Avalanche (AVAX), one of the leading layer-1 blockchain platforms, is drawing attention with its impressive monthly active wallet growth.

However, despite the explosion in active addresses, AVAX’s price remains worryingly low. It has dropped over 60% since the end of 2024 and is now trading at 2021 levels. This raises an important question: Is Avalanche being undervalued by the market, or is this a sign of deeper challenges?

Why is Avalanche’s On-chain Activity Soaring?

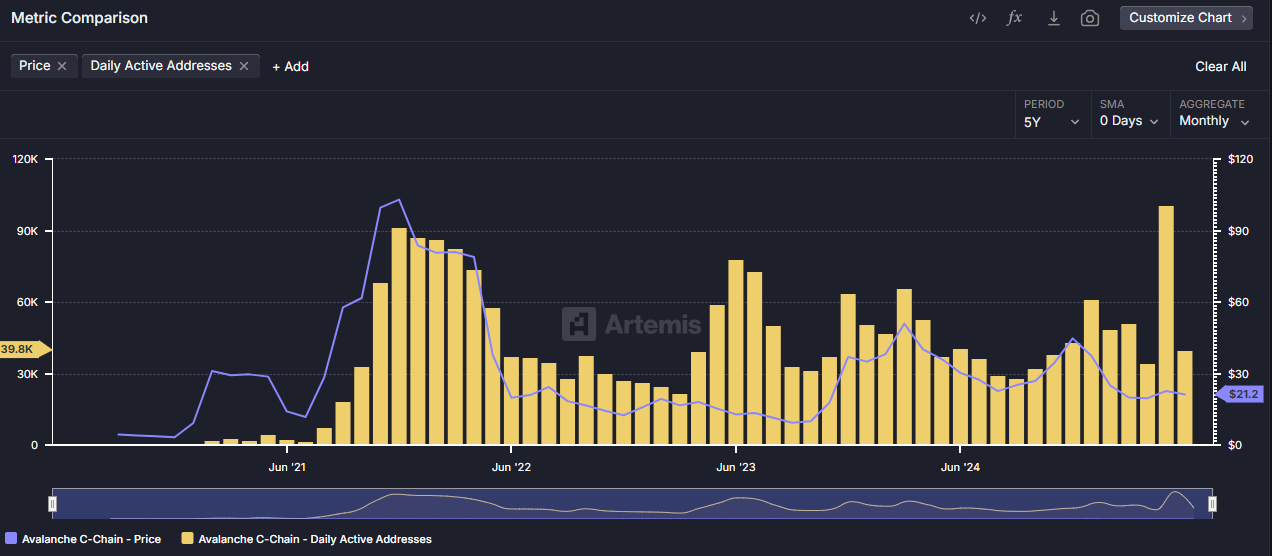

According to data from Artemis, the number of daily active wallets on the Avalanche C-Chain recently surged past 100,000. This figure even surpasses the number recorded when AVAX reached its all-time high of over $147 at the end of 2021.

In addition, Token Terminal data shows that monthly active wallets on Avalanche jumped from below 500,000 to 2.2 million in just one month.

This is a positive signal. It shows growing interest from users and developers in the Avalanche ecosystem. Market observer Wu Blockchain attributed this increase in activity to institutional attention.

“This surge is likely driven by the launch of the blockchain game MapleStory Universe. Meanwhile, BlackRock’s tokenized short-term US Treasury product, sBUIDL, has been adopted as collateral on the Avalanche-based Euler protocol,” Wu Blockchain explained.

However, Avalanche faces a paradox. On-chain activity seems disconnected from AVAX’s market sentiment. The token is still priced around $21, over 60% below its late-2024 high.

This discrepancy has led some analysts to believe it may be a good time to accumulate AVAX.

Crypto investor Crypto Pirates predicts that AVAX has entered a demand zone and could rebound in June.

“AVAX tapped into my daily demand level. From here, we can plan longs all the way to the weak high,” Crypto Pirates said.

Looking at the bigger picture, investor Hasan believes AVAX is now within a historical demand zone based on its four-year price history. Although future volatility remains uncertain, Hasan suggests this may be a time to observe and consider long-term accumulation.

“Performance hasn’t been great yet. It rose from $14 to $27 recently. Right now, it seems to be attracting demand around the $16 range. If BTC corrects in June, AVAX could revisit this area. Those thinking of investing might want to wait and reassess if the price returns to that level,” Hasan commented.

Despite several positive developments around AVAX last month, investor sentiment has been dampened by the SEC’s delay of the AVAX ETF application. This has stalled any significant price breakout. Additionally, the broader altcoin market is still sluggish, as Bitcoin dominance remains high at over 63%.

For now, AVAX investors may need to wait for a real convergence of strong fundamentals and a more favorable altcoin market environment to realize substantial returns in the future.

The post Avalanche On-chain Activity Explodes—Yet AVAX Trades Like It’s Still 2021 appeared first on BeInCrypto.