By Francisco Rodrigues (All times ET unless indicated otherwise)

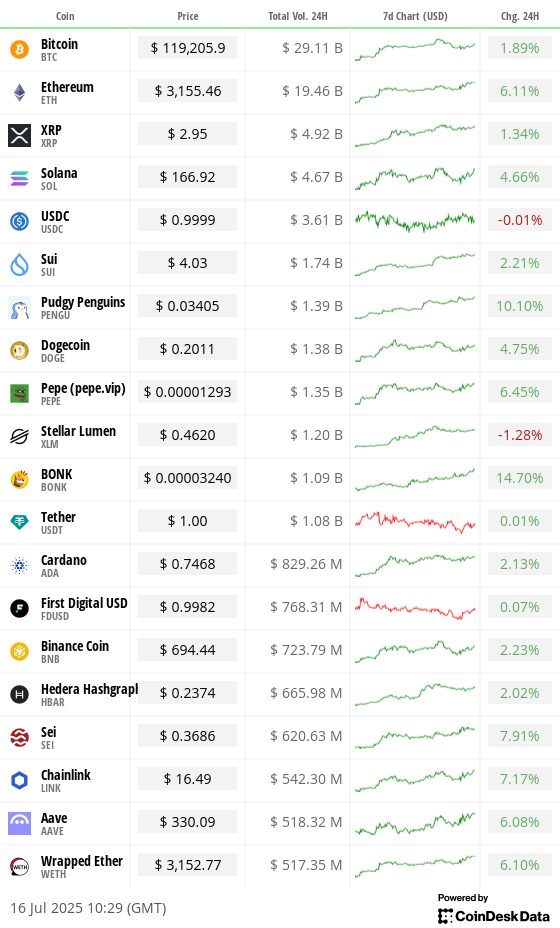

Traders are waking up to discover the crypto rally still has legs. Bitcoin (BTC) is up 2% over the past 24 hours to $119,000 after U.S. consumer-price data stirred talk that tariffs are feeding inflation.

Even though the dollar strengthened after the Tuesday report, demand pushed through, with money flowing into U.S. spot bitcoin ETFs, which are seeing $700 million in total net inflows so far this week.

Demand is further supported by corporate treasuries which, according to BitcoinTreasuries data, now hold 859,993 BTC worth over $100 billion. That figure is likely to keep growing, and Cantor Fitzgerald Chairman Brandon Lutnick is in late-stage talks for a $3 billion bitcoin treasury deal.

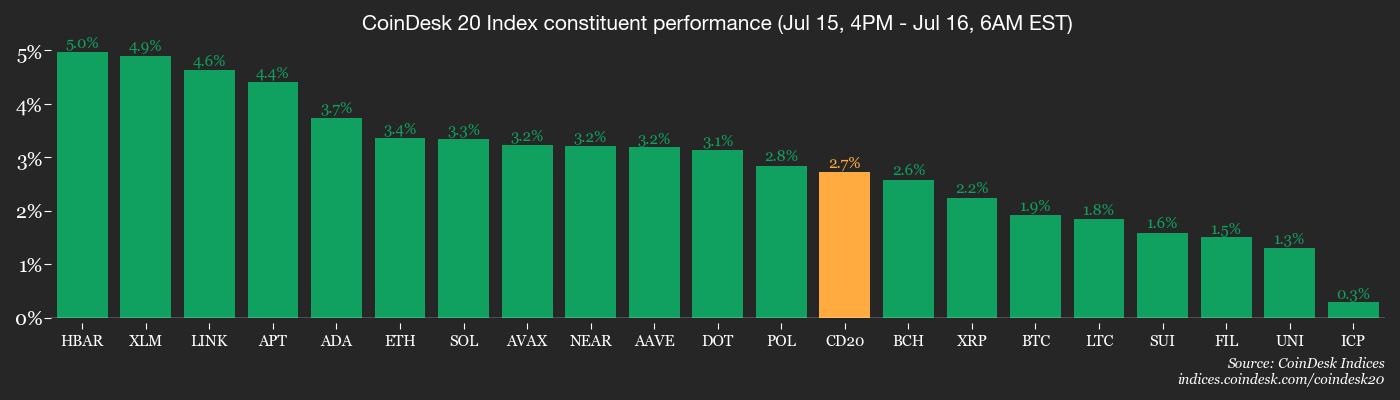

Against that background, it’s worth noting that altcoins are outperforming, with the CoinDesk 20 (CD20) index up 3.5%. Ether (ETH) has risen 6% in the past 24 hours, jumping past $3,100, its best level since February, as companies start to consider it also a candidate for corporate treasury adoption. Just yesterday, SharpLink Gaming overtook the Ethereum Foundation as the largest corporate holder of ETH.

