Avalanche (AVAX), the blockchain platform known for its scalability and infrastructure, made significant strides in the fourth quarter (Q4) of 2023. According to a report by Messari, AVAX emerged as one of the best-performing tokens, driving the protocol to record notable gains in key metrics.

Record-Breaking Milestones For Avalanche

The report shows that AVAX experienced a notable increase in its market cap, which climbed 344% quarter-over-quarter (QoQ) and 326% year-over-year (YoY), reaching $14.4 billion at the end of the year. This large increase propelled AVAX’s market cap rank among all tokens from 20 to 9, up 11 spots (currently 10th behind Cardano (ADA).

One of the driving factors behind Avalanche’s significant revenue growth was the surge in inscriptions, particularly Avascriptions (ACS-20 tokens).

These on-chain call data transactions saw a significant boost, resulting in a substantial increase in revenue. From November to December, Avalanche witnessed a surge in revenue, with a 2,874% increase measured in USD, from $1.9 million to $56.5 million.

The surge in revenue was accompanied by a significant increase in daily transactions, which jumped 450% QoQ to 1.5 million. The emergence of Avascriptions also drove the majority of these transactions.

Avalanche’s C-Chain experienced a record-breaking 6.3 million transactions, with nearly 6.1 million being inscriptions. This marks the highest number of transactions ever recorded in a single day for Avalanche.

While C-Chain saw a 50% QoQ decrease in daily active addresses, this was primarily due to decreased activity on LayerZero – a bridge between different blockchains. However, the report highlights that Avalanche saw a significant increase in active validators, growing 20% QoQ from 1,374 to 1,651 validators.

According to Messari, this growth in validators, coupled with an 11% QoQ increase in AVAX stakes, indicates a promising long-term appetite for AVAX in the coming year.

Avalanche’s TVL Surges 78%

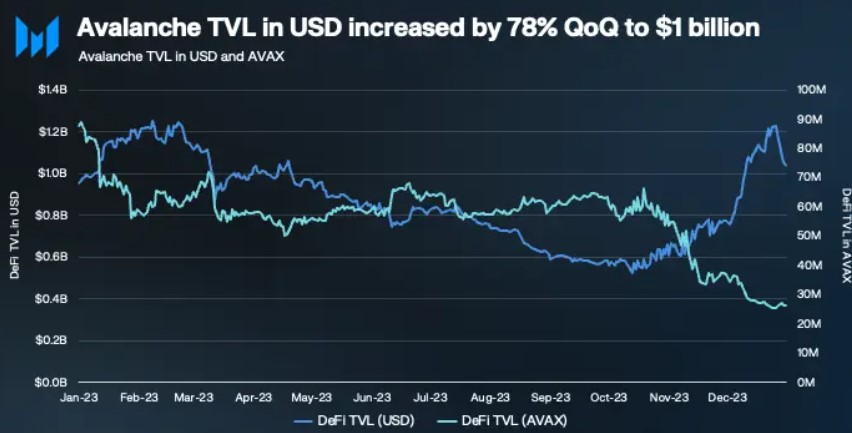

Avalanche’s Total Value Locked (TVL) denominated in USD experienced a substantial 78% QoQ increase, reaching $1.03 billion by the end of Q4 2023. This positioned Avalanche as the 7th chain by TVL, denominated in USD.

However, TVL-denominated in AVAX decreased by 71% QoQ, primarily due to AVAX price appreciation driving the increase in USD-denominated TVL.

The report also sheds light on the performance of various protocols on Avalanche. AAVE, the largest protocol by TVL, witnessed a 60% QoQ growth, while Benqi and Trader Joe demonstrated strong gains of 205% and 131% QoQ, respectively. Together, these three protocols accounted for 79% of Avalanche’s TVL, showcasing their dominance in the ecosystem.

Smaller-sized protocols, such as Pangolin and GMX, also showcased impressive growth, while Balancer, aided by Benqi’s sAVAX liquidity pool, attracted significant TVL on Avalanche. Additionally, Q4 witnessed a surge in average daily DEX volumes, rising by 245% QoQ.

Analysis of the 1-day chart reveals that Avalanche’s token trading pair AVAX/USD experienced significant growth during Q4, breaking free from a prolonged period of sideways price action.

However, following a notable uptrend that propelled the token to reach $50, its highest level in 20 months, on December 24, AVAX underwent a sharp correction, plunging to the $27 price level.

The cryptocurrency has rebounded in response to Bitcoin’s (BTC) rally and the prevailing bullish sentiment in the market. Over the past fourteen days, AVAX has witnessed a 13% price increase, currently reclaiming the $40 zone.

Featured image from Shutterstock, chart from TradingView.com

Disclaimer: The article is provided for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.