A fresh look at on-chain studies shows the United States far ahead in Bitcoin holdings. Investors and analysts are watching closely as countries and companies build out their positions. The sheer size of America’s stash is reshaping conversations about scarcity and value in the crypto world.

Geographic Breakdown Shows US Dominance

According to analysis from Fred Krueger, the US holds nearly 8 million BTC out of almost 20 million in circulation. That adds up to 40% of all existing coins.

Based on reports, a $120,000 valuation per BTC would put America’s holdings at around $936 billion. At the same time, US Bitcoin ETFs saw net inflows of $6 billion in July. It was the third-strongest month ever for these products, trailing only February and November 2024.

Who owns Bitcoin?

1/ Bitcoin is mainly a US thing

2/ India is the surprise number 2

3/ Europe is really not involved. pic.twitter.com/zhiZ21i7HQ— Fred Krueger (@dotkrueger) August 3, 2025

Supply outside America is much smaller. India comes in second with 1 million BTC, or 5% of the supply, worth about $120 billion at the same price point. Europe follows at 900,000 BTC (4.6%), valued at $108 billion.

China’s government holds roughly 194,000 BTC (1%), mostly from seizures, pegged at $23.3 billion. Together, Latin America and the rest of Asia each control about 400,000 BTC (2%), valued at $48 billion apiece. Africa and other regions combine for 300,000 BTC (1.5%).

Corporate Giants Hold Big Stakes

Reports have disclosed that public companies in the US are key players in the Bitcoin game. Strategy leads by a mile with 628,791 BTC on its books. Marathon Digital Holdings (MARA) sits next with 50,000 BTC, while XXI Capital holds 43,514 BTC.

Bitcoin Standard Treasury Company has 30,021 BTC, and Riot Platforms keeps 19,225 BTC. US President Donald Trump Media & Technology Group Corp. makes the list too, owning 18,430 BTC. That mix of companies spans from miners to financial services, showing how varied corporate interest has become.

India And Europe Keep Growing

Data shows India’s crypto surge continues despite a murky regulatory landscape. Most of the country’s holders are retail investors with small balances, but the sheer headcount places the country ahead of Europe.

In Europe, a blend of retail and institutions drives adoption. Still, growth here has been steadier than in India’s near-100% compound annual rate (CAGR) from 2018 to 2023—versus about 8% for traditional payments. That difference highlights crypto’s unique pull among Indian users.

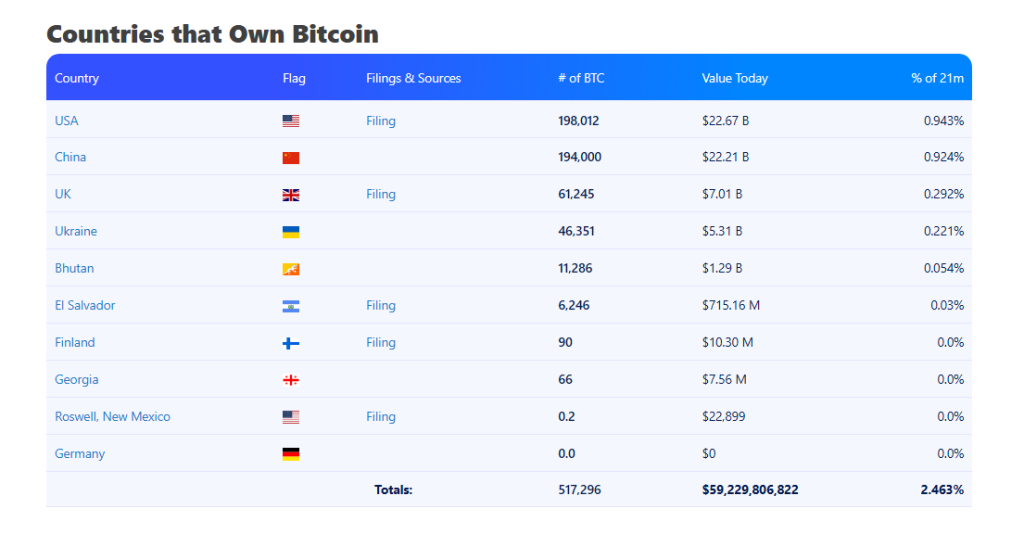

Meanwhile, Bitbo’s recent chart also sheds light on national-level reserves. It shows over 200,000 BTC linked to the US and a similar figure for China.

The UK ranks third with 61,000 BTC, Ukraine fourth at 46,000. Smaller players like Bhutan, El Salvador, and Finland hold between 5,000 and 10,000 BTC.

Featured image from Pexels, chart from TradingView