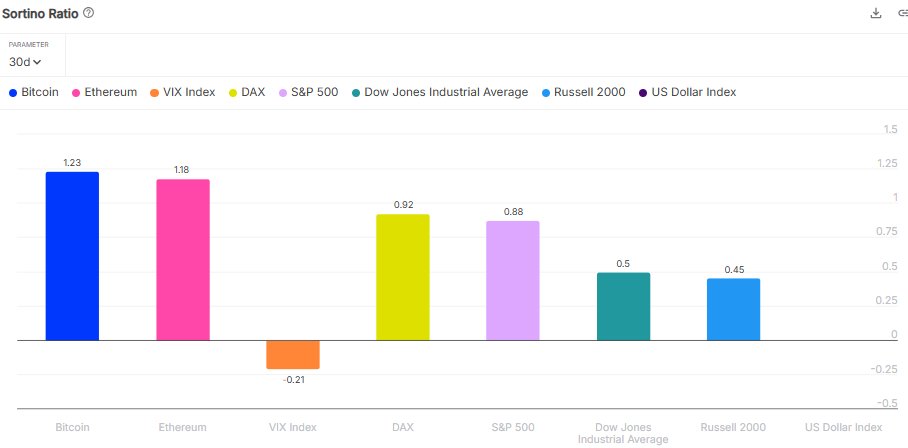

Data shows Bitcoin has outperformed the major equity indices on the Sortino Ratio. Here’s what this says about the cryptocurrency’s performance.

Bitcoin’s 30-Day Sortino Ratio Is Currently At 1.23

In a new post on X, the institutional DeFi solutions provider Sentora (formerly IntoTheBlock) has talked about the Sortino Ratio of Bitcoin. The “Sortino Ratio” is an indicator that’s similar to the Sharpe Ratio, which compares the returns of an asset against its volatility.

The Sharpe Ratio takes the “volatility” or the risk involved with the asset as the standard deviation of returns over a given period. Note that the indicator doesn’t differentiate between positive and negative returns. This is where the Sortino Ratio differs.

The Sortino Ratio takes only the standard deviation of the negative returns, aiming to capture just the ‘harmful’ volatility. As a result, the metric’s value tells us how the returns of an asset stack up against the downside risk associated with it.

Now, here is the chart shared by the analytics firm, showing how the 30-day Sortino Ratio looks for Bitcoin as well as other assets and indices:

As is visible in the above graph, the Sortino Ratio of Bitcoin has recently stood at 1.23, which implies the asset’s returns over the past month have outweighed its downside volatility.

It’s also apparent that the same has been true for Ethereum and the indices listed in the chart as well, but clearly, BTC has come out on top compared to all of them. The only one that comes close is ETH, a fellow cryptocurrency, with its metric sitting at 1.18.

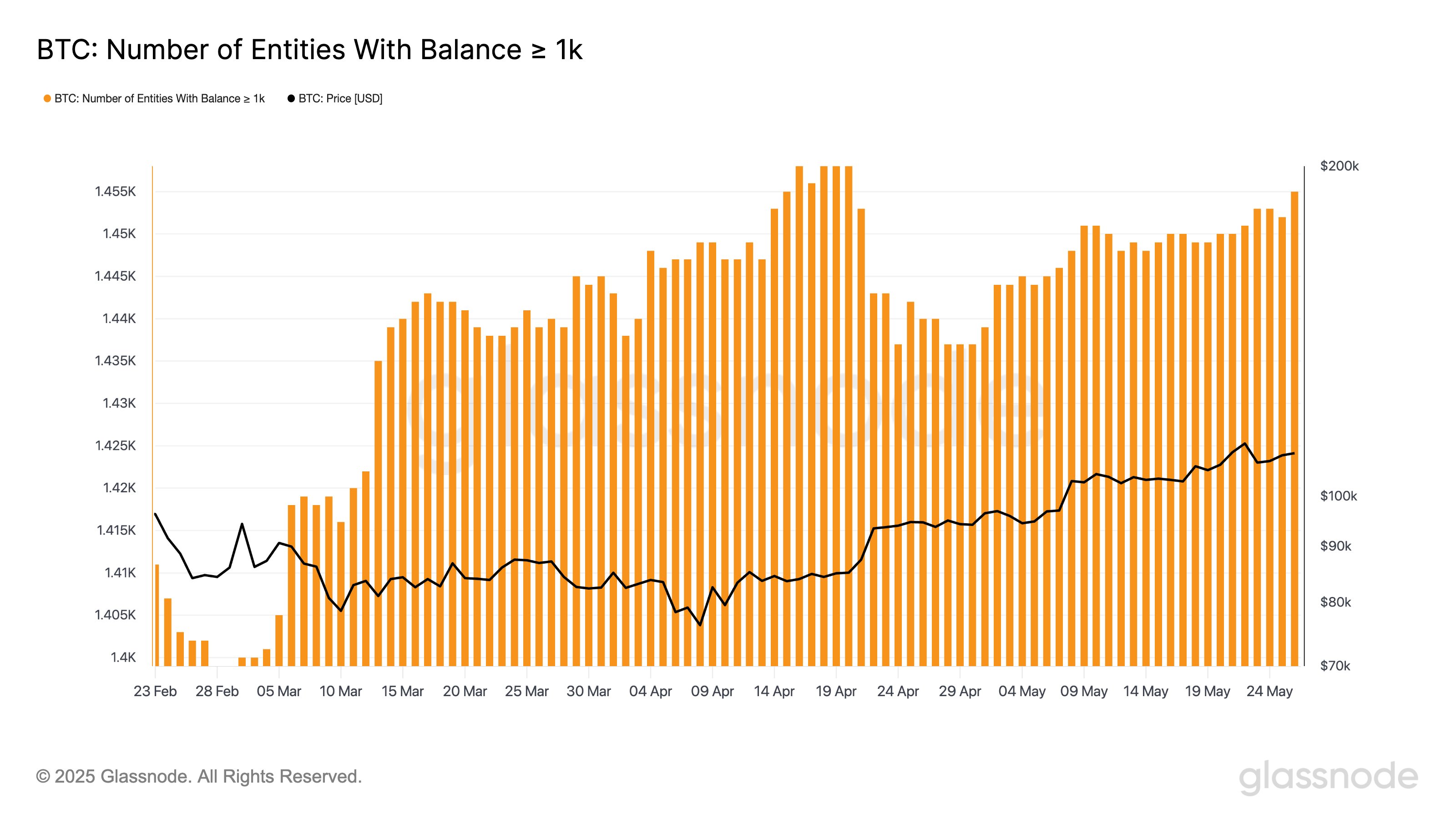

In some other news, the whale population on the Bitcoin network has resumed growth recently, as the on-chain analytics firm Glassnode has shared in an X post.

“Whales” in the context of BTC refer to the entities holding 1,000 or more coins. Here is a chart that shows the trend in the number of investors of this size who exist on the blockchain:

As displayed in the chart, the number of whale-sized Bitcoin investors saw a phase of decline in April, a sign that some of the big-money investors exited from the cryptocurrency.

This month, however, the metric resumed an uptrend and has continued to go up even with the asset’s price hitting a new all-time high (ATH). At present, there are 1,455 whale entities on the blockchain.

Note that ‘entities’ here don’t simply refer to individual addresses carrying 1,000 or more BTC. Rather, an ‘entity’ is a cluster of addresses that the analytics firm has determined to belong to the same investor through its analysis.

BTC Price

At the time of writing, Bitcoin is floating around $109,700, up 3% over the last seven days.