Former Bloomberg Intelligence analyst Jamie Coutts says an alt season may take longer to arrive compared to previous market cycles.

Coutts says that even though many altcoins are having breakouts, Bitcoin (BTC) continues to dominate the crypto market based on its share of total market capitalization.

He says that Bitcoin’s dominance may last longer than previous cycles if spot market Bitcoin exchange-traded funds (ETFs) are approved because massive capital would flow into them, boosting the crypto king’s dominance.

“While altcoins are breaking out from their basing pattern, it is still a Bitcoin-dominant market. Yet, the shift towards altseason feels imminent. Considering the significant capital flows expected from BTC ETFs next year, maybe it takes longer this cycle. Usually altseason hits within one to one-and-a-half years from the cycle low which is around Q2 2024.”

He also says that when the alt season arrives, some projects will emerge stronger than others as the adoption of their blockchain technology continues to expand.

“While human behavior remains a constant, with the rotation fueled by BTC profits, FOMO (fear of missing out) and greed, we will see the emergence of some clear long-term winners in this cycle; alt-L1s (layer-1s), L2s (layer-2s) and DApps (decentralized applications) with product market fit and growing adoption. Blockchain adoption is in a structural uptrend. Strap yourself in.”

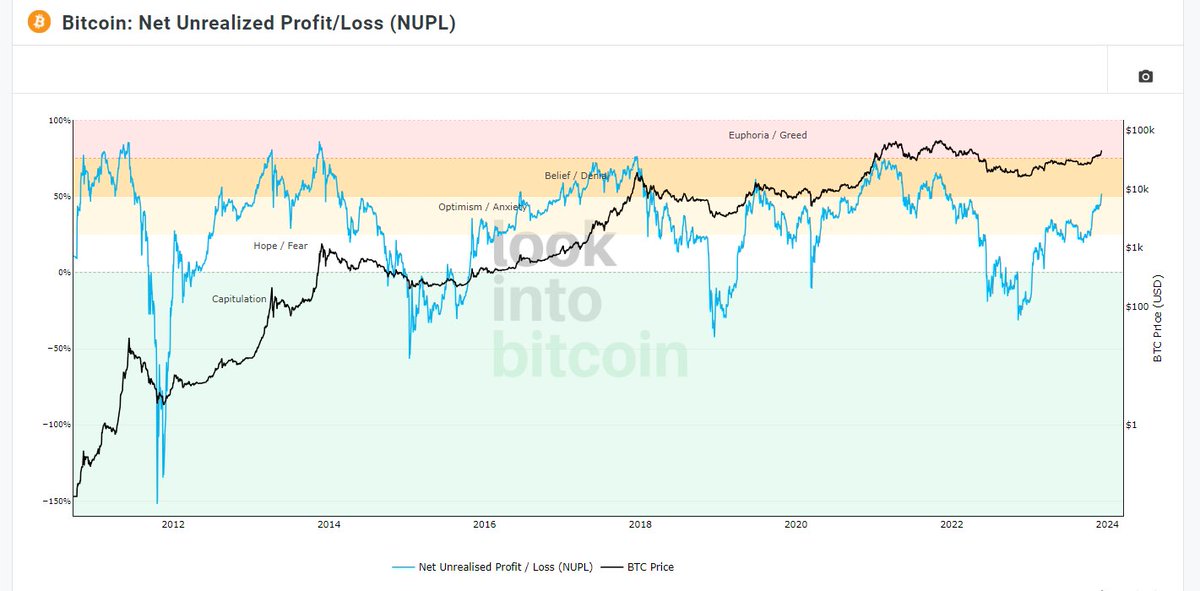

The crypto analyst also warns that Bitcoin could see a sudden correction based on the net unrealized profit/loss (NUPL) metric, which divides Bitcoin investors’ unrealized profit or loss by the BTC market cap.

“Bitcoin is entering belief/denial zone. This is when 25%-30% pullbacks can start appearing regularly. Make no mistake, the compulsion to sell will inflict itself on every holder. However, on-chain, we can see, based on metrics like illiquid supply/long-term holders etc. that this bull market started from a much higher base level of conviction than ever before.

This has a lot to do with a far more informed population. There has been an explosion in the study and analysis of central banking, liquidity and macro analysis. Thanks to the contributions of many great thinkers and educators, concepts/knowledge purposely obfuscated are now illuminated and comprehended.”

Bitcoin is trading for $43,383 at time of writing, up 3.1% in the past 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Comdas/INelson