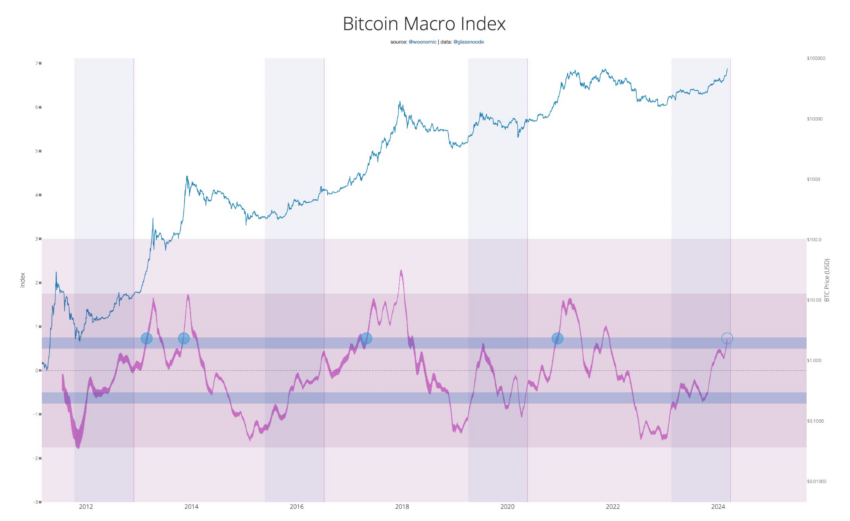

On-chain analyst Willy Woo argues that fundamentals will drive the true crypto bull run. Traditional finance will be shocked when the Bitcoin Macro Index breaches a certain threshold.

Woo predicts that an increase in the Bitcoin Macro index signals the start of a new bull market.

Why the Bull Market Is Not Here Yet

Woo reflected that crypto will enter a true bull run when fundamental factors drive prices. Previous analyses of bull markets reveal that this phenomenon occurs when the Bitcoin Macro Index crosses a certain threshold.

The Bitcoin Macro Index absorbs fundamental and technical analyses into machine learning models that give a broader view of where an asset is placed in a given cycle. The model calibrates the influence of each metric on the broader picture by looking at how much insight the metric previously lent to the performance of Bitcoin.

Woo suggests that based on the model’s previous performance, the crypto bull market is still some way off.

“So you think we’re in a bull market? We’re not, this has been the warm up. A full fundamentals driven bull market is marked by a break of the upper blue band. When it breaks, TradFi is in for a shock,” Woo said.

Read more: Bitcoin Price Prediction 2024 / 2025 / 2030

The last bull market, for example, benefited from the pandemic stimulus money and low-interest rates. Speculative trading gained popularity as homebound workers saw crypto as a way to make easy money.

This market is slightly different, as interest rates are higher and borrowing has fallen. The high-interest rates, however, make investing in long-term financial products an attractive option. Inflows into ETFs that form part of larger crypto portfolios suggest that while Bitcoin is on a tear, it may form small parts of investor portfolios compared to assets that stand to gain from high interest rates.

How Macro Fundamentals Drive Bitcoin

Willy Woo’s claim signifies the importance of looking at past cycles when assessing the current market. The US Federal Reserve’s decisions, for example, to tighten interest rates since March, are fundamental factors that have influenced the price of Bitcoin in different ways as the cycle has lengthened.

The decision to increase rates started in March 2022 and continued until the middle of 2023. The severity and speed of initial rate cuts saw Bitcoin’s price drop dramatically. Later, the collapses of Terra Luna, FTX, and other projects further depressed the price.

However, Bitcoin has historically proven less sensitive to interest rate policies the longer interest rate cycles go. For example, 11 months into the cycle, Bitcoin and the S&P 500 negatively correlated for the first time since the FTX collapse.

Read more: What Are Crypto Trading Patterns? A Basic Introduction

Now, almost two years into the tightening cycle, technical analyst Rekt Capital expects crypto to enter its next bull run in a year-and-a-half or so. Barring a shock like the FTX collapse, cycles unearthed through technical analysis generally repeat themselves. Some crypto traders prefer the Bitcoin rainbow chart when planning when they will invest.

If Rekt Capital’s analysis comes true, a bull market will start in April and end between September and October 2025.

The post This Is Why the Crypto Bull Market Hasn’t Even Started appeared first on BeInCrypto.