Aster (ASTER) has gained over 12% in the past 24 hours, but the bounce may not tell the full story. Despite the short-term uptick, the ASTER price is still down over 22% in seven days. The market’s mood looks uncertain, and while today’s rally might excite traders, on-chain signals show that conviction is fading fast.

All major holder groups seem to be moving in the same direction, and not the bullish one.

Whales, Smart Money, and Retail All Pull Back

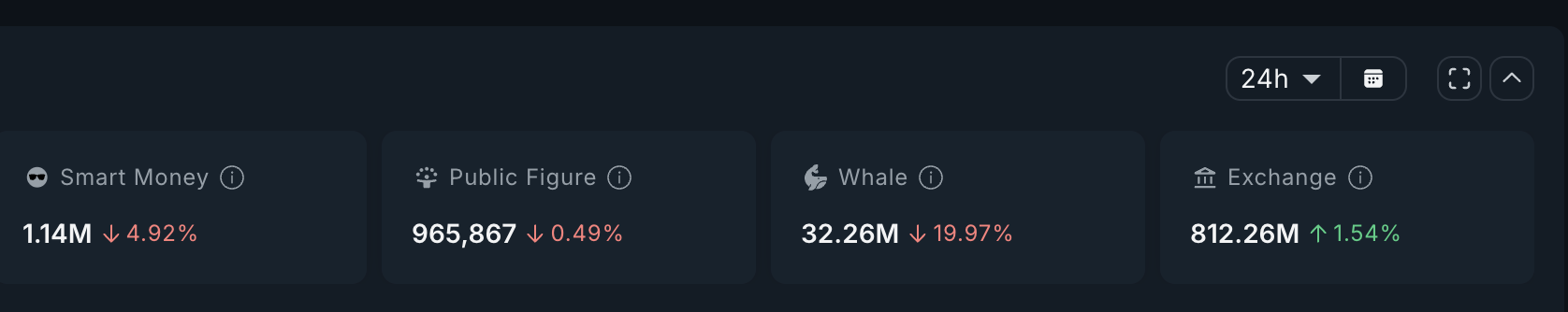

On-chain data shows that conviction among Aster’s largest investors has weakened sharply.

Whales holding more than 10 million ASTER have offloaded nearly 20% of their total stash in the past week, dropping about 8.05 million ASTER, worth roughly $12.07 million at the current ASTER price.

Smart money addresses — typically early, informed investors — have also trimmed holdings by about 5% (almost 59,000 tokens), while overall exchange balances have risen by 12.32 million tokens in the last 24 hours.

That increase in exchange reserves often signals more tokens being prepared for sale, even from retail, reinforcing the bearish flow.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

