The cryptocurrency market is showing signs of an impending altcoin season, a period characterized by a surge in the price of other assets relative to Bitcoin. Market participants often shift their focus and capital toward altcoins during this period.

A number of key indicators are beginning to point to this gradual shift in market dynamics. This analysis delves into some of these factors.

Altcoin Season May Be Underway

One such indicator is the increasing trend in TOTAL3, a metric that tracks the total market capitalization of all cryptocurrencies, excluding Bitcoin and Ethereum. As of this writing, it stands at $933 billion, surging by 35% since the beginning of the month. For context, the market capitalization of this group of assets has added $212 billion over the past 22 days.

As TOTAL3 approaches its all-time high of $1.13 trillion, it suggests that investors are allocating more capital to altcoins. Notably, the uptick in TOTAL3 comes during a period of consolidation in Bitcoin’s dominance (BTC.D).

Readings from its daily chart show that the BTC.D has oscillated between 61% and 58% since November 8. As of this writing, BTC.D stands at 59.30%.

When TOTAL3 spikes while BTC.D consolidates, it’s a significant indicator of a potential altcoin season. This means that investors are shifting their focus from Bitcoin to other cryptocurrencies, leading to increased demand and potentially higher prices for altcoins.

Moreover, in a new report, on-chain data provider CryptoQuant has noted an uptick in the values of several Layer 1 altcoins since the conclusion of the US presidential elections, confirming that a potential altcoin season might be underway.

“Cryptocurrencies like XRP, TRX (TRON), TON, ADA, and SOL have seen their prices increase sharply on expectations that the new US administration will be more pro-crypto,” CryptoQuant stated.

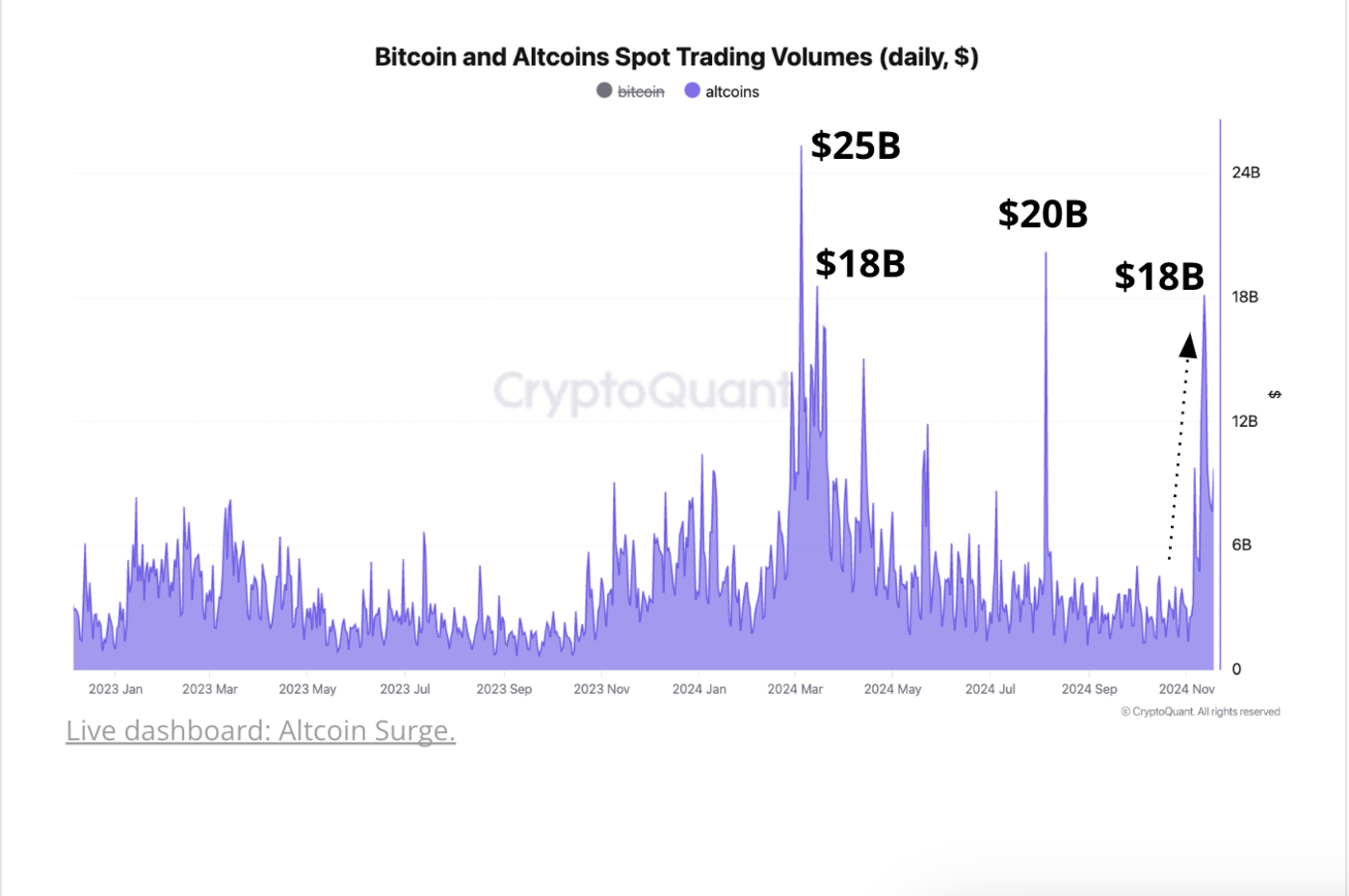

Furthermore, CryptoQuant explains that a spike in spot trading volume has accompanied this price surge.

