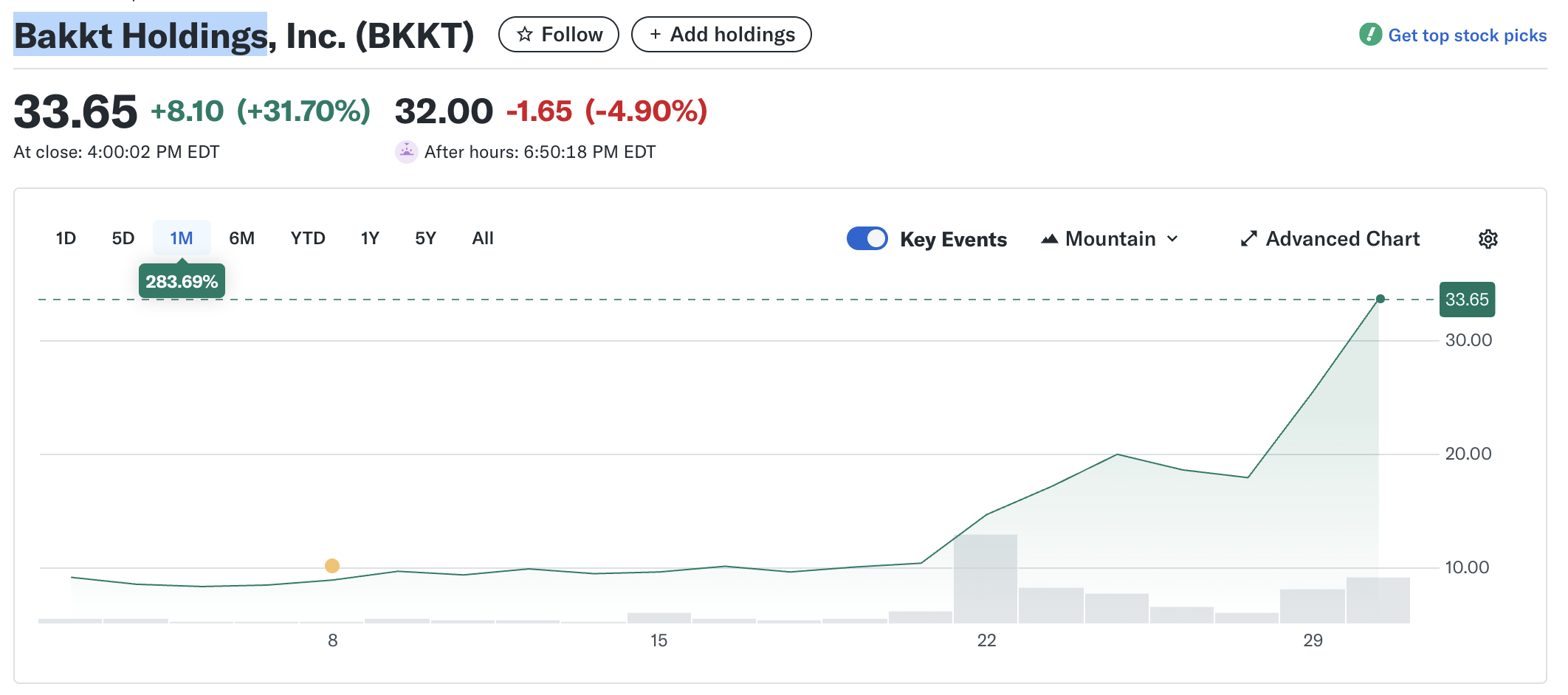

Bakkt Holdings (BKKT) shares jumped 17% on Tuesday, extending a two-week rally that has seen the stock rise more than 170%. The surge followed Benchmark Company’s decision to more than triple its 12-month price target to $40.

It marked the first time Bakkt crossed the $30 threshold since January, a sharp reversal for a company that had struggled below $10 for much of the year. Investors are betting that a combination of new leadership, treasury expansion, and streamlined operations can restore credibility to the digital asset platform.

Bakkt Analyst Upgrade Sparks Investor Optimism

Benchmark analyst Mark Palmer described Bakkt as “an attractive buy” even after its rapid appreciation, citing growth potential across crypto custody, stablecoin payments, and treasury management. He noted that the company’s valuation remains modest compared to peers such as Coinbase and Robinhood. Founded in 2018 by Intercontinental Exchange, Bakkt provides crypto custody, trading, and payments infrastructure for institutions and enterprises.

“BKKT remains an attractive buy even after its sharp run-up, as it continues to trade at valuations far below its growth potential and peers,” Palmer said.

Palmer also praised the recent appointment of veteran investor Mike Alfred to Bakkt’s board, arguing that his experience in scaling fintech firms will add rigor to strategic decisions. The board reshuffle was interpreted by markets as a vote of confidence in the company’s new direction under CEO Akshay Naheta, who took charge in August.

According to Yahoo Finance data, Bakkt’s recovery still leaves it down 97% from its 2021 all-time high above $1,060, underscoring the scale of its challenge. Yet the rally has drawn attention from traders who see parallels with other digital-asset companies that staged sharp rebounds after prolonged downturns.

Adding to the bullish tone, Investor’s Business Daily recently lifted Bakkt’s Relative Strength Rating to 96, signaling its price performance over the past year now ranks among the top stocks in the market. It currently sits mid-pack in its specialty finance group, ranking below top performers like Riot Platforms and IREN but ahead of many smaller peers.

Beyond Price: Streamlining for Core Growth

While the rally is fueled by analyst upgrades, Bakkt has also been reshaping its business model. Earlier this year, it sold its loyalty rewards unit for $11 million, a divestiture aimed at narrowing its focus to custody infrastructure and tokenized payments.

To support an ambitious new strategy, Bakkt is pursuing significant capital raising. On June 26, 2024, the company filed an S-3 registration statement with the SEC to potentially raise up to $1 billion through the offering of various securities. Crucially, Bakkt’s board recently approved a revised corporate investment policy that permits the company to purchase Bitcoin and other digital assets for its treasury using surplus cash or future financing proceeds.

CEO Akshay Naheta emphasized the shift on a recent investor call, stating, “Digital assets are moving from speculative to strategic,” and that Bakkt intends to act as a bridge between institutions and emerging financial rails.

Industry analysts suggest this dual strategy—strengthening core services while signaling long-term confidence in Bitcoin—could attract institutional partners. However, the S-3 filing highlighted Bakkt’s ongoing financial challenges, including a limited operating history and reliance on a single major client, underscoring the obstacles of volatility and stiff competition.

The post Bakkt Jumps 17% as Benchmark Lifts Target, Extending 170% Two-Week Rally appeared first on BeInCrypto.