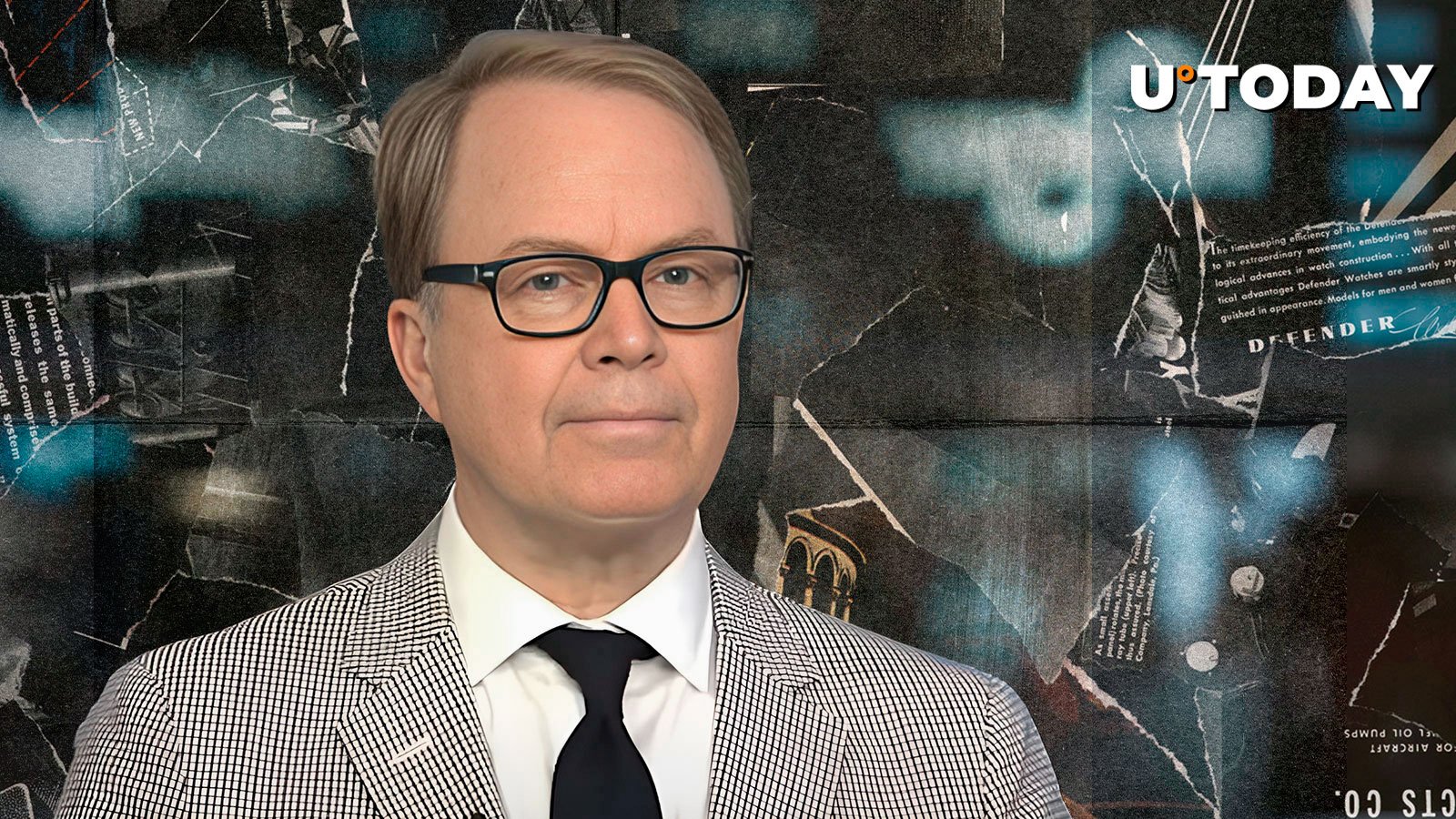

Jurrien Timmer, director of global macro at Fidelity, has opined that the leading coin appears to be following the playbook of the two previous cycles.

“Bitcoin appears to be following the playbook of the last two winters-turned-into-summers. There’s an unmistakable rhythm to Bitcoin’s cycles,” he said in a social media post.

Last month, Timmer noted that Bitcoin and other assets were boosted by falling interest rates.

“Liquidity is a formidable lubricant to grease the wheels of equity prices, not to mention gold and bitcoin, especially if it’s combined with falling real rates,” he said.

On Tuesday, Bitcoin reached a new record high of $94,040. The price of the leading cryptocurrency has since dropped by nearly 2%.

The flagship cryptocurrency is up by more than 32% during this month. The seasonal trend of October and November being the best months for the flagship cryptocurrency appears to be alive and well. Bitcoin also bucked the trend by finishing September (its most bearish month) in the green due to the Federal Reserve’s 50-basis-point rate cut.

During a recent appearance on CNBC’s “Closing Bell,” Macro Risk’s John Kolovos predicted that Bitcoin could potentially hit $240,000.

According to Kolovos, the current Bitcoin trend is “undeniably strong.”

As reported by U.Today, Mike Novogratz of Galaxy Digital warned that there were some warning signs, pointing to high funding rates.

Moreover, long-term holders have been reducing their positions. “This is the largest selling activity compared to other market participants during this run to new all-time highs,” Glassnode co-founder said on Twitter.