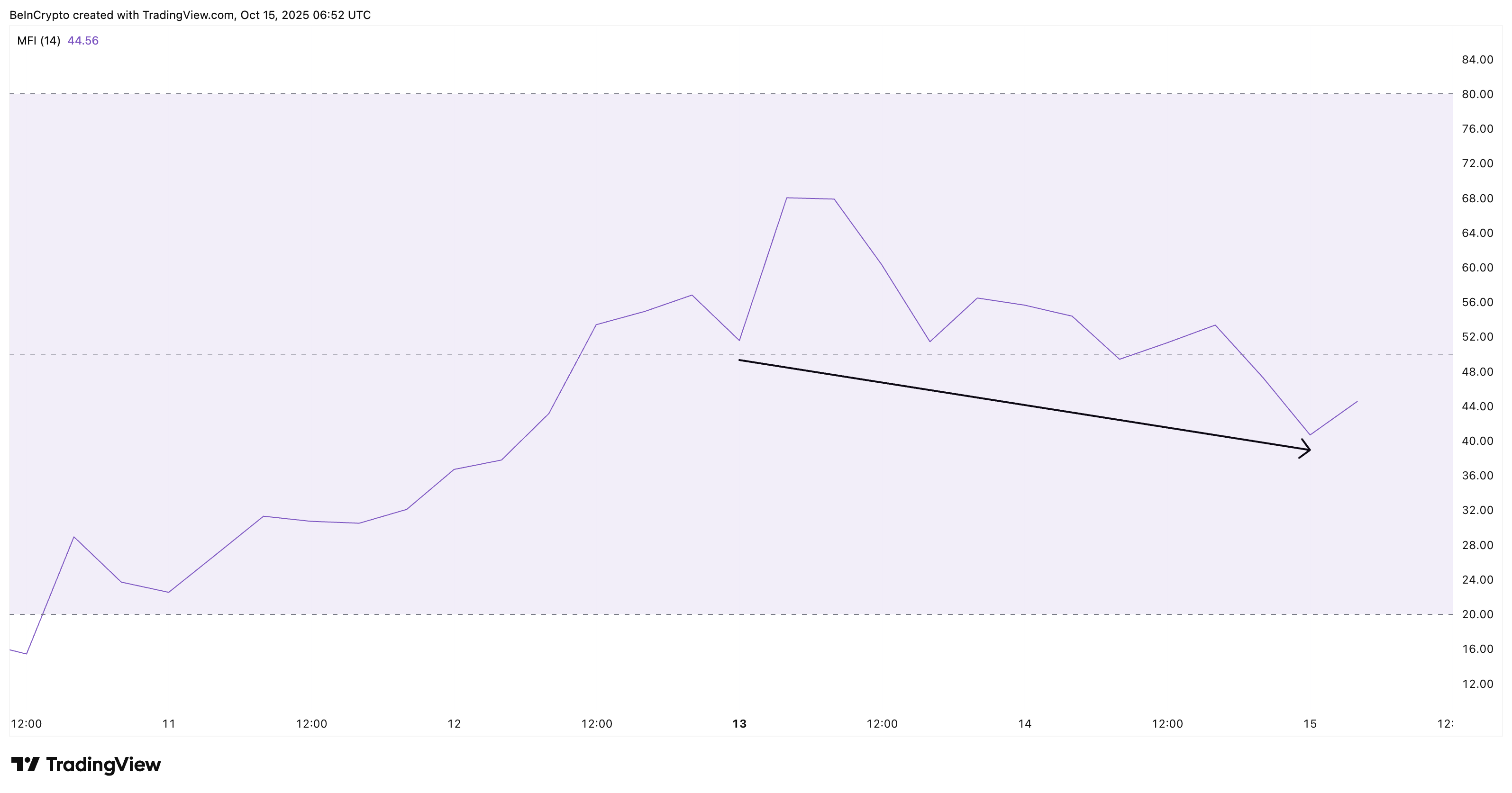

Retail sentiment on the technical chart mirrors this weakness. The Money Flow Index (MFI) — an indicator that tracks buying and selling pressure using both price and volume — continues to make lower lows, showing that smaller traders are not buying the dip. Retail interest appears to be drying up as prices grind lower.

Combined, these shifts create a rare consensus across all trading groups — with whales, smart money, and retail all cutting exposure.

ASTER Price Faces Bearish Setup — $1.59 Is Key

On the 4-hour chart, the ASTER price trades inside a descending triangle, a structure that often signals weakening demand. The triangle’s bases sit around $1.30, $1.15, and $0.98, which now act as critical support zones. A breakdown below these levels could trigger deeper corrections.

To change that outlook, the token must close above $1.59, a key resistance level that would invalidate the short-term bearish trend. A clean break above this level could open paths to $1.72 and even $2.02, flipping short-term momentum and disproving the uniform bearishness seen across holder data.

The Relative Strength Index (RSI) — which measures price momentum — also shows a hidden bearish divergence (marked by the red arrow), where RSI rises while prices make lower highs. This pattern typically hints at fading strength and a possible continuation of the ASTER price downtrend unless bulls reclaim control.

For now, ASTER sits at a crossroads. Every major trading group seems to agree on selling — but if $1.59 breaks, that consensus could turn out to be wrong.

The post ASTER Jumps 12%—But Are Big Holders Quietly Heading for the Exits? appeared first on BeInCrypto.