Strategic Ether Reserve data shows that companies now hold 1.6 million ETH. In addition, spot ether ETFs in the U.S. added $192 million yesterday, for a weekly total of $451.3 million.

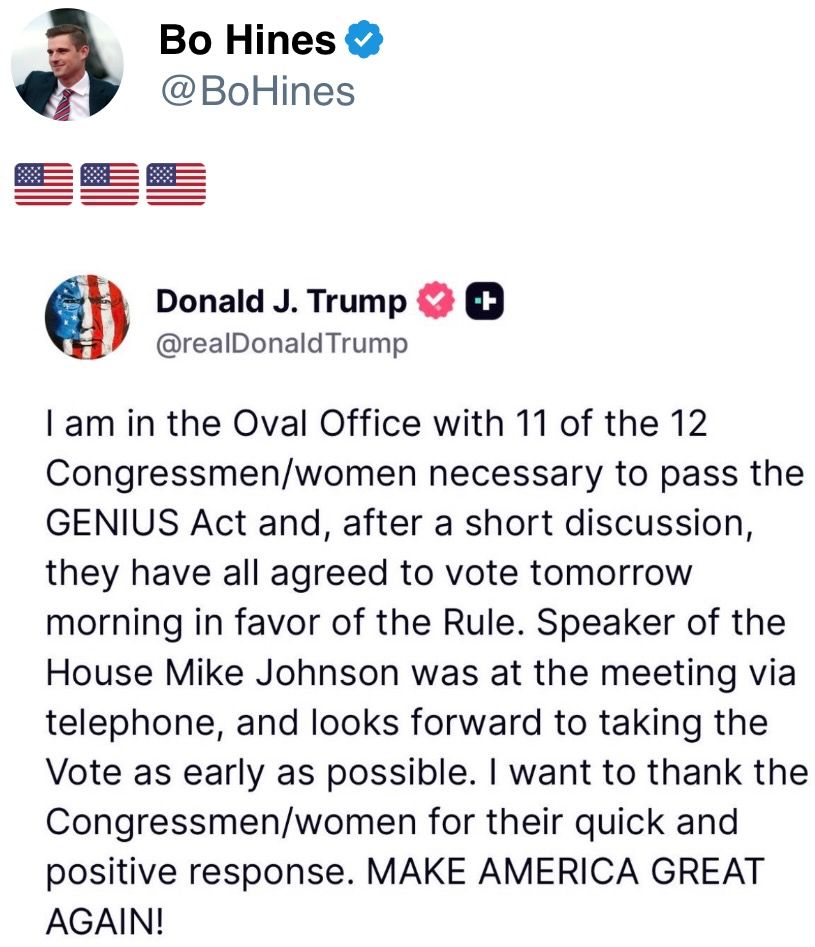

Crypto investors are now bracing for the House debate on the GENIUS Act, a bipartisan bill that could halt yield-bearing U.S. stablecoins while giving stablecoin issuers greater clarity.

President Donald Trump has said Republican lawmakers who objected to a trio of crypto bills, including the GENIUS Act, are now ready to approve them.

If the bills pass, funds now chasing stablecoin interest may pivot to staking and other ether-based strategies. “That would potentially reinforce Ethereum’s importance within the digital asset ecosystem,” Markus Thielen, founder of 10x Research, said in a note shared with CoinDesk.

Looking ahead, producer price inflation being released by the U.S. Bureau of Labor Statistics will be closely watched, as will speeches by several Fed governors for hints on the central bank’s monetary policy as Trump calls for rate cuts.

For now, both the CME Fedwatch Tool and Polymarket point to a 97% chance that rate cuts won’t happen this month. Stay alert!

What to Watch

- Crypto

- July 16, 9 a.m.: U.S. House Ways and Means Committee oversight hearing titled “Making America the Crypto Capital of the World: Ensuring Digital Asset Policy Built for the 21st Century.”

- July 18: Lorenzo Protocol, a Cosmos-based blockchain with native token BANK, launches USD1+ OTF on BNB Chain’s mainnet. The institutional-grade on-chain traded fund lets users stake stablecoins to mint sUSD1+ tokens that earn stable, NAV-backed yield from real-world assets, CeFi quantitative strategies and DeFi protocols. All returns are settled in USD1 stablecoin, issued by World Liberty Financial, whose stablecoin infrastructure powers the product’s stable yield mechanism.

