The crypto market is heating up, with Bitcoin testing a critical resistance zone just below its all-time high and Ethereum surging past the $4,300 mark to reach multi-year highs. This renewed strength is fueling optimism across the sector, with some analysts calling for the long-awaited altseason as bullish structures take shape in many altcoins. The combination of major assets pushing higher and growing institutional activity is creating a charged atmosphere, setting the stage for what could be a significant market move in the coming weeks.

However, not everyone is convinced the rally will be sustained. Some major players are positioning for a downturn, betting against the market’s momentum. Arkham Intelligence, a blockchain analytics firm known for unmasking the people and companies behind blockchain wallets and transactions, revealed that Abraxas Capital — a large fund with substantial crypto exposure — is currently down over $100 million while shorting the market.

The battle between bullish momentum and bearish positioning is intensifying, and with Bitcoin, Ethereum, and key altcoins approaching critical levels, the next moves could determine whether the market breaks into a full-blown altseason or faces another round of consolidation.

Abraxas Capital’s Massive Short Position Raises Market Tension

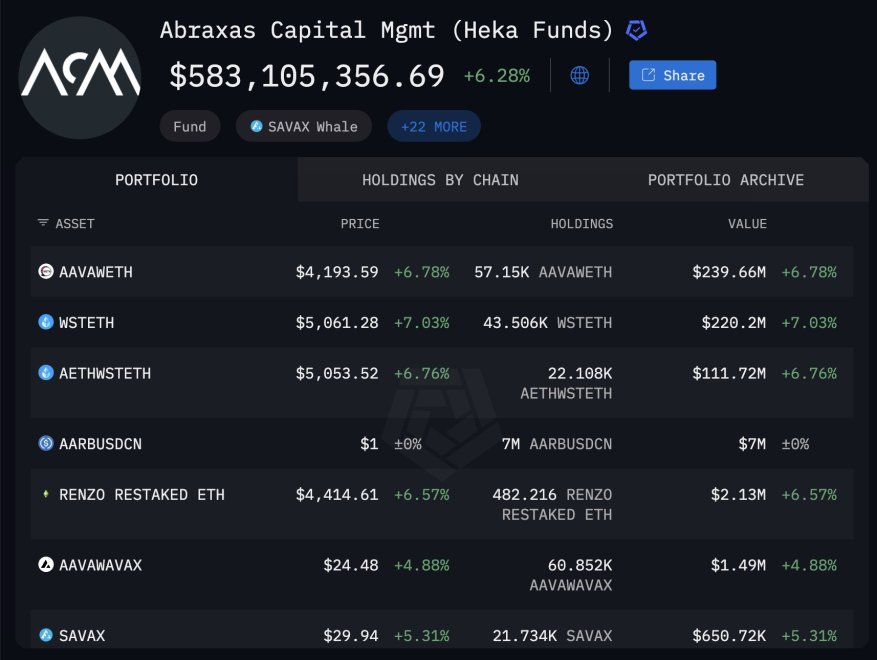

Arkham Intelligence has revealed that Abraxas Capital’s account, identified as 0x5b5, is currently shorting over $750 million worth of cryptocurrency and facing a $119.2 million unrealized loss. The fund’s Bitcoin liquidation price stands at $153,429 — a level that, if reached, could trigger a significant cascade of liquidations in the market.

In addition to its large short position, Abraxas Capital also holds over $573 million in ETH and $69.4 million in HYPE. These positions are delta-positive and delta-neutral, respectively, suggesting a complex trading strategy. They may be farming funding rates on Hyperliquid, taking advantage of perpetual futures market dynamics. It is also possible that Abraxas has additional positions on Binance or other centralized exchanges that are not visible on-chain, adding another layer of uncertainty to their overall exposure.

While some analysts believe this is a hedge strategy, others warn that such concentrated short exposure could backfire if market momentum accelerates. A sharp rally could force large short players, including Abraxas, to close positions rapidly — triggering a short squeeze that adds fuel to price gains.

With BTC hovering just below $123K and ETH above $4,200, both nearing all-time highs, the coming weeks could determine whether Abraxas’s strategy pays off — or becomes a major bullish catalyst for the entire crypto market.

Total Crypto Market Cap Nearing Breakout

The total cryptocurrency market cap is showing strong bullish momentum, currently at $3.98 trillion, just shy of the $4 trillion mark and just below all-time highs. The chart displays a clear uptrend, with higher highs and higher lows forming consistently since the May rebound.

The 50-day moving average (3.21T) is trending sharply upward and remains well above the 100-day (3.14T) and 200-day (2.64T) moving averages, confirming a strong long-term bullish structure. Price action has also been supported by rising volume, a sign of healthy market participation as capital flows into digital assets.

If the market cap breaks convincingly above the $4 trillion psychological barrier, it could trigger further momentum and potentially set new records. This breakout would likely be fueled by Bitcoin and Ethereum’s strength, combined with renewed interest in altcoins as traders position for a possible altseason.

Featured image from Dall-E, chart from TradingView