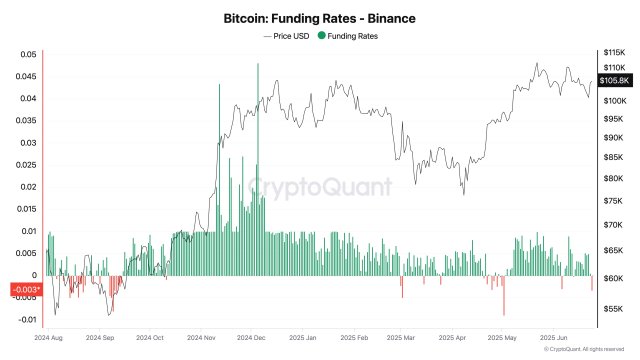

As Bitcoin gradually recovers from its recent breakdown below the $100,000 mark, it appears to have triggered a fresh wave of bearish activity from investors. Its market dynamics are about to transition as key metrics such as the Funding Rates on the Binance platform have taken a negative turn.

Binance Traders Betting Against Bitcoin

In a dramatic bounce, Bitcoin has reclaimed the $105,000 price mark and is slowly approaching $106,000. While BTC has recovered, the impressive run has been met with negative sentiment, particularly from investors on Binance, the largest cryptocurrency exchange.

Darkfost, a verified author for CryptoQuant, reported that funding rates on the Binance exchange have declined sharply, signaling a shift in trader sentiment. Data from the expert reveals that the rates dropped to the -0.0033 level just as BTC swiftly bounced back since this past weekend.

This scenario implies that traders are progressively placing bets on further decline, indicating that bearish pressure is building on Binance. Negative funding rates may signal pessimism, but historically, they have also preceded short squeezes. As the price of Bitcoin navigates increased volatility and shifting momentum, this is a crucial period to observe.

According to the on-chain expert, negative financing rates suggest that most open positions are currently short as investors question whether the recent upward move is sustainable. Although this may initially appear to be negative, markets often move against the crowd, particularly when there is an overcrowded short side.

Furthermore, Darkfost has drawn attention to past scenarios, particularly in September last year. During the period, the market constantly shifted in the opposite direction whenever Binance’s funding rates fell into negative territory, whether in the short or medium term.

However, the sole exception was when new tariff policies were announced, momentarily altering market dynamics. If shorts persistently increase on the Binance platform, Darkfost is confident that these positions could eventually bolster the rally that started earlier this week.

Thus far, the expert has offered one key takeaway, stating that it is crucial to understand that the natural tendency of traders leans toward longing the market, which makes this current signal more remarkable.

BTC To Surge To A New All-Time High

After rallying earlier this week, BTC is currently facing significant resistance at the $106,500 threshold. However, this resistance level could give way soon, as Michael Van De Poppe, a market expert, has predicted a major rally to new all-time highs.

According to the expert, Bitcoin is stalling at levels below $106,500 until the next significant surge to new highs occurs. Van De Poppe believes that the anticipated move is only a matter of time, and BTC is likely to reach a new peak in July. Therefore, the expert suggests “buying the dip now is the best strategy.”