Top Stories of The Week

Bitcoiners lose their mind after Scott Bessent walks into a Bitcoin bar

The Bitcoin community lit up on Thursday after US Treasury Secretary Scott Bessent made an unannounced appearance at the launch of Washington’s new Bitcoin-themed bar, Pubkey.

“Having the Secretary of the Treasury at the Pubkey DC launch seems like a moment I could easily look back on and say ‘wow, it was all so obvious,’” Bitcoin treasury company Strive’s chief investment officer Ben Werkman said in an X post on Thursday.

Steven Lubka, Nakamoto’s vice president of investor relations, called it “the sign you have been waiting for.”

Many other prominent Bitcoiners, including Bitcoin analyst Fred Krueger, Gemini chief of staff Jeff Tiller, Bitcoin podcaster Natalie Brunell, and Bitcoin Policy Institute co-founder David Zell, also viewed Bessent’s appearance as a hugely positive sign for Bitcoin.

India’s government may consider stablecoin framework, diverging from RBI

The government of India may consider stablecoin regulations in its Economic Survey 2025-2026, while the Reserve Bank of India (RBI) takes a “cautious” approach to crypto and pushes for a central bank digital currency, revealing a divergence in policy recommendations.

The government will “present its case” for stablecoins in the annual report published by India’s Ministry of Finance, which outlines key policy recommendations and the state of the economy, business publication Moneycontrol reported, citing an official familiar with the matter.

However, the central bank continues to urge a “cautious” approach to stablecoins, according to RBI Governor Sanjay Malhotra, speaking at the Delhi School of Economics on Thursday.

Bitcoin hits ‘most bearish’ levels: Is the bull cycle ending?

Bitcoin is entering bearish territory as institutional demand dries up and key market indicators point to a downward phase, according to data from analytics platform CryptoQuant.

Bitcoin market conditions have turned the “most bearish” within the current bull cycle that started in January 2023, CryptoQuant said in its latest crypto weekly report shared with Cointelegraph.

CryptoQuant’s Bull Score Index has declined to extreme bearish levels of 20/100, while the BTC price has fallen far below the 365-day moving average of $102,000 — a key technical level and the final bearish signal marking the start of the 2022 bear market.

The price drop comes amid weakening institutional demand, including reduced buying by Bitcoin treasury firms such as Michael Saylor’s Strategy, along with limited inflows into exchange-traded funds.

Warning: WhatsApp worm targets Brazilian crypto wallets, bank accounts

Brazilian crypto holders are urged to be on the lookout for a sophisticated hacking campaign that includes a hijacking worm and banking trojan shared via WhatsApp messages.

According to a new report from Trustwave’s cybersecurity research team SpiderLabs, the banking trojan, known as “Eternidade Stealer” is being pushed via social engineering on messaging application WhatsApp such as “fake government programs, delivery notifications,” messages from friends and fraudulent investment groups.

“WhatsApp continues to be one of the most exploited communication channels in Brazil’s cybercrime ecosystem. Over the past two years, threat actors have refined their tactics, using the platform’s immense popularity to distribute banker trojans and information-stealing malware,” said Spiderlabs researchers Nathaniel Morales, John Basmayor and Nikita Kazymirskyi.

Ex-Coinbase lawyer announces run for New York Attorney General, citing crypto policy

Khurram Dara, a former policy lawyer at cryptocurrency exchange Coinbase, officially launched his campaign for New York State Attorney General.

In a Friday notice, Dara cited his “regulatory and policy experience, particularly in the crypto and fintech space” among his reasons to try to unseat Attorney General Letitia James in 2026.

The former Coinbase lawyer had been hinting since August at potential plans to run for office, claiming that James had engaged in “lawfare” against the crypto industry in New York.

Until July, Dara was the regulatory and policy principal at Bain Capital Crypto, the digital asset arm of the investment company. According to his LinkedIn profile, he worked as Coinbase’s policy counsel from June 2022 to January 2023 and was previously employed at the crypto companies Fluidity and AirSwap.