- Macro

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June producer price inflation data.

- Core PPI MoM Est. 0.2% vs. Prev. 0.1%

- Core PPI YoY Est. 2.7% vs. Prev. 3%

- PPI MoM Est. 0.2% vs. Prev. 0.1%

- PPI YoY Est. 2.5% vs. Prev. 2.6%

- July 16, 10 a.m.: Speech by Fed Governor Michael S. Barr on “Financial Regulation” at “Conversation with Governor Barr” in Washington. Livestream link.

- July 17, 10 a.m.: Speech by Fed Governor Adriana D. Kugler on “A View of the Housing Market and U.S. Economic Outlook” at the Housing Partnership Network Symposium in Washington. Livestream link.

- July 17, 6:30 p.m.: Speech by Fed Governor Christopher J. Waller on the economic outlook at an event hosted by the Money Marketeers of New York University.

- Aug. 1, 12:01 a.m.: New U.S. tariffs take effect on imports from trade partners that failed to reach agreements by the July 9 deadline. These increased duties could range from 10% to as high as 70%, impacting a wide range of goods.

- July 16, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June producer price inflation data.

- Earnings (Estimates based on FactSet data)

- July 23: Tesla (TSLA), post-market, $0.42

- July 29: PayPal Holdings (PYPL), pre-market, $1.29

- July 30: Robinhood Markets (HOOD), post-market, $0.30

- July 31: Coinbase Global (COIN), post-market, $1.35

- July 31: Reddit (RDDT), post-market, $0.19

- Aug. 5: Galaxy Digital (GLXY), pre-market

Token Events

- Governance votes & calls

- Aavegotchi DAO is voting on a $245,000 funding proposal to expand Gotchi Battler into a revenue-generating game with PvE modes, NFTs and battle passes, aiming to reverse declining player numbers, boost GHST utility and create sustainable rewards. Voting ends July 22.

- Uniswap DAO is conducting a temperature check on Etherlink’s request to co-incentivize Uniswap v3 liquidity. Tezos Foundation would put up $300K for three months of rewards on WETH/USDC, WBTC/USDC and LBTC/USDC, and is asking the DAO for $150K more, aiming to anchor Etherlink’s rising TVL and future native tokens on Uniswap. Voting ends July 18.

- Rocket Pool DAO is voting to finalize Saturn 1’s implementation. Approval by a 75% supermajority will ratify key protocol changes, including new transaction designs and a potential revenue share to the pDAO treasury. Voting ends July 24.

- July 16, 5 p.m.: VeChain to host a monthly update with community representatives and the VeChain Foundation.

- Unlocks

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating supply worth $37.15 million.

- July 17: ZKSync (ZK) to unlock 2.41% of its circulating supply worth $9.24 million.

- July 17: ApeCoin (APE) to unlock 1.95% of its circulating supply worth $9.86 million.

- July 18: Official TRUMP (TRUMP) to unlock 45.35% of its circulating supply worth $827.17 million.

- July 18: Fasttoken (FTN) to unlock 4.64% of its circulating supply worth $90 million.

- Token Launches

- July 16: Bybit to delist Tap (TAP), VaporFund (VPR), Cosplay Token (COT), Souni (SON), Tenet Protocol (TENE), Havah (HVH), and Brawl AI Layer (BRAWL) among others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known as State of Crypto) is a one-day boutique event held in Washington on Sept. 10 that allows general counsels, compliance officers and regulatory executives to meet with public officials responsible for crypto legislation and regulatory oversight. Space is limited. Use code CDB10 for 10% off your registration through July 17.

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 21-22: Malaysia Blockchain Week 2025 (Kuala Lumpur)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

- Aug. 6-7: Blockchain.Rio 2025 (Rio de Janeiro, Brazil)

- Aug. 6-10: Rare EVO (Las Vegas)

- Aug. 7-8: bitcoin++ (Riga, Latvia)

- Aug. 9-10: Baltic Honeybadger 2025 (Riga, Latvia)

- Aug. 9-10: Conviction 2025 (Ho Chi Minh City, Vietnam)

Token Talk

By Shaurya Malwa

- Eclipse Foundation, creator of the Eclipse layer-2 blockchain, debuted its native ES token, positioned as the gas and governance token for its “Solana on Ethereum” network.

