Bitcoin Price Weekly Outlook

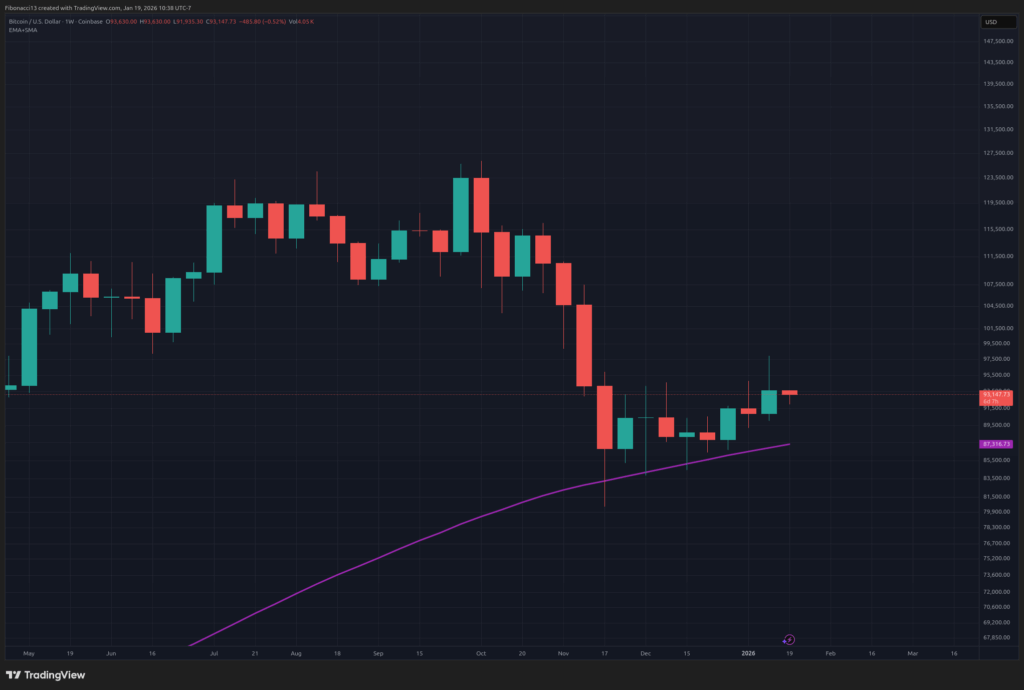

Well, the bitcoin price action was looking quite bearish after last week’s close, but the bulls managed to maintain the bullish structure around the $90,000 level and made that push up to $98,000 resistance. The price retreated from there and closed the week out at $93,638. Expect the bulls to take another run at the $98,000 resistance level this week and aim for the upper end of this resistance zone at $103,500 if they can sustain price action above $98,000. Early in the week, support at $91,400 may be tested and must hold for the bulls to continue their charge.

Key Support and Resistance Levels Now

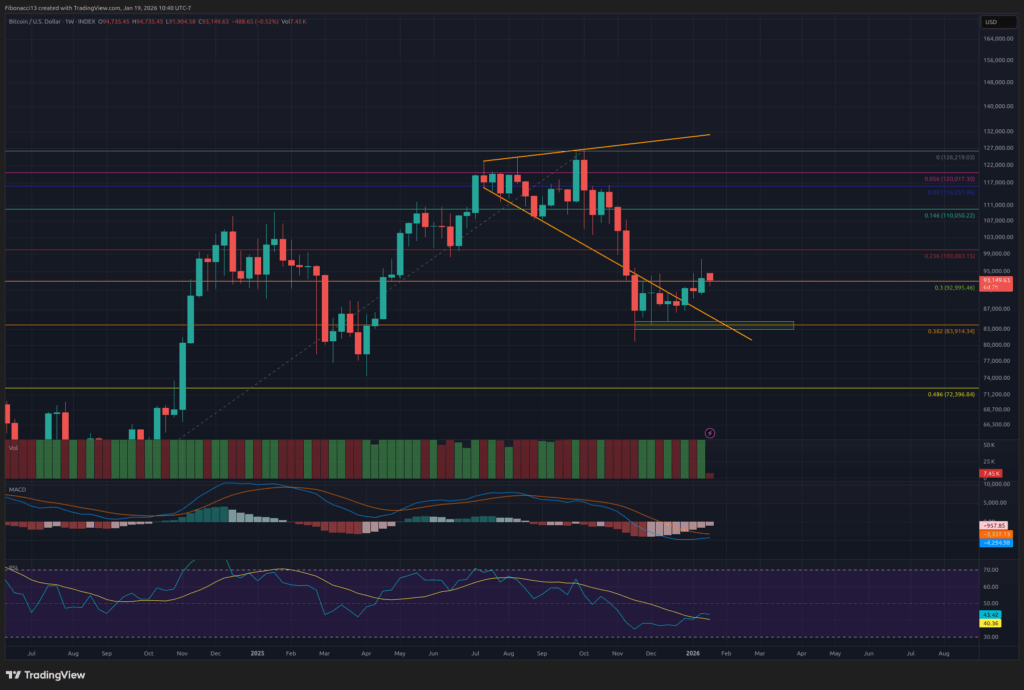

The bulls have finally made some progress, chipping away at overhead resistance. The bulls will look to regain the $94,000 level as short-term support this week. If they can keep the momentum going, they will once again challenge the $98,000 resistance and try to push to the upper end of this zone at $103,500. Closing days at the upper end of this zone should usher in a move up to the next major resistance zone at $106,000 to $109,000. This area should be very strong resistance, but $116,000 lies beyond this range at the 0.786 Fibonacci retracement if the bulls’ strength can persist.

Look for bulls to defend the $91,400 level with authority, as losing this level would give the bears some renewed confidence to push the price down even lower. $87,000 would look to contain price action below there, and act as a doorway to the major $84,000 support level. Breaking $84,000 support opens up the low $70,000 area for a test.

Outlook For This Week

Bulls should attempt to capitalize on their recent resolve heading into this week. Look for another test of $98,000 if they can manage to regain $94,000 early this week. However, a more bearish test of the $91,400 support is possible here as well, but as long as bulls can hold this level, bullish bias remains, and re-challenging $98,000 is in the cards. Closing a day above $98,000 should lead the price towards $103,500.

Market mood: Slightly Bullish – The bulls finally managed to show some resilience here as they defended the $90,000 area last week. Price action leans in their favor heading into this week.

The next few weeks

The bulls have held onto some momentum over the past week, but they are entering some heavier resistance areas now. If bulls can push even higher, above $100,000, they will start entering an area where we could see a major price reversal. $103,500 to $109,000 should be a tough zone to conquer, and we should not be surprised to see price kicked back down with authority from this area over the coming weeks. Holding support from there would be critical in determining whether this rally can keep going to new highs or if it finally gives way to new lows below $80,000.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).