“Daily spot trading volume for altcoins increased after the US presidential election and spiked as high as $18 billion on November 11, the highest since early August. Prior to this, altcoin spot trading volume had remained muted since May.”

The Altcoins May Need Some More Time

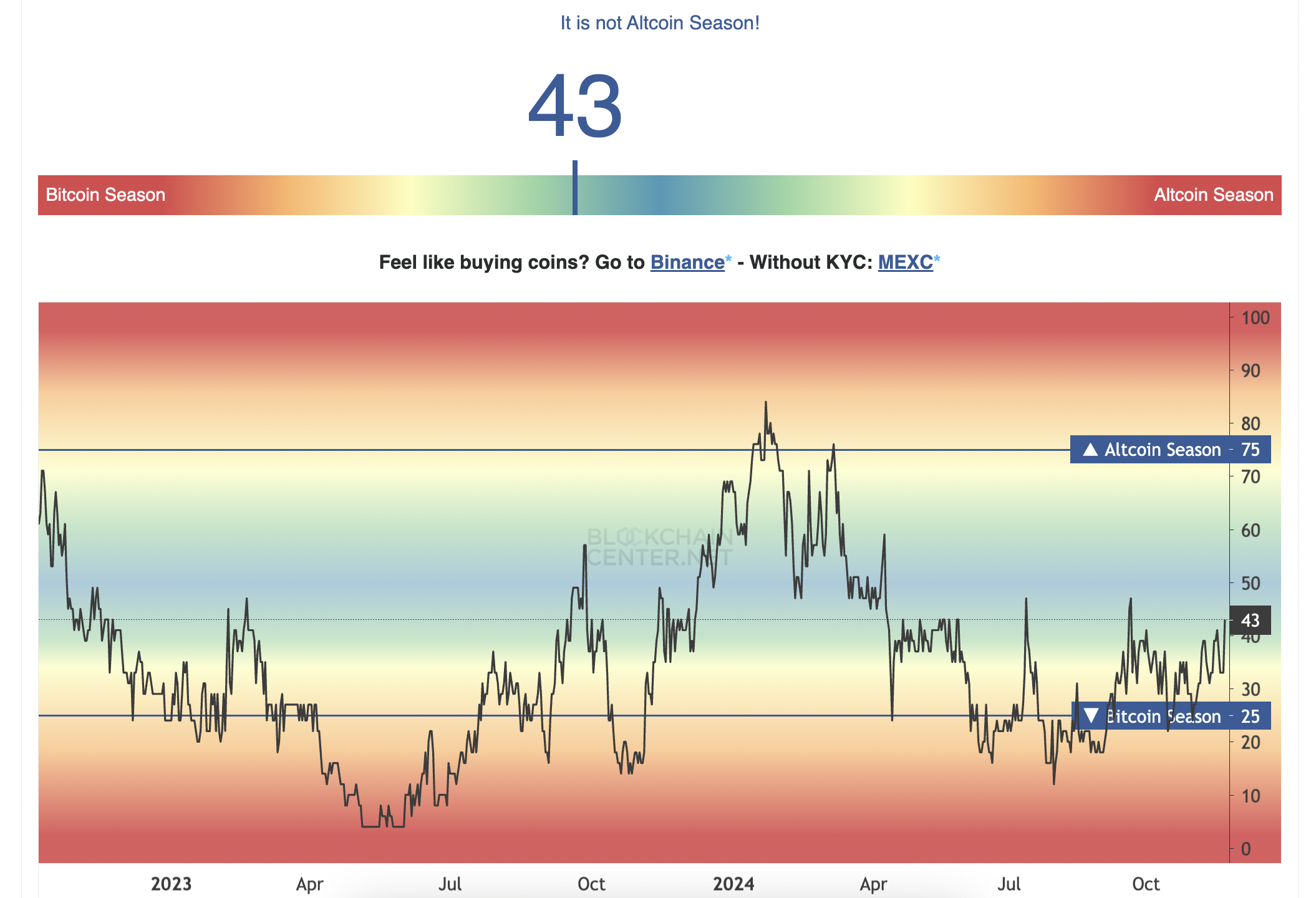

While readings from the indicators mentioned above suggest a likely altcoin season in the near term, it is key to note that this will be confirmed when at least 75% of the top 50 altcoins outperform Bitcoin over a three-month period.

However, data from Blockchain Center reveals that only 43% of these top altcoins have surpassed Bitcoin’s performance in the past 90 days — well below the 75% threshold required to declare an altcoin season officially.

The post Altcoin Season Approaches as Key Indicators Flash Bullish Signals appeared first on BeInCrypto.