- Key allocations:

• 10% (100M) airdrop to early users

• 5% for liquidity on exchanges

• 35% to ecosystem and development

• 19% to contributors (4-year vesting, 3-year lock)

• 31% to early supporters/investors (3-year lock) - Airdrop eligibility is based on three factors:

• Turbo Tap gameplay (“grass” points earned via stress-testing)

• X (Twitter) activity, measured by Kaito analytics

• Discord engagement - No 1:1 conversion from “grass” points to tokens; snapshot and allocation details will be published after the airdrop to prevent manipulation.

- Airdrop starts Wednesday, with distributions spread over 30 days across Eclipse, Ethereum and Solana mainnets.

- ES token will acts as gas token via native paymaster mechanism and enables decentralized governance for protocol upgrades and decision-making

- The Eclipse team is excluded from the airdrop to prevent insider manipulation; contributors will receive their allocation via vesting.

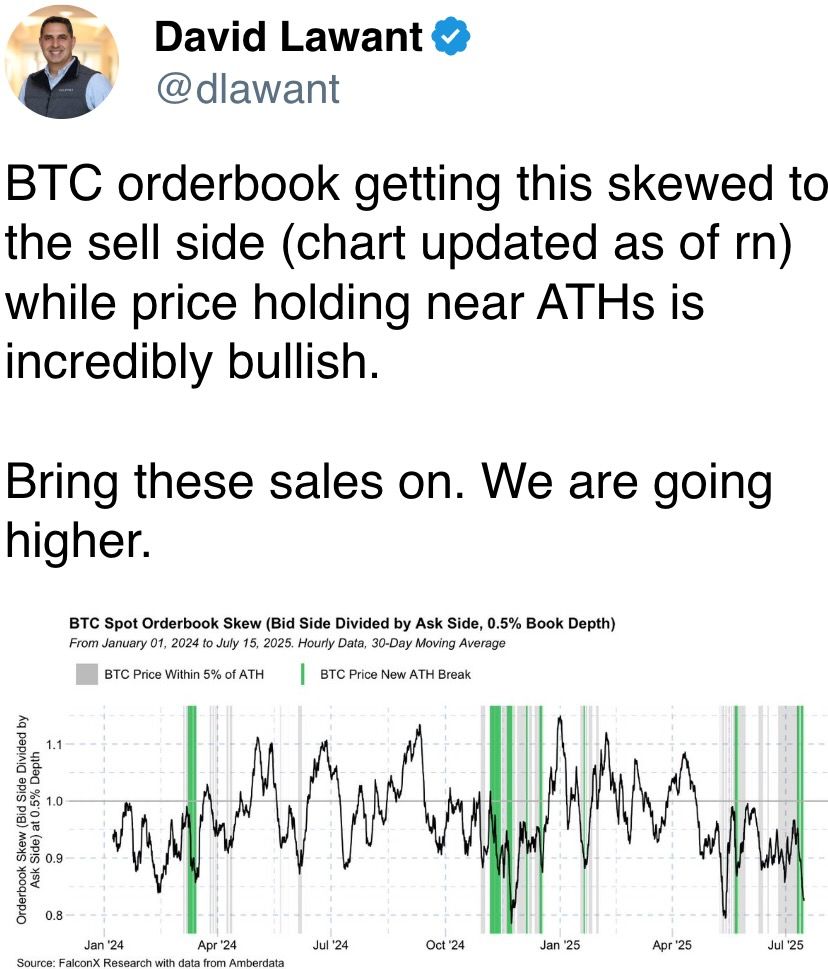

Derivatives Positioning

- Cumulative open interest in BTC futures and perpetual futures listed worldwide has hit a record high of 739K BTC. Annualized perpetual funding rates have topped 23%, the highest in months, suggesting growing demand for leveraged bullish plays.

- All major coins now have funding rates in double digits.

- However, only ETH, TON, BTC, AAVE and SHIB have seen positive cumulative volume delta in the past 24 hours, a sign buyers are becoming more aggressive.

- On Deribit, BTC short duration skew has flipped positive again while ETH continues to see call bias across tenors.

- Block flows on OTC liquidity platform Paradigm featured a long position in the September expiry call at the $140K strike.

