause a Price Crash appeared first on BeInCrypto.