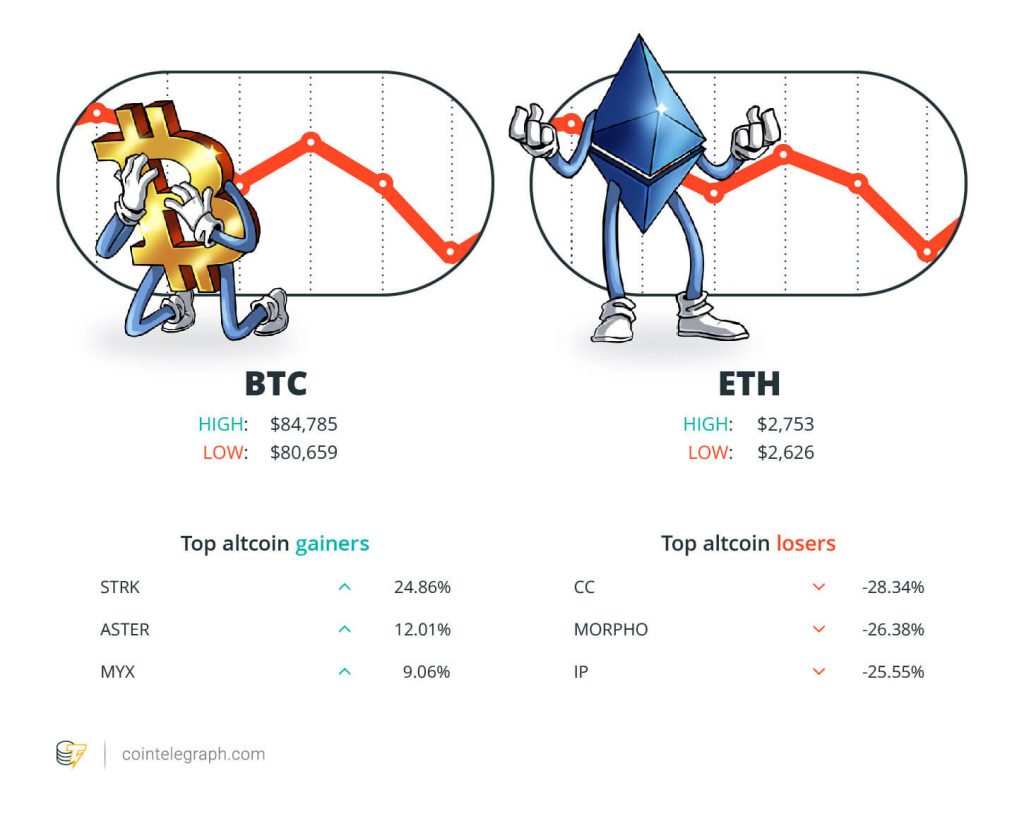

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $84,785, Ether (ETH) at $2,753 and XRP at $1.95. The total market cap is at $2.90 trillion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are Starknet (STRK) at 24.86%, Aster (ASTER) at 12.01% and MYX Finance (MYX) at 9.06%.

The top three altcoin losers of the week are Canton (CC) at 28.34%, Morpho (MORPHO) at 26.38% and Story (IP) at 25.55%. For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Top Prediction of The Week

Bitcoin won’t hit $200K until Q3 2029: Veteran trader Peter Brandt

Veteran trader Peter Brandt said he doesn’t see Bitcoin reaching $200,000 before the end of the year as some crypto executives have predicted. In fact, he argues it may take nearly four more years to get there.

“The next bull market in Bitcoin should take us to $200,000 or so. That should be in around Q3 2029,” Brandt said in an X post on Thursday, while emphasizing that he is a “long-term bull on Bitcoin.”

Read also

Features

Deposit risk: What do crypto exchanges really do with your money?

Features

Bitcoin payday? Crypto to revolutionize job wages… or not

Brandt’s forecast stands out for several reasons. Many prominent Bitcoin advocates, such as BitMEX co-founder Arthur Hayes and BitMine chair Tom Lee, had expected at least $200,000 by the end of this year. Lee and Hayes even reiterated their confidence in the prediction as recently as October.

Brandt’s projection also significantly contrasts with the bullish targets from crypto executives such as Coinbase CEO Brian Armstrong and ARK Invest’s Cathie Wood, who both anticipate $1 million Bitcoin by 2030, just one quarter later than Brandt expects the price to be roughly five times lower.

Top FUD of The Week

Ex-prosecutor denies promising not to charge FTX executive’s partner

Danielle Sassoon, one of the US attorneys behind the prosecution of former FTX CEO Sam “SBF” Bankman-Fried, took the stand in an evidentiary hearing involving a deal with one of the company’s executives.

In a Thursday hearing in the US District Court for the Southern District of New York, Sassoon testified about the guilty plea of Ryan Salame, the former co-CEO of FTX Digital Markets, which resulted in his sentencing to more than seven years in prison.

According to reporting from Inner City Press, Sassoon said that her team would “probably not continue to investigate [Salame’s] conduct” if he agreed to plead guilty. Further investigation into the former FTX executive and his then-girlfriend, Michelle Bond, resulted in the latter facing campaign finance charges.

Advocacy groups urge Trump to intervene in the Roman Storm retrial

More than 65 cryptocurrency and blockchain companies and advocacy groups have called on US President Donald Trump to step in as federal prosecutors may be preparing to retry Tornado Cash co-founder and developer Roman Storm.

Read also

Features

Story Protocol helps IP creators survive AI onslaught… and get paid in crypto

Features

NFT collapse and monster egos feature in new Murakami exhibition

In a letter to Trump dated Thursday and shared with Cointelegraph, advocacy organizations including the Solana Policy Institute, Blockchain Association and DeFi Education Fund, among others, made several requests regarding crypto-related policies.

The groups asked Trump to direct the IRS and US Treasury to clarify tax policy on digital assets, protect DeFi from regulators and encourage regulatory clarity through financial regulators like the Securities and Exchange Commission and Commodity Futures Trading Commission.

US won’t start Bitcoin reserve until other countries do: Mike Alfred

The US government is unlikely to start accumulating Bitcoin for its strategic reserve until other nations make the first move, says crypto entrepreneur Mike Alfred.

Alfred said in a podcast published on Tuesday that the US government will start putting Bitcoin into its reserve created earlier this year “when there is enough pressure externally.”

“Once the US government recognizes that others are taking action before them, that’ll probably catalyze additional action in the future,” he said, adding that the timeline for the US government’s action is up in the air.

Top Magazine Stories of The Week

Ethereum’s Fusaka fork explained for dummies: What the hell is PeerDAS?

If you don’t know the difference between PeerDAS and a precompile, Magazine is here to help.

Bitcoin whale Metaplanet ‘underwater’ but eyeing more BTC: Asia Express

Metaplanet will raise $135M to buy more Bitcoin while it’s on sale; around 61% of Singaporean retail investors now hold crypto.

Musk’s ‘AI in space’ plan, vending machine calls in FBI over $2 fee: AI Eye

One in five Base txs are now generated by AI Agents, and Anthropic employees keep scamming their AI vending machine.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Editorial Staff

Cointelegraph Magazine writers and reporters contributed to this article.