Market Movements

- BTC is up 2.29% from 4 p.m. ET Tuesday at $119,095.12 (24hrs: +1.85%)

- ETH is up 3.81% at $3,157.00 (24hrs: +6.06%)

- CoinDesk 20 is up 3.25% at 3,703.30 (24hrs: +3.4%)

- Ether CESR Composite Staking Rate is down 1 bps at 3.03%

- BTC funding rate is at 0.0263% (28.7985% annualized) on Binance

- DXY is unchanged at 98.53

- Gold futures are up 0.34% at $3,348.20

- Silver futures are up 0.45% at $38.28

- Nikkei 225 closed unchanged at 39,663.40

- Hang Seng closed down 0.29% at 24,517.76

- FTSE is up 0.11% at 8,947.72

- Euro Stoxx 50 is down 0.41% at 5,332.42

- DJIA closed on Tuesday down 0.98% at 44,023.29

- S&P 500 closed down 0.4% at 6,243.76

- Nasdaq Composite closed up 0.18% at 20,677.80

- S&P/TSX Composite closed down 0.53% at 27,054.14

- S&P 40 Latin America closed up 0.14% at 2,600.94

- U.S. 10-Year Treasury rate is down 1.4 bps at 4.475%

- E-mini S&P 500 futures are down 0.14% at 6,275.50

- E-mini Nasdaq-100 futures are down 0.30% at 22,986.75

- E-mini Dow Jones Industrial Average Index are unchanged at 44,231.00

Bitcoin Stats

- BTC Dominance: 64.85% (0.17%)

- Ether to bitcoin ratio: 0.02651 (-0.6%)

- Hashrate (seven-day moving average): 935 EH/s

- Hashprice (spot): $59.88

- Total Fees: 4.17 BTC / $489,636

- CME Futures Open Interest: 156,645 BTC

- BTC priced in gold: 35.7 oz

- BTC vs gold market cap: 10.1%

Technical Analysis

- The chart shows that DOGE is consolidating in a bull flag-like counter trend channel.

- A potential breakout would signal resumption of the initial uptrend.

Crypto Equities

- Strategy (MSTR): closed on Tuesday at $442.31 (-1.93%), +1.73% at $449.98

- Coinbase Global (COIN): closed at $388.02 (-1.52%), +0.76% at $390.97

- Circle (CRCL): closed at $195.33 (-4.58%), +1.45% at $198.17

- Galaxy Digital (GLXY): closed at $20.86 (-2.75%), +3.02% at $21.49

- MARA Holdings (MARA): closed at $18.76 (-2.34%), +1.87% at $19.11

- Riot Platforms (RIOT): closed at $12.1 (-3.28%), +2.23% at $12.37

- Core Scientific (CORZ): closed at $13.76 (+1.47%), +0.22% at $13.79

- CleanSpark (CLSK): closed at $12.19 (-3.25%), +2.13% at $12.45

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $25.05 (-2.03%)

- Semler Scientific (SMLR): closed at $42.18 (-6.74%), +1.35% at $42.75

- Exodus Movement (EXOD): closed at $31.33 (-7.03%), +3.32% at $32.37

ETF Flows

Spot BTC ETFs

- Daily net flows: $403.1 million

- Cumulative net flows: $53.04 billion

- Total BTC holdings ~1.28 million

Spot ETH ETFs

- Daily net flows: $192.3 million

- Cumulative net flows: $5.78 billion

- Total ETH holdings ~4.53 million

Source: Farside Investors

Overnight Flows

Chart of the Day

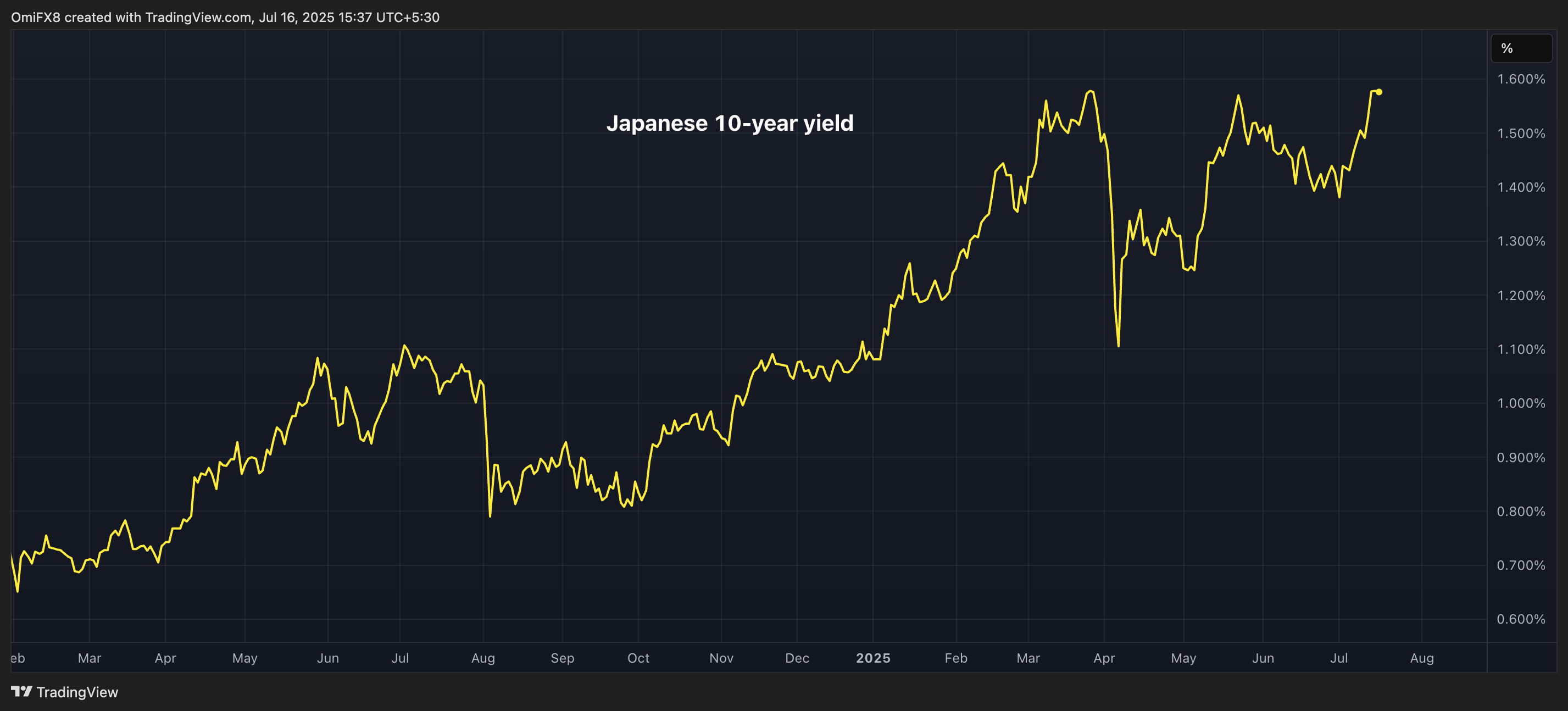

- The Japanese 10-year government bond yield is on the verge of setting new, multidecade highs above 1.58%.

- That could add to volatility in bond markets across advanced nations, potentially leading to a mini bout of risk aversion.

While You Were Sleeping

- Trump Reaps $50B Tariff Haul as World ‘Chickens Out’ (Financial Times): Analysts say global restraint stems from fears of inflation, trade disruption and jeopardizing U.S. security ties, as even early retaliators like China and Canada backed down.

- Ether Races 6% Against Bitcoin as GENIUS Act Puts Spotlight on Yield-Bearing Stablecoins: Analyst (CoinDesk): 10x Research’s Markus Thielen said ETH’s latest rally reflects expectations the GENIUS Act will pass, prohibiting yield on U.S. stablecoins and increasing the Ethereum network’s appeal within crypto.

- Crypto Is Going Mainstream and ‘You Can’t Put the Genie Back in the Bottle,’ Bitwise Says (CoinDesk): The asset manager’s report said pending U.S. crypto legislation could unlock billions in new investment and pave the way for trillions in traditional assets to migrate onto blockchain infrastructure.

- Strategy’s Convertible Bond Prices Surge as Stock Advances Back Toward Record High (CoinDesk): The firm’s $8.2 billion in convertible debt now carries a $5.2 billion premium as the surging share price pushes five of six notes deep into the money, driving values higher.

- The European Charm Offensive That Helped Turn Trump Against Putin (The Wall Street Journal): President Trump’s shifting stance on Russia followed frustration with President Putin, the German chancellor’s pledge to fund U.S. air defense systems for Ukraine and European officials engaging in talks with pro-Ukraine U.S. politicians.

- U.K. Inflation Unexpectedly Rises to Highest Since January 2024 (Reuters): Headline CPI rose to 3.6% in June from 3.4%, complicating a possible August rate cut, with fuel, airfare and rail costs driving the increase. Inflation may peak near 3